The pound surged and U.K. government bonds fell as the Bank of England said it sees scope for stimulus reduction in coming months, spurring markets to bring forward expectations for a rate increase.

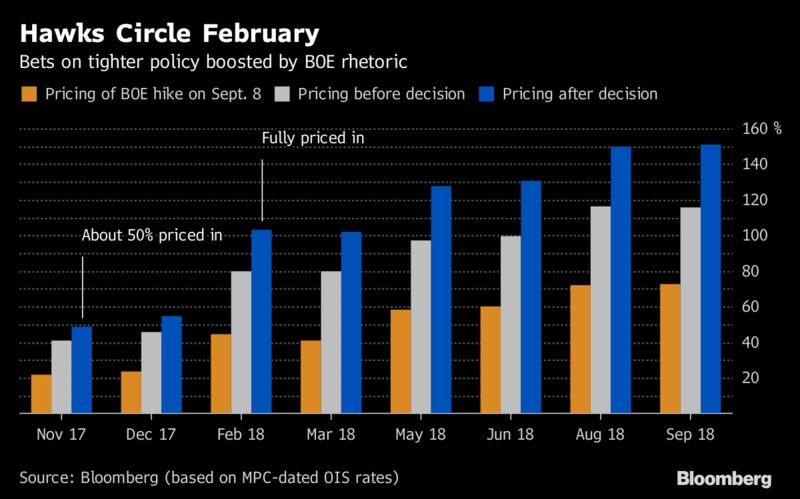

Sterling rose to the highest in a year against the dollar and strengthened versus all of its Group-of-10 peers, with a rate increase fully priced in for February 2018, compared with around mid-2018 previously. The implied probability of a 25-basis-point-rate increase by November this year also rose to 50 percent, compared with 40 percent before the BOE announcement, according to MPC-dated SONIA.

The BOE’s Monetary Policy Committee voted 7-2 to keep the key interest rate at a record-low 0.25 percent and said some withdrawal of monetary stimulus was likely to be appropriate over the coming months to return inflation sustainably to target.

“The comment that most see scope for stimulus reduction in the coming months suggests it was a closer call than the 7-2 vote would suggest,” said Royal Bank of Canada currency strategist Adam Cole.

Sterling rose as much as 1.1 percent to $1.3356, the highest since September 2016, and by 1.3 percent to 88.78 pence per euro. The yield on benchmark 10-year gilts climbed seven basis points to 1.22 percent, its highest in more than a month.

The pound gained this week on expectation of a more hawkish tone from the central bank following a pickup in inflation data on Tuesday. That was tempered by jobs data on Wednesday showing low unemployment failing to feed through to faster wage growth, but the central bank’s comments appeared to suggest it was willing to look past sluggish wages.

“This clearly at the margin makes a move in November more likely, but it depends on what happens to the data between now and then,” said John Wraith, the London-based head of U.K. rates strategy and economics at UBS Group AG. “For now they are obviously determined to try and get more traction in the market, which they’ve been hoping to do and I think this move can extend a little bit.”