Onome Amuge

Nigeria is doubling down on indigenous oil-services companies as the government seeks to restore confidence in an industry squeezed by falling investment, persistent security challenges, and rising competition from other African producers.

Tamrose Limited, a marine logistics operator, sits at the centre of this restructuring after completing repayment of a $10 million loan from the Nigerian Content Intervention Fund (NCI Fund) earlier this year.

Heineken Lokpobiri, the minister of state for petroleum resources (Oil), who confirmed the development during a stakeholder gathering in Yenagoa, Bayelsa State’s capital and a symbolic location in the Niger Delta, stated that Nigeria intends to produce more companies like Tamrose.

A new narrative for a stressed sector

Africa’s largest oil producer has battled a decade of under-investment, declining production volumes and oil theft that has rattled investor confidence and starved the treasury of revenue. As international oil companies (IOCs) retrench from onshore and shallow-water assets, the country has become increasingly reliant on domestic service providers to deliver critical offshore, logistics and security operations.

Lokpobiri’s remarks reflected a growing recognition that Nigeria’s content-development strategy, once framed mainly as a localisation goal, has become a stabilisation tool for a struggling industry.

“Tamrose is one of only 21 companies to have fully repaid its NCI Fund facility. Their progress shows why we must expand support for indigenous companies. They are the backbone of our capacity to compete not only at home, but across Africa,” the minister noted.

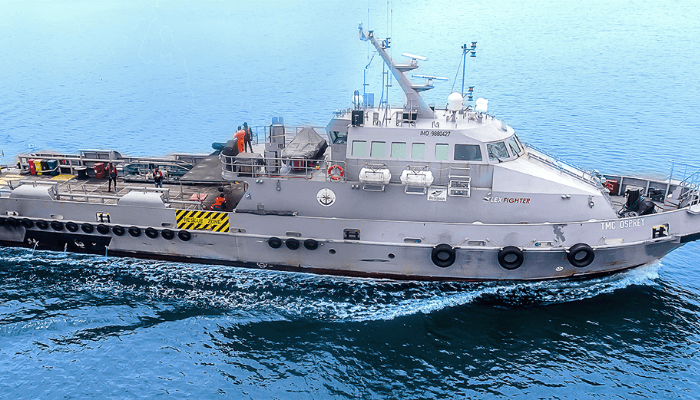

Tamrose’s track record provides ammunition for optimists. Since drawing on its $10 million NCI Fund facility in 2019, the company has expanded its fleet from four vessels to 15, including 10 security patrol vessels and five platform supply vessels, marking nearly 300 per cent growth. It has also extended operations to Angola, one of the continent’s most competitive offshore markets.

The company stated that it now employs almost 250 workers directly and supports over 600 additional livelihoods. More than 100 cadets have passed through its training scheme, and the company boasts over 1,500 employees and dependents enrolled in health-management organisations.

For policymakers, these figures translate to something more politically useful, being a narrative of Nigerian capability at a time when the state is under pressure to justify its local-content policies in the face of persistent sector underperformance.

“Today is not just a celebration of one company. It is proof that the NCI Fund is working,” said Esueme Dan Kikile, speaking on behalf of the NCDMB’s executive Secretary.

Why support for domestic service providers is becoming more urgent

The renewed emphasis on indigenous players comes as Nigeria confronts structural challenges in its offshore logistics chain. Vessel availability has tightened, insurance costs have risen, and foreign operators have become more cautious about operating in Nigerian waters.

For years, IOCs leaned on foreign marine contractors, but shifting security dynamics and the rising cost of compliance have pushed them toward domestic companies that understand the terrain and can operate with lower overheads.

This shift has elevated the importance of financing instruments such as the NCI Fund, managed by the Bank of Industry in partnership with the Nigerian Content Development and Monitoring Board (NCDMB). While over 70 companies have accessed the fund, only 21 have successfully completed repayment; a statistic that underscores both the risk and the opportunity.

For the government, expanding the pool of successful indigenous operators is not just an economic objective but a financial imperative. The state is seen as being unable to sustain high levels of intervention funding unless beneficiaries demonstrate repayment capacity.

The Yenagoa event, themed “Celebration of Growth and Impact”, brought together a constellation of stakeholders including the Bank of Industry, NIMASA, international oil companies, local financiers and traditional rulers.

But beyond the ceremony, the event functioned as a subtle investor-relations exercise. Officials sought to signal that Nigeria’s marine logistics market is maturing, and that indigenous providers can be disciplined counterparties worthy of long-term credit.

For banks facing pressure to diversify beyond oil trading and public-sector exposure, this message carries weight. A local marine-services company with a proven repayment record and expanding regional footprint is considered to offer a rare combination of growth and risk mitigation.

“Tamrose is a point of contact for all Nigerian entrepreneurs in the oil and gas sector,”, Ambrose Ovbiebo, the company’s executive chairman.

Although the government presents its support as developmental, the real change is structural. As IOCs divest and concentrate on deepwater assets, local service companies are stepping in to fill operational gaps, from patrol services to supply-vessel operations and marine security. These companies are gradually building capacity and shifting influence within Nigeria’s oil-services ecosystem, making indigenous operators essential for offshore scheduling, compliance, and continuity planning.

Some experts argue that this trend could elevate Nigerian firms to regional competitors, with Tamrose’s expansion into Angola signaling that possibility.