BY CHARLES ABUEDE

The total earnings of some of Nigeria’s major banks in the first quarter of 2022 have been buoyed principally by a significant rise in their non-interest income, an analysis of the numbers churned out in their first quarterly statements for the year has shown.

Banks in the country have, over the years, been striving to boost their earnings through improved income generation from fees and commission paid by customers, charges on account maintenance, commission on foreign exchange deals, among other drivers.

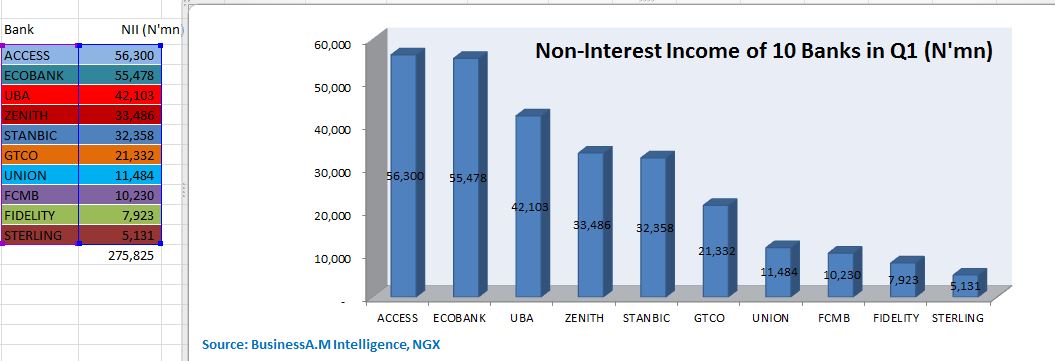

An analysis of the first quarter performance of some of the major deposit money banks (DMBs) in Nigeria based on their reported earnings from non-interest-bearing income streams, as published in their unaudited first-quarter financial statements filed to the Nigerian Exchange (NGX), showed that 10 banks generated N275.83 billion in credit-related fees and commissions, account maintenance charge and handling commission, electronic banking income, commission on foreign exchange deals, among others.

The collated data, pooled by Business A.M. Intelligence after a careful analysis of banks’ unaudited results and accounts for the period ended March 31, 2022, also shows that there was a 25.2 percent year on year increase in the number from N220.38 billion generated by these banks in the corresponding period of last year.

The banks include Zenith Bank, Ecobank Transnational, Access Holdings, United Bank for Africa (UBA), Stanbic IBTC Bank, Fidelity Bank, Sterling Bank, Guaranty Trust Holding Company (GTCO), Union Bank of Nigeria and First City Monument Bank (FCMB).

In line with expectation, the growth in fee and commission income weighed on the banks’ non-interest income (NII) for the reported period. The key contributing factors, as seen from the published Q1 financial statement on the NGX, were commissions on foreign exchange deals, account maintenance charges and handling commission, electronic banking income and other credit-related fees and commissions.

The collated data revealed that Access Holdings led the chart with the highest income gained from non-interest yielding charges and bank account maintenance charges, among other sources.

Access Holdings reported a 45 percent increase in its commission from customers to N56.3 billion at the close of the first three months of 2022, up from N38.95 billion after the same period last year. Also, the company’s fees from electronic channels and other electronic-business income contributed 35.7 percent to Access Holdings’ fee and commission of N20.13 billion in Q1 2022, from 46 percent or N17.92 billion reported in Q1 2021.

Meanwhile, last year, the bank recorded N159.2 billion in fees and commissions from transactions by customers, which represents a 36 percent increase when compared to N116.7 billion in the Covid-19 year.

However, Herbert Wigwe, group chief executive officer of the financial institution, while speaking during the bank’s investors’ and analysts’ conference call, said the recorded growth after restructuring into a holding company was largely underlined by income from increased transaction velocity across all channels and other e-businesses, as well as credit-related fees and commissions which grew by 33 per cent.

“We will continue to gain traction on our income from these lines as we extend our retail and loan offerings,” Wigwe said.

Trailing Access Bank on the log is Ecobank Transnational International (ETI), which recorded a total of N55.48 billion in total non-interest income in its Q1 2022 financial performance spurred by fees and commissions from customers, up 21.6 percent year on year, from N45.62 billion in the prior year’s corresponding quarter.

According to the bank’s Q1 2022 financial statement, “non-interest revenue was $198 million for the first quarter of 2022, increasing by 15 percent or $25 million, or by 25 percent on a constant currency basis, boosted by the continued robustness in client and customer activity, following the lifting of most of the Covid-19 pandemic-induced restrictions.

“As a result, net fees and commission income increased by 16 percent or $16 million to $116 million, with fees generated on cards rising by 30 percent to $24 million, credit-related fees increased by 17 percent to $37 million, and cash management fees rose by 9 percent to $54 million. Additionally, NIR benefited from net trading income, which increased by 12 percent or $8 million to $72 million, predominantly driven by a 216 percent increase in fixed-income trading to $34 million, partially offset by a decrease in client-related foreign-currency sales of 29 percent to $38 million.

“As a result, the contribution of non-interest revenue to total net revenue (the NIR ratio) was 45 percent versus 42 percent in the year-ago period,” it reported.

Next up, Africa’s global bank, United Bank for Africa (UBA), reported a stable net profit number for just first quarter, growing its fees and commission income by 20.4 percent to N42.1 billion from N35 billion in the same quarter last year, which was offset by more than a proportionate increase in fees and commission expense by 22.1 percent year on year, limiting net fee and commission income growth to 19.3 percent year on year to N24.3 billion in Q1 of 2022.

Meanwhile, the fee and commission income was boosted by a 109.2 percent year on year increase in the trade transactions income to N7.4 billion, supported by a 21 percent year on year rise in electronic banking income to N15.1 billion, partially offset by a 28.5 percent decline in funds transfer fee to N1.8 billion and a 16 percent drop in commissions on transactional services to N5.8 billion in the same first quarter.

Also, Zenith Bank reported an 11.8 percent year on year rise in non-interest income to N57.2 billion in Q1 of 2022, while it made N33.49 billion in fees and commission from customers during the first three months of 2022, up from N28.69 billion in the corresponding quarter of 2021.

As disclosed in its unaudited financial statement filed to the NGX, Zenith Bank noted that, “Going forward into the rest of the year, the group will continue to focus on sustainable growth across all its business segments, deploy technology platforms and digital assets intuitively to serve the needs of its various customers in order to deliver enhanced returns to its stakeholders.”

Stanbic IBTC Holdings came next on the log as it, in the period under review, reported N23.13 billion in fee and commission income from customers; up from N22.17 billion reported in the prior year’s corresponding quarter.

Guaranty Trust Holding Company also saw its fee and commission income continue to be robust, with a 21.4 percent quarter on quarter spurt to N21.3 billion.

However, analysis of the bank’s fee and commission expenses shows a shrinkage by 40.8 percent quarter on quarter to N1.7 billion in Q1 2022, while loan recovery expenses climbed 440.6 percent quarter on quarter to N920 million in Q1 2022, resulting in a 13.1 percent quarter on quarter decline in fee and commission expenses to N2.6 billion and then the net fee and commission income jumped 28.4 percent quarter on quarter to N18.8 billion compared to N14.6 billion in 2021.

In addition, Union Bank of Nigeria reported a dive to N11.5 billion in fees and commissions from customers during the first quarter of 2022; down from N14.2 billion last year, owing to a decline in customer deposits during the prior year, and then, FCMB Group, reported a 34 percent increase in fee and commission income from customers’ transactions to N10.23 billion in Q1 2022, from N7.66 billion in Q1 2021.

Fidelity Bank reported a 32 percent fee and commission income from customers, increased in Q1 2022 to N7.9 billion from N6.01 billion in Q1 2021, while Sterling Bank reported N5.13 billion fee and commission income from customers in Q1 2022, from N3.65 billion in Q1 2021.