The Economic Intelligence Group of Nigeria’s tier-1 lender, Access Bank, has put out a call on the country’s July inflation numbers to come in at 15.94 percent when the Nigerian Bureau of Statistics releases the figures next week.

But the group expects that Nigeria’s central bank would maintain a cautious monetary policy stance, notwithstanding the expected deceleration in the inflation rate, a gradual fall that has been seen happening for months.

The group joins a number of other analysts who have also predicted that July inflation will further recede from the figure posted in June. FSDH had earlier said: “We expect the inflation rate (year-on-year) to drop to 15.96% in July from 16.10% recorded in the month of June 2017.”

In the July inflation forecast note made available to Businessamlive, the analysts at Access Bank said that they arrived at the prediction using a methodology that adopts an autoregressive analysis of past prices while recognizing all the assumptions used by the National Bureau of Statistics (NBS) in its computation of monthly composite consumer price index (CCPI).

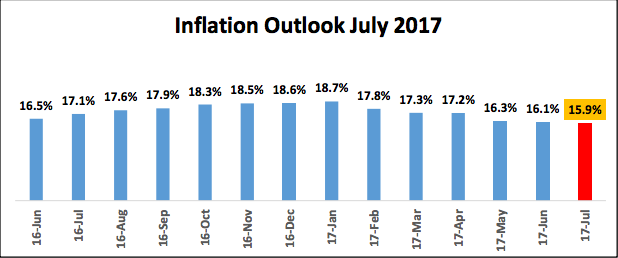

Based on this methodology the Economic Intelligence Group said: “The Economic Intelligence Group forecasts inflation rate (year-on-year) to trend downwards to 15.94% in July 2017 from 16.10% posted in June 2017.”

If the call comes true when the inflation figures are released next week, it would be the sixth consecutive month that the pace of annual inflation will slow after reaching a peak of 18.72% in January, they noted, but the central bank which has inflation targeting as a core mandate is not expected to be bullish in responding with an accommodative monetary policy, the group observed in the inflation note.

According to the group, “considering that inflation is still far above the Central Bank’s target range (6-9% y-o-y), the apex bank is likely to take a cautious approach in any move towards a more accommodative monetary policy,” adding that under this circumstance, their expectation is that benchmark policy rate would remain at the prevailing level of 14 percent.

The group observed that the scenario does not offer room to expect any change in the apex bank’s approach to its monetary policy stance, including its approach to the exchange rate. “With no change in the monetary policy rate anticipated, we expect FX stability to remain the primary aim of CBN monetary policy, prompting it to maintain open-market operations, pre-funded FX auctions to mop up excess liquidity, and issuance of stabilization securities to deal with maturing debt instruments,” the analysts noted.

On what they called the probable impact on the money and fixed income market, the Access Bank Economic Intelligence Group said it expected appetite for the longer-dated paper to increase on the back of the deceleration of inflation rate, supported by relative exchange rate stability, and the prospect for further primary debt issuance.

But the call on inflation by the Access Bank Intelligence group is expected to happen on the back of a number of drivers, including that the moderation for the month would come as rising prices for food items were partially offset by a drop in core inflation.

“In July, prices of food and non-alcoholic beverages, the largest component in the consumption basket (with a weight of 51.8%) rose slightly. According to an independent survey, prices of main staple food commodities such as beans and yam ticked slightly upwards. According to the NBS, the Food Index increased by 19.91% year-on-year (y-o-y) in June, 0.64 per cent points higher than the rate recorded in May (19.27%),” the group explained.

They also noted that core inflation, which excludes the prices of volatile agricultural produce, extended its downward trend in July, and attributed this partially to increased foreign exchange availability and the appreciation of the Nigerian currency, the naira, on the street market.

“The value of the naira remained stable at the interbank market while it appreciated at the parallel [street] market by 0.54% to close at $/N365.00 from $/N367 at the end of June. The core inflation for the month of June stood at 12.5%, 0.5 per cent lower than the 13% recorded in May 2017 and the 7th consecutive monthly decline in the core index since December 2016,” the group further explained.