Investing in healthcare ventures and stocks remains one of the most lucrative and popular money streams on Wall Street. Fund managers deem it to be bankable and insulated from the macroeconomic volatility we have become so accustomed to in recent years. It is hardly surprising that those managing the most successful healthcare funds possess specialist knowledge of that world.

What may indeed surprise some is that a group of twenty-somethings, yet to complete their formal education in medicine and finance, are having a right royal crack at it, delivering some spectacular returns in their own small but sure-footed way.

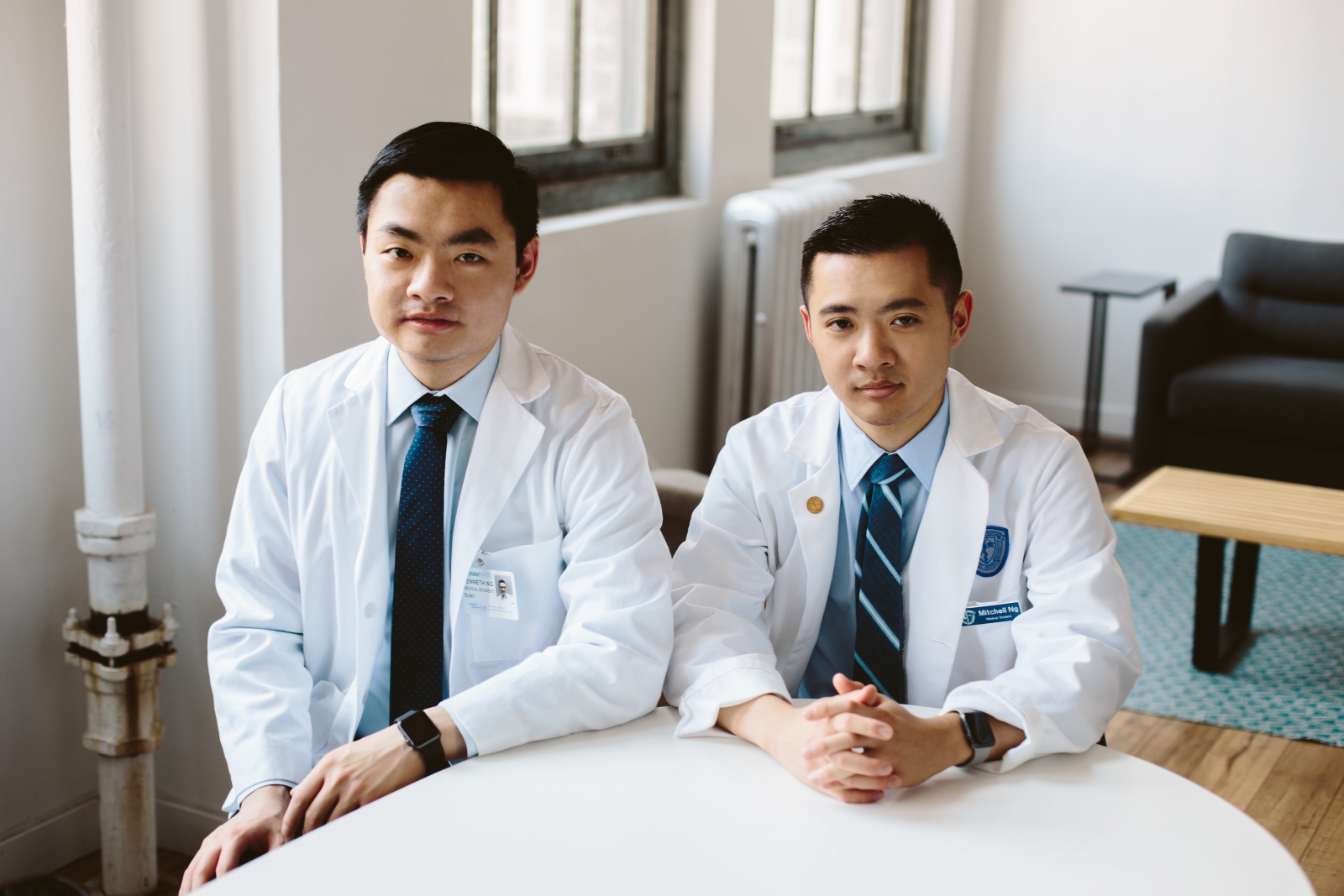

That motley crew of partners is Thessalus Capital Management, an investment fund fronted by 22-year-old Mitchell Ng, a medical student at Case Western Medical School in Ohio, US and Princeton molecular biology major.

In 2016, Mitchell’s outfit delivered a 44% return, when the S&P500 returned less than 9%, and cumulative returns of 62% roughly two years since its inception, with over $3m (£2.32m) in assets under management (AUM) and rising. That’s an impressive feat for an outfit so young and with a back-story conjured up in university dorm rooms, from a seed capital of $350,000 in 2014, largely raised from extended family and close friends.

“While majoring in molecular biology at Princeton, I interned at Ferghana Partners, a healthcare investment bank and got really interested in the business side of medicine. At Ferghana, I noticed how the healthcare sector was almost guaranteed to grow exponentially. For instance, the sector’s market cap had grown by 292% stateside over the previous five years,” Mitchell tells IBTimes UK.

Eyeing an opportunity, Mitchell roped in his elder brother Kenneth, 25, a medical student at SUNY Downstate College of Medicine, New York, and NYU biochemistry major. Given the sector is vast; both brothers narrowed their interest down to three primary segments – specialty pharmaceuticals, gene editing and molecular diagnostics.

“It took two months to complete the legal formalities of starting an investment fund, following which we started doing a bottom-up examination of every company we wanted to invest in (or not). Ours was, and still remains, a very science-based approach and we feel that’s our competitive edge.”

The ‘long’ and ‘short’ of it

Their team of researchers and partners, mostly of a similar age profile, has grown to over 20 PhD and MD students, with Mitchell being the “first among equals.”

Explaining Thessalus’ approach, he notes: “For the finance side of things we use specific metrics (market capitalisation, EBITA, P/E ratios) to screen out companies we’re not interested in. Then of what’s left, we conduct a bottom-up analysis, looking individually at what’s in their product pipeline, followed by a standard analysis of how a particular company would do compared to another in the same marketplace.”

The nascent fund’s track record proves it knows a thing or two about the sector. For instance, in 2016, Sarepta Therapeutics was riding high after it claimed to have found a cure of Duchenne Muscular Dystrophy (DMD); a terminal disease.

Initial media hype prompted Thessalus to go long, i.e. bet on the stock price rising. However, colleague Ariel Kantor, 20, a junior at Duke University majoring in biotechnology, cut through hype to form a conclusion that the drug just didn’t work.

“Social and political pressure suggested the US Food and Drug Administration (FDA) would approve it for trial and the stock would jump. We went long, it happened and Sarepta’s share price spiked by 80%. However, as research suggested otherwise, we subsequently shorted the stock which plummeted when the drug was found wanting, netting us double-digit returns.”

“We had to cut through the emotion. If the politics of the hour and an FDA approval was running contrary to what medical experts’ opinion was pointing to, our instinct was to go with the latter, and we were vindicated.”

Research, more research and then some

Mitchell has plenty of case studies to flag up Thessalus’ credentials. For instance, a company called Medivation – proponent of prostate cancer drug Xtandi – which was acquired by Pfizer in September 2016.

It had a final share price $81.44 versus Thessalus’ point-of-entry price of $36.17; an upside of 120%. “We initiated comprehensive equity research of all current and in-development oncology drugs early January 2016, literature review completed late February 2016, which coloured our vision about Medivation’s prospects.

“What we also saw before us a strong management team committed to maximisation of shareholder value via increasing corporate attractiveness for acquisition. Taken together, this clearly pointed to Medivation as a winner and we reaped the benefits.”

Exelixis, another one of Thessalus’ bets, has seen its stock rise by 400% in the last 15 months. “Exelixis is primarily focused on developing small molecule therapies for cancer. Three drugs developed at Exelixis have been met with regulatory approval, the most important of which is Cabometyx.

“We picked up on Cabometyx when looking at favourable Phase III clinical trial data; we realised the likely FDA approval of Cabometyx as a second line treatment late stage renal cell carcinoma (RCC). This occurred in April 2016 and sent the stock price soaring. Given the dearth of available treatments for this disease, we decided it was likely Cabometyx would quickly capture significant market share, and that turned out to be the case.”

Ultimately it all bottles down to research and a bottom-up trading strategy. “The [bottom-up] approach might not be for every sector, but we feel it is particularly relevant for healthcare.”

So any recommendations? The question draws a smile. “You wouldn’t expect us to reveal all would you? All I can say is our best performing stock of 2017 is Vanda; currently trading $16.10 versus point-of-entry price $10.39; up 55%.

“The clinical efficacy of both its drugs – Fanapt (for schizophrenia) and Hetlioz (only existing treatment for non-24 hour sleep-wake disorder) – is well established but their market looks set to grow. For instance, preparation for the launch of Hetlioz in five largest European Union countries is on the horizon, potentially doubling patient population addressed.”

Of Ivy League young guns and the ‘Money Man’

With returns like these, the Ng brothers’ boutique fund is attracting some interesting investors and advisers. Bill Kridel, a former Barclays director and President of Ferghana Partners remains a mentor and confidant.

Former Blackrock Managing Director Bernard Lee and Avinash Singh, a former Chief Operating Officer of Birlasoft and boss of Excel Capital Ventures, are also among Thessalus’ list of investors and advisers, peppered with real estate tycoons and former JPMorgan executives.

Bringing them all together is the Ng brothers’ tenacity and that of their childhood friend Raj Bagaria, a 19-year-old University of Pennsylvania freshman in the Huntsman programme of International Studies and Business; a dual-degree course between the College of Arts and Sciences and the Wharton School.

“It would be fair to give Raj the accolade of our ‘Money Man’. Nearly 50% of investment funds raised so far have been via him. He’s a highly impressive young man, who – despite his father running a multinational raw materials empire – chose not mention this at all in his college application to the Huntsman programme.

“He was admitted by virtue of his own impeccable academic credentials and will be starting this fall, at one of the most selective in the country and possibly even more selective than Harvard or Princeton. Together with Ariel (Kantor) and Nish Patel, Raj leads the pack of our young guns,” adds the not-all-that-old Mitchell.

By any stretch of anyone’s imagination, running an investment fund while juggling studies, research, publishing papers, and in Kenneth’s case an upcoming medical residency, is no mean feat. So the young guns back each other up, putting in 10 hours per week to the Thessalus cause.

Combining medicine with business

“That still adds up to a 50-60 hour week individually if you include our studies. But I find it rewarding, and would not have gone down the route if I did not believe in it. I could have been done with Princeton, headed off to a Wall Street analyst’s gig then onto an MBA and down a linear finance career path, but my heart wasn’t in it,” Mitchell says.

“Right now, you can call Thessalus Capital a very serious hobby. Our aim is to consistently achieve 30-35% returns at the very least; that’s how you get attention on Wall Street. The average fund on Wall Street is typically $50-$100m and that is the end point we are hoping to achieve in a few years, and leverage our position. I believe once medical school and residency is finished we can devote more time to this.”

However, Mitchell adds, it won’t quite be the end goal for him. “I do want to finish medical residency, have a good medical group practice where there are other doctors that make the same kind a cash that I’m making, and then we raise enough money to invest in one or two actual drugs, instead of being a fund that’s scattered and involved in equities.”

A biotech CEO’s job sits well with Mitchell with his own clinic to spring off of and his elder brother by his side. “There are a lot of exciting things on the horizon. For instance, immunotherapy and gene editing are almost guaranteed to spring up new start-ups that are going to be developing new treatments and drugs.

“These will provide investment avenues, chances to offer advice and also possibly leading one of the ventures. Both mine [and Kenneth’s] future involves combining medicine with business. Thessalus is just the start.”