The Bank of Canada forged ahead with another interest rate hike in a nod to the country’s surging economy, while signaling its appetite for further tightening may be curbed by a rising currency and sluggish price pressures.

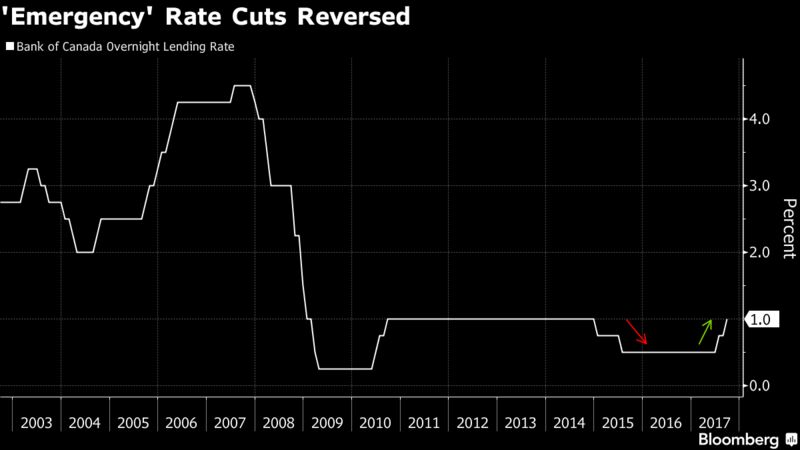

Policy makers raised their benchmark rate 25 basis points to 1 percent, the second increase since July. At the same time, they cited risks including continued excess capacity, subdued wage and price pressures, geopolitics and the higher Canadian dollar, along with concern about the impact of rising interest rates on indebted households.

“Future monetary policy decisions are not predetermined and will be guided by incoming economic data and financial market developments as they inform the outlook for inflation,” the Bank of Canada said Wednesday in a statement from Ottawa.

Governor Stephen Poloz is trying to strike a balance between bringing interest rates back to more normal levels amid the strongest growth spurt in more than a decade, without harming an economy that is only now beginning to fully recover from an almost decade-long downturn. Markets, shrugging off some of the more dovish language, sent the Canadian dollar to the highest level in more than two years as it interpreted the statement as confirmation the central bank is firmly on a rate hike path.

“What they are saying to me is they are leaving the door open to future

hikes,” said Derek Holt, head of capital markets economics at Bank of Nova

Scotia in Toronto. He changed his forecast last week to correctly predict the

rate increase.

Investors are anticipating as many as two hikes from the Bank of Canada over the next year, including one by the end of 2017, according to swaps trading, on the expectation the central bank is worried quickly vanishing economic slack will soon fuel inflation.

Canada’s currency climbed as much as 1.8 percent after the decision, reaching C$1.2146 against its U.S. counterpart, the highest intraday level since June 2015, and extending the gain this year to 10 percent. Bonds yields surged, with the two-year note jumping seven basis points to 1.42 percent, the highest in more than five years.

Only six of 26 economists surveyed by Bloomberg News expected the central bank to hike its benchmark rate. Traders had assigned about a 40 percent chance of an increase.

Adding to the market reaction was the fact the bank didn’t repeat language from previous statements about the current degree of stimulus being “appropriate,” which suggests it will stay on its tightening path.

‘Fairly Hawkish’

“It didn’t say that the current level of stimulus is now ‘appropriate,’ which has been a phrase used in the past and would have been a way of signaling a pause in hikes from here,” Andrew Grantham, an economist at Canadian Imperial Bank of Commerce, said in a note to investors. “It was a fairly hawkish move and statement today.”

Few developed economies are growing as quickly as Canada. The economy accelerated at a 4.5 percent pace in the second quarter — tops among Group of Seven countries — led by the biggest binge in household spending since before the 2008-2009 global recession

Quarterly growth has averaged 3.7 percent over the past four quarters, compared to 2.2 percent in the U.S. Economists are now projecting growth of above 3 percent in Canada for all of 2017, a full percentage point above the U.S. The surge may have already brought the country to full capacity more quickly than the central bank estimated only two months ago. That would typically be a strong signal to policy makers that interest rates need to rise.

Considerable Stimulus

The bank cited Canada’s stronger-than-expected economic performance for the hike, warranting a removal of some of the “considerable” stimulus in place. In effect, the bank fully removed the two rate cuts from 2015, which were meant to counter the negative impact of falling commodity prices.

Recent better-than-expected data supports the view that growth is more “broadly-based and self-sustaining,” the bank said, citing more “widespread strength” in business investment and exports, and “stronger-than-expected indicators of growth” globally.

Yet, there was an introduction of cautionary language, and new worries about financial market developments, that weren’t in the last rate decision and suggests the central bank isn’t quite ready to declare victory on the economy totally eliminating its slack.

“There remains some excess capacity in Canada’s labor market, and wage and price pressures are still more subdued than historical relationship would suggest,” according to the statement.

Poloz may also be attempting to restrain market expectations it will get too far ahead of the Federal Reserve, citing worries about recent “financial market developments.”

The bank said there remains “significant geopolitical risks and uncertainties” around international trade and fiscal policies that have weakened the U.S. dollar. The suggestion is the Canadian dollar gains aren’t totally reflective of Canadian growth and it was the first reference to the Canadian dollar in a rate statement since March.

The bank also said it will pay close attention to the “sensitivity” of the economy to higher interest rates given “elevated” household indebtedness, and added it will pay “particular focus” to the evolution of the economy’s potential growth rate, possibly a suggestion that the economy can run at a faster pace than the bank originally thought without triggering inflation.

Report courtesy Bloomberg

When applause travels faster than hunger