China has an insurance policy against a full-scale market meltdown: the daily currency fixing.

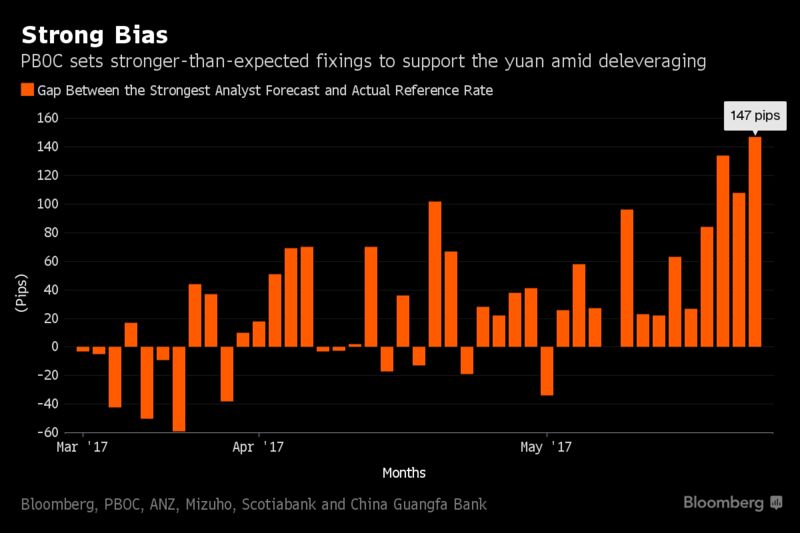

With stocks and bonds in retreat amid anxiety over Beijing’s deleveraging campaign, officials have been guiding the yuan higher against the dollar in a move that’s caught market watchers by surprise. After meeting expectations earlier in the year, the reference rate used by the People’s Bank of China to manage the yuan has come in stronger than the forecasts of four banks who regularly track the measure on 25 of the past 32 trading days.

“The PBOC is using the stronger fixings to prevent panic sentiment from spreading to the currency market,” said Xia Le, chief economist at Banco Bilbao Vizcaya Argentaria SA in Hong Kong, referring to the reference rate that’s updated each day. “In the short term, no one can fight against the PBOC when it intervenes through the fixings. Investors will likely become more willing to sell the dollar, pushing the yuan higher from current levels.”

China seems to be trying to find a balance between tackling financial risks while avoiding a wider selloff that undermines faith in the markets and Beijing’s regulatory powers.

Policy makers are railing against speculation and stepping up controls on the banking industry, but also boosting injections of cheap cash amid concern over tight liquidity. The yuan is playing a steadying role, too, with foreign investors citing the currency’s stability in the face of spiking bond yields and equity-market whiplash as one of the reasons they’re sanguine about the clampdown.

While China has largely stemmed outflows through tougher capital controls, the PBOC is engineering a stronger yuan to preempt a renewal of those pressures amid the stock- and bond-market gyrations, says Khoon Goh, head of Asia research for Australia & New Zealand Banking Group in Singapore. The onshore yuan reached a three-week high on Wednesday.

Unpredictable Moves

“The authorities likely want to ensure that there is no pick-up in outflows and keeping the yuan stable is one way to ensure this,” said Goh, one of the analysts whose forecasts have been trailing the yuan’s reference rates this month.

Central bank policy stipulates that the yuan is restricted to moves of no more than 2 percent either side of the reference rate. But officials have never divulged exactly how the daily rate is calculated, with banks having to come up with their own models based on what the fixing has done in the past and bits of intelligence from policy makers. Since mid-2016, the reference rate has been very predictable — until now.

The rate has come in stronger than the median of fixing forecasts provided by the four banks — ANZ, Mizuho Bank Ltd., Scotiabank and China Guangfa Bank Co. — every trading day since April 5, according to Bloomberg calculations. The fixing was 0.23 percent higher than the median projection on Friday, the biggest deviation since at least February.

The stronger fixing policy will help lure foreign investors to China’s onshore bond market, said Ken Cheung, a Hong Kong-based currency strategist at Mizuho. Offshore funds are set to get increased access to the mainland debt market via a trading link with Hong Kong.

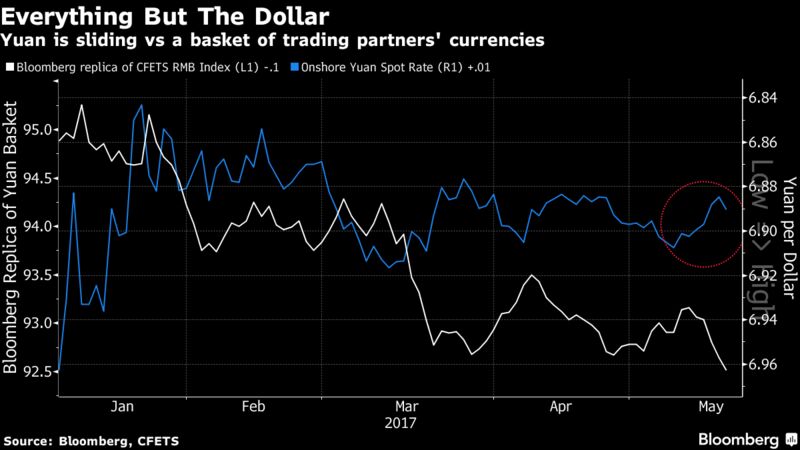

The fact the yuan is seeing stability against the dollar, but remains weak versus other currencies, suggests the stronger fixing run is a sentiment-boosting move. The PBOC didn’t respond to questions faxed to its press office on Thursday.

Traders have been paring bets on yuan weakness, with odds of a drop beyond 7 per dollar by the end of June at 8 percent, down from 38 percent two months ago, according to options data compiled by Bloomberg. But strategists still see the currency, which traded at 6.8900 per dollar as of 6 p.m. local time on Friday, retreating to 7.05 per dollar by year-end.

Treasury Secretary Steven Mnuchin praised yuan strength on Thursday, saying China’s use of foreign-currency reserves to support the currency benefits American workers. U.S. President Donald Trump backed down on a vow to label the country a currency manipulator after meeting with his Chinese counterpart Xi Jinping in early April.

While ANZ’s Goh says the yuan’s “stronger bias” will likely persist, it will become difficult for the PBOC to maintain as the market starts to price in further interest-rate hikes from the Federal Reserve.

“This is not a fundamental revamp of China’s foreign-exchange policy — the PBOC will want to keep its policy consistent, which is the cornerstone of yuan stability,” said Mizuho’s Cheung. “But as China eases capital curbs to push for internationalization in the second half, the currency will face mild pressures to weaken.”

Courtesy Bloomberg