World stocks tumbled for the fifth straight day on Wednesday, while safe-haven gold rose back towards seven-year highs after health authorities warned of a possible coronavirus pandemic and markets stepped up bets on interest rate cuts.

Adding to alarm, the World Health Organization said the epidemic had peaked in China, but urged other countries to prepare for virus outbreaks.

In a change of tone, the U.S. Centers for Disease Control and Prevention also advised Americans to be ready for community spread of the virus.

Drastic travel restrictions in China, where coronavirus has claimed almost 3,000 lives, have slammed the brakes on mainland manufacturing and consumer spending, and there are worries other countries will face similar disruptions.

“China’s template to contain the virus was to restrict economic activity and that’s hitting home,” Lombard Odier’s chief strategist Salman Ahmed said.

“Markets are fearing there will be sequential shutdowns of economic systems to stop the spread.”

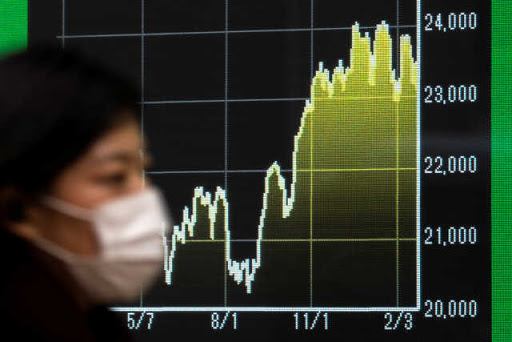

Those fears of severe economic damage, even a recession, have sent MSCI’s All-Country equity index to 2-1/2-month lows, wiping almost $3 trillion off its value this week alone.

Asian shares excluding Japan fell 1%. Tokyo lost 0.8% on concerns the virus could force the cancellation of the Olympics scheduled for July. That weighed on shares in firms such as Dentsu that are involved in the Games.

A pan-European equity index lost 1%, shrugging off slight gains on futures for the S&P 500, Dow Jones and Nasdaq.

Economic growth worries are reflected in steep drop in bond yields — 10-year U.S. yields are down 60 basis points since the start of 2020. Moreover, U.S. three-month T-bill yields remained some 18 basis points above 10-year rates — the curve inversion that’s considered a classic signal of recession.

Ten- and 30-year U.S. Treasury yields teetered just off record lows and another safe-haven, German bonds, also saw 10-year yields tumble to four-month lows below -0.5%.