The International Energy Association (IEA) has said that year 2018 might not necessarily be a happy New Year for those who would like to see a tighter market, especially members of the Organisation of Petroleum Exporting Countries (OPEC).

The agency’s current outlook for 2018 indicates that total growth in supply could exceed demand growth, which is currently expected at 1.3 million barrels per day.

“A lot could change in the next few months but it looks as if the producers’ hopes for a happy New Year with de-stocking continuing into 2018, at the same 500 kb/d pace we have seen in 2017, may not be fulfilled,” the IEA said.

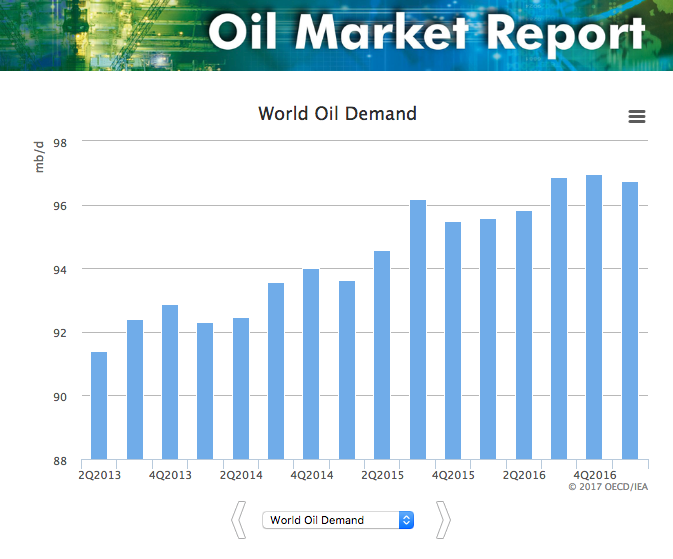

In its closely watched monthly oil market report, the IEA said the amount of crude oil on the global market rose by 170,000 barrels a day in November to 97.8 million barrels a day, the highest in a year on the back of rising US production, adding that output was nonetheless down 1.1 mb/d on a year ago when Russia and Middle East OPEC producers pumped at record rates.

“Our forecast for global demand growth remains unchanged at 1.5 mb/d in 2017 (or 1.6%) and 1.3 mb/d in 2018 (or 1.3%). Revisions have been made to data for Nigeria, Germany and Iraq. The baseline for oil demand has been raised by roughly 0.2 mb/d.,” the Paris based agency said.

It specifically stated that in the first half of 2018, global oil surplus could be 200,000 bpd before reverting to a deficit of around 200,000 bpd in the second half next year, “leaving 2018 as a whole showing a closely balanced market.”

“On considering the final component in the balance – non-OPEC production – we see that 2018 might not be quite so happy for OPEC producers,” the IEA noted.

Fuel, cars top most imported goods in the world but Nigeria fails to tap into refining

It indicated that non-OPEC supply is set to rise by 0.6 mb/d in 2017 and 1.6 mb/d next year, just as it stated that OPEC crude supply fell in November for the fourth consecutive month to 32.36 mb/d, down 1.3 mb/d on a year ago.

The IEA noted that output was lower in Saudi Arabia, Angola and Venezuela, and that compliance with agreed cuts rose to 115 percent, the highest this year, and lifted the 2017 average to 91 percent.

The IEA report equally noted that OECD commercial stocks fell 40.3 mb in October to 2 940 mb, their lowest level since July 2015, though 111 mb above the five-year average. Chinese crude stocks likely fell in October for the first time in a year. Preliminary global stocks data for November shows a mixed picture.

Benchmark crude prices rose by $4-5/bbl on average in November and traded at their highest level in more than two years in early December. The extension of the OPEC/non-OPEC output cuts and, latterly, the closure of the Forties pipeline system were factors.

Global refinery throughput in 3Q17 reached a record high at 81.2 mb/d, even including the impact of Hurricane Harvey, but has fallen back in 4Q17 due to maintenance. Global margins declined in November, losing almost $1/bbl.

This week’s closure of the Forties pipeline network that carries about 400 kb/d of North Sea oil added momentum to Brent crude oil prices that have settled above $60/bbl since the end of October.

The IEA said for the time being and in response to the Forties pipeline incident, it has reduced its estimate for UK production in December by 300 kb/d, and will revisit this as the situation becomes clearer.

“After the initial surge that understandably accompanies such a major supply disruption, the market has settled down again and, unless another dramatic event occurs in what remains of 2017, it looks as if the Brent crude price will average about $54/bbl for the year, an increase of twenty percent on 2016. For the producers at least, 2017 has been encouraging. Will this carry over into the New Year?”