STAX Inc, a strategy consultancy, says as African economies continue to grow, more opportunities will open up for Sri Lankan firms in areas such as tourism, hospitality education, and green energy.

“Service industries such as retail, banking, and healthcare can also expand into to Africa to take advantage of the growth in the services sector,” said Rasitha Wickramasinghe, business development lead of STAX Inc.

“Mini-hydro power companies such as VS Hydro and Hemas Power, a subsidiary of Hemas Holdings plc, were among the early entrants of Sri Lankan companies into Africa as opportunities in the local market started to saturate. They were followed by construction, ICT, logistics and automotive companies.”

Wickramasinghe says STAX is seeing renewed interest in African countries as of late and that it recently assisted a Sri Lankan FMCG market leader to tap into the burgeoning consumer market in East Africa by helping it to find suitable in-country partners.

In the ICT sector, hSenid, the largest Human Capital Management (HCM) solution in Sri Lanka, entered the African market more than 10 years ago when it successfully bid for an RFP in Tanzania with a local partner.

According to Founder Chairman Dinesh Saparmadu, Africa is a high growth market for companies with clients in banking, insurance, telecom, and NGO sectors.

“Today we have more than 60 corporate clients across 17 African countries for our HCM and mobile solutions.”

In order to cater for growing demand, hSenid opened an office in Nairobi, Kenya and from there rest of the African continent is serviced via direct and partner channels.

St. Theresa Industries (STI), a company that specialises in the manufacturing of power distribution and transmission materials, is another company that has expanded into Africa over the last four years.

In 2013, STI set up a factory with a local partner in Kenya to take advantage of the huge market potential due to limited rural electrification and distribution network.

“We were able to take advantage of the 2030 vision of the Kenyan government which promotes local manufacturing by providing exclusive rights to government contracts,” Madusanka Fernando, director of STI said.

“To date, we have been successful in securing over US 15 million dollars worth of contracts from the public and private sector and are already looking to increase our footprint to Tanzania and Rwanda by the end of this year.”

During 2017, apparel manufacturers Hela clothing and Hirdaramani group also established their manufacturing presence in Africa.

As a whole, Africa has become more peaceful and stable over the last decade.

The World Health Organisation reports that deaths through conflict in Africa declined by 95 percent between 2000 and 2012. This improved peace and stability is starting to reap economic benefits for the African nations.

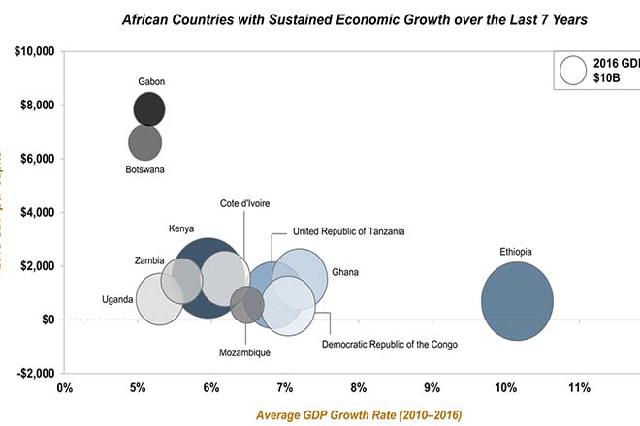

Between 2000 and 2007, Sub-Saharan Africa nearly tripled its growth rate to 6 percent a year and over the last decade African economies have added nearly US 1 trillion dollars, and the combined GDP of African countries today stand around the US 2.2 trillion dollars.

The combined population of Africa is 1.2 billion today and accounts for more than 15 percent of world’s population. Africa’s working age population as a share of the total population is set to continue to rise from its current 56 percent, all the way through to the next century.

The link between a country’s level of urbanisation and economic growth is also well established, two decades ago less than 30 percent of Africa’s population lived in urban areas. This has increased to 40 percent today.

Problem with Nigeria Revision of first-hand account of the AGSMEIS programme (2)