Nigeria’s VAT revenues grow 31.69% year-on-year to N246.3bn in Q2 2017 with manufacturing sector lead contributor

October 20, 20172.1K views0 comments

Data released by Nigeria’s statistical agency, the National Bureau of Statistics (NBS) Friday indicate that the country generated N246.30 billion as value added tax (VAT) in Q2 of 2017, up 31.69 percent year-on-year over the N187.03 billion realized in the corresponding period of 2016.

According to the report, the increase in the amount generated represented 20.28 percent increase quarter-on-quarter from the N204.77 billion generated as at Q1 2017.

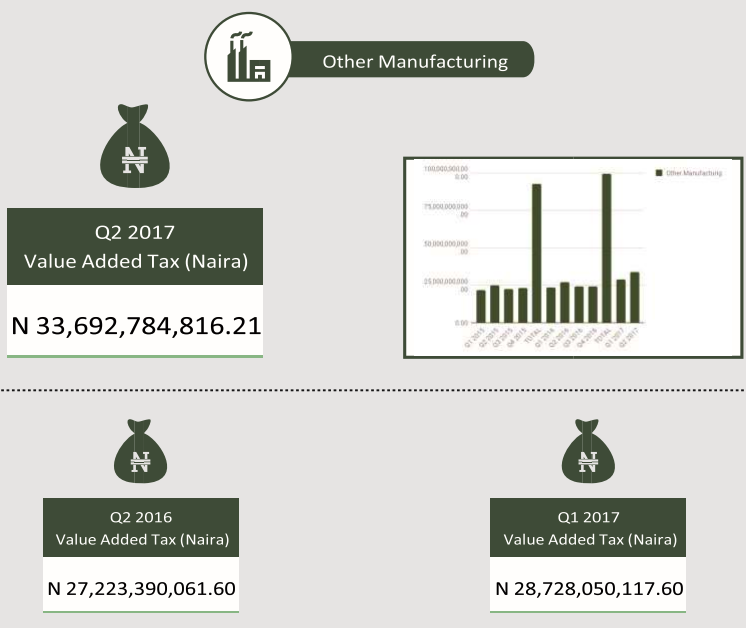

The sectoral distribution of the realized amount showed that the manufacturing sector is the lead contributor, generating N33.69 billion or 13.77 percent of the total amount. This was closely followed by professional services and oil-producing generating N21.64 billion and N14.94 billion respectively.

The mining sector was adjudged the least contributor with N34.19 billion, while local government councils and pharmaceutical, soaps and toiletries generated N154.72 million and N194.26 million respectively.

Read Also:

Nigeria set to boost mining reserves, lures investors with $42m

The report further indicated that out of the total amount generated in Q2 2017, N137.79 billion was generated as non-import VAT locally, while N59.83 billion was generated as non-import VAT for foreign.

The balance of N48.68 billion was generated as Nigerian Customs Service (NCS) import VAT.

VAT, a consumption tax that is placed on a product whenever the value is added at a stage of production and at final sale, is one major non-oil revenues of the Federal Government of Nigeria.

In terms of origination of the country’s VAT proceeds, Kemi Adeosun, minister for finance, said recently that more than half of Nigeria’s value-added tax (VAT) comes from Lagos state alone.

Quoting current value-added tax (VAT) collection data across Nigeria, the minister said: “55% of Nigeria’s VAT is collected in Lagos State, while 20 percent is derived from Abuja, the Federal Capital Territory.”

Other top contributors to the VAT pool include Rivers (6%), Kano (5%) and Kaduna (1%), meaning that four states of the federation account for 87 percent of VAT receipts with the other 32 accounting for a mere 13 percent.