Nigeria’s foreign reserves, which stood at $43.07bn as of the beginning of January 2019, fell by $4.45bn to $38.619bn as of the end of December, 2019.

The reserves, which had been recording a downward trend dropped from $39.8bn on November 11 to $39.24bn on December 13, latest figures from the Central Bank of Nigeria have revealed.

The foreign reserves fell by $1.26bn from $41.76bn on October 2 to $40.5bn as of the end of the month.

According to the CBN, the reserves dropped by $482.18m from N45.14bn as of July 8 to $44.65bn on August 8, 2019.

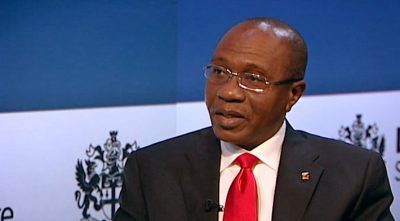

He said, “Average monthly inflows of forex into the CBN fell from over $3.4bn in June 2014 to a low of $1.4bn in September 2016. The decline in forex earnings was further complicated by the foreign capital flow reversals due to rising yields in the USA. The impact on our economy was evident in the rising pressure on the naira-dollar exchange rate.

“With the drop in forex inflows, the exchange rate at the parallel market rose from about N200/$ in August 2015 to N525/$ in February 2017. Inflation also rose from 9.6 per cent in January 2016 to over 18.7 percent in January 2017.

“Our external reserves fell from about $31bn in April 2015 to $23bn in October 2016, and activities in the industrial sector witnessed a lull as manufacturers struggled to get access to key inputs needed in the production process.”

He said the CBN introduced a demand management approach in order to conserve the country’s reserves and support domestic production of certain goods in Nigeria.

Emefiele said, “The introduction of the I&E window, along with improvement in domestic production of goods, has helped shore up our external reserves. Transactions have reached over $55bn since the inception of the window and our foreign exchange reserves has risen to $42bn in September 2019 from $23bn in October 2016.