The Federal Government has been urged to understand that its biggest challenge is not diversifying an already diversified economy, but diversifying its revenues, according to a report on the assessment of the current administration made available to businessamlive.

The report indicated that going by the recent Q1 2017 gross domestic product (GDP) figures released by the Nigerian Bureau of Statistics (NBS), the oil and non-oil sectors of the economy are doing quite well as they both experienced growth during the quarter. This means the economy has been relatively diversified leaving government to widen its very limited tax net while delivering on the promise to cut the cost of governance drastically.

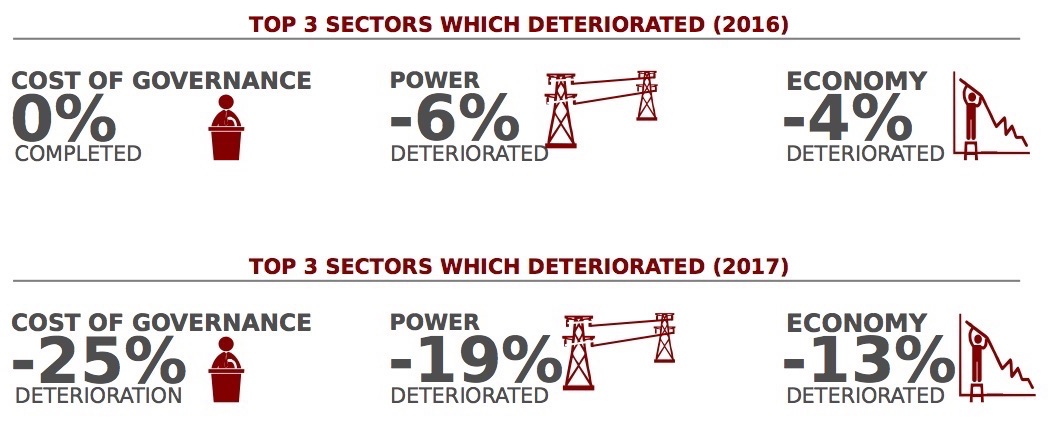

“It is particularly untenable that in the face of dwindling government revenues, the cost of running government has continued to increase to record levels,” the reports said.

“Economically however, the Buhari Administration needs to understand that its biggest challenge is not diversifying an already diversified economy, but diversifying government revenues,” it added.

The report maintained that drop in government revenues has created a climate of debt-ridden federal government and states who are unable to fulfil their basic commitments, let alone fund badly needed infrastructural programmes – a situation which has placed the federal government under even more pressure.

Total reliance on oil for revenues and a lukewarm approach to broadening the tax net has created shortfalls that have affected the country’s macroeconomic stability.

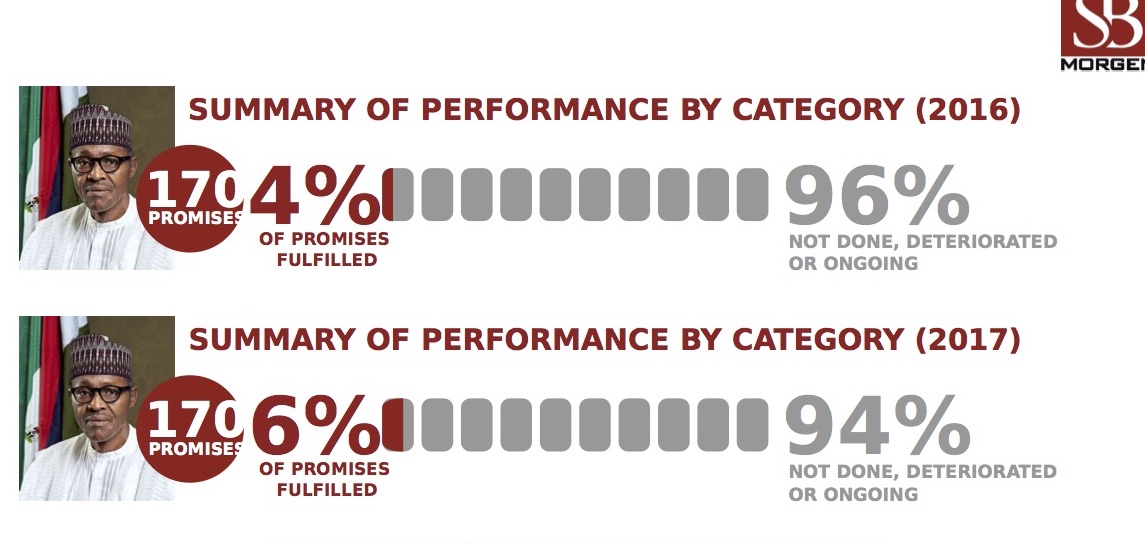

In its mid-term scorecard for the current administration, SBM Intel said aside the economy, the three important drivers of the Buhari electioneering campaign were anti-corruption, accountability in public service and reduction of cost of governance, which according to the report is still too poor to definitively proclaim any significant progress.

On anti-corruption, it gave the government a low 33% performance when measured against promises, even though it is an improvement on the 17% recorded in the administration’s first year, saying the jostling between the government’s executive and the National Assembly is impacting on the administration’s ability to deliver so-called ‘dividends of democracy’ to Nigerians.

“The Buhari administration has come under an unwelcome spotlight over two marquee issues: foreign exchange policy & power reform,” it said, adding that it had bred a mix of frustration and confusion among Nigerians.

“A principal element that will unleash the economic potential of Nigeria is the building of key infrastructure. While the campaign promises of the APC recognised this, the execution in the last two years leaves so much undone, with only 8% performance in such a critical category,” the report claimed.

Job creation, housing and social welfare are also deemed to be the in negative territory, which is worrying for a country with a very large youth population, high population growth and an increasing percentage of people living in abject poverty.

“Today, there are no social safety nets and more and more people have fallen into poverty as a result of economic decline over the last two years.

Two key areas that affect Nigerians today and have significant impact on our future as a country, have also seen lacklustre performance from the Buhari Administration. Education has a mere 3% performance, while healthcare has actually deteriorated by 8% over the last two years. When measured against events like the avoidable deaths due to meningitis, it is clear that this deterioration is already impacting Nigerians on the ground.

The report also advised government to bring those who are complicit in the mismanagement of funds meant for the IDPs to book.

“A situation where Nigerians have escaped Boko Haram and are subject to unspeakable conditions under the care of the government is unacceptable as it only creates a willing pool of recruits for the terrorists for rewards as basic as food and shelter,” the report stated.

By Business a.m. live staff