Over the weekend, together with a select group of African professionals and leaders across various fields, we had the privilege of engaging with Dr. Akinwunmi Adesina, co‑founder of the Global Africa Investment Summit (GAIS) and immediate past President of the African Development Bank (AfDB). Our conversation ranged widely from investment opportunities across the continent to the principles and practice of leadership in a rapidly changing world. Listening to Dr. Adesina was a reminder of what clarity sounds like. His message was unmistakable: Africa is not a continent of deficits but a continent of vast, undervalued assets. Our task is to prepare, package and present ourselves accordingly.

Last week, this column reflected on the launch of GAIS and its bold proposition that Africa is not a peripheral actor in the global economy but a central engine of future growth if we choose to act with coherence, confidence and collective purpose. This week, we extend that argument by examining three levers that will determine whether Africa’s economic promise becomes a lived reality: the African Continental Free Trade Area (AfCFTA), a continent‑wide industrialisation strategy, and the strategic deployment of our sovereign assets. But these levers cannot operate in isolation. They require a fourth pillar: the technical skills, institutional capability and policy discipline to drive them.

These are not separate debates. They are parts of the same system. And unless we treat them as such, Africa will continue to underperform while others extract disproportionate value from our markets, minerals and talent.

AfCFTA: Market without production is missed opportunity

AfCFTA remains the most ambitious economic integration project of our time. A single market of 1.4 billion people with a combined GDP of over $3.4 trillion is not just a trade agreement. It is a geopolitical asset. Yet Africa’s intracontinental trade has hovered between 14 percent and 18 percent for years, compared to over 60 percent in Europe and nearly 50 percent in Asia.

The reason is straightforward: Africa cannot trade what it does not produce. Tariff reductions alone will not transform our economies. Roads and ports alone will not build competitiveness. AfCFTA needs a production base, real industries, real value chains, real firms that can scale across borders. Without industrial capacity, AfCFTA risks becoming a duty‑free consumption zone rather than a platform for African manufacturing, technological innovation and job creation.

Industrialisation: Missing middle in Africa’s development journey

For decades, Africa’s development conversation has oscillated between subsistence agriculture and raw material extraction, often skipping over the industrial middle that historically powered every major economic transformation. Industrialisation is not a romantic idea. It is a practical necessity.

By 2050, Africa will host one in four people on the planet, with the world’s largest working‑age population. Yet manufacturing contributes less than 12 percent to Africa’s GDP, far below the levels seen in East Asia during its rise. Our MSMEs, which make up over 80 percent of Africa’s businesses, remain trapped in fragmented markets without structured value chains or access to finance. More than 70 percent of our exports remain unprocessed.

A serious industrialisation strategy must include:

– regional value chains that allow countries to specialise and scale.

– standards and quality systems that make African products competitive.

– more industrial parks and SEZs linked to energy and logistics corridors.

– technology transfer and skills development embedded in investment deals.

– regulatory environments that reward production, not import arbitrage.

Industrialisation is the engine. AfCFTA is the transmission. But even with both, Africa cannot accelerate without fuel. And that fuel lies in our sovereign assets.

Sovereign assets: Africa’s hidden balance sheet

At GAIS, Adesina reminded us that Africa is not poor. It is simply underpriced, undervalued and underleveraged. Africa holds 30 percent of the world’s mineral reserves, including cobalt, platinum, manganese and rare earths; 60 percent of the world’s uncultivated arable land; the world’s largest solar potential; a young labour force that will shape global productivity; and sovereign wealth and pension assets estimated at over $2 trillion.

Yet we continue to negotiate from a position of perceived weakness, often accepting terms that do not reflect the true value of what we bring to the table. This perception gap persists despite evidence to the contrary. A 14‑year assessment by Moody’s Analytics found that Africa’s infrastructure investment loss rate averaged 1.7 percent, significantly lower than the double‑digit loss rates recorded in parts of Latin America and Eastern Europe. In other words, Africa’s actual investment performance is far stronger than the risk premiums imposed on it. The continent is penalised not for its fundamentals, but for outdated narratives.

If Africa wants investors to see opportunity rather than risk, we must prepare differently. That means:

– mapping and valuing our sovereign assets with precision

– structuring them into investable instruments

– using them to derisk private capital

– capturing more value domestically from minerals and energy

– building African credit enhancement mechanisms to reduce borrowing costs

When Africa prices its assets correctly, the investment conversation changes. We stop pleading for capital and start negotiating partnerships.

The missing pillar: Skills, institutions and policy capability

None of these ambitions, not AfCFTA, not industrialisation, not sovereign asset leverage, can succeed without the technical skills and institutional capacity to drive them.

Africa’s skills gap is visible in:

– the shortage of industrial engineers and technicians

– weak regulatory and standards institutions

– limited capacity for complex contract negotiation

– fragmented investment promotion systems

– inconsistent policy implementation across ministries and agencies

We cannot build regional value chains without people who understand logistics, standards and industrial processes. We cannot negotiate fair mineral contracts without economists, geologists and lawyers who understand the value of what sits beneath our soil. We cannot leverage sovereign assets without financial engineers who can structure instruments that global markets respect.

Policy coherence is equally essential. In many African countries, industrial policy sits in one ministry, trade policy in another, investment promotion in a third, and skills development in a fourth, each moving in different directions. No country industrialises with such fragmented governance.

Africa needs a new generation of technical talent and institutions capable of executing complex economic strategies. Without this, even the best ideas remain aspirations.

From potential to power

Africa’s challenge is not the absence of assets or opportunities. Our challenge is preparation. Our challenge is coherence. Our challenge is the discipline to value what we have and present it to the world with the confidence it deserves.

If Africa is to shift global perception from risk to opportunity, then we must do the work of mapping, valuing, structuring and marketing our sovereign assets with the same sophistication global markets expect. We must build industries that anchor AfCFTA. We must invest in the skills and institutions that make these ambitions real. And we must recognise that no one will tell Africa’s story better than Africans themselves.

This is the moment to move from potential to power. The continent is more than ready. Now let’s get to work.

- business a.m. commits to publishing a diversity of views, opinions and comments. It, therefore, welcomes your reaction to this and any of our articles via email: comment@businessamlive.com

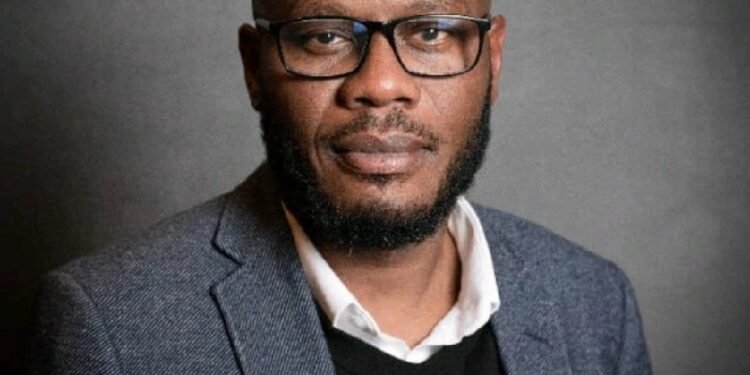

Dr. Wale Osofisan, PhD, is a seasoned governance strategist and policy analyst with over 23 years of experience advancing African-led, evidence-based solutions to political transitions, humanitarian crises and development challenges.

From assets to agency: Turning Africa’s balance sheet