Charles Abuede

Fitch Ratings, the global rating agency, says losses in the investment portfolios of life insurers, which have been generally manageable in the midst of the pandemic, are expected to become more impactful come 2021.

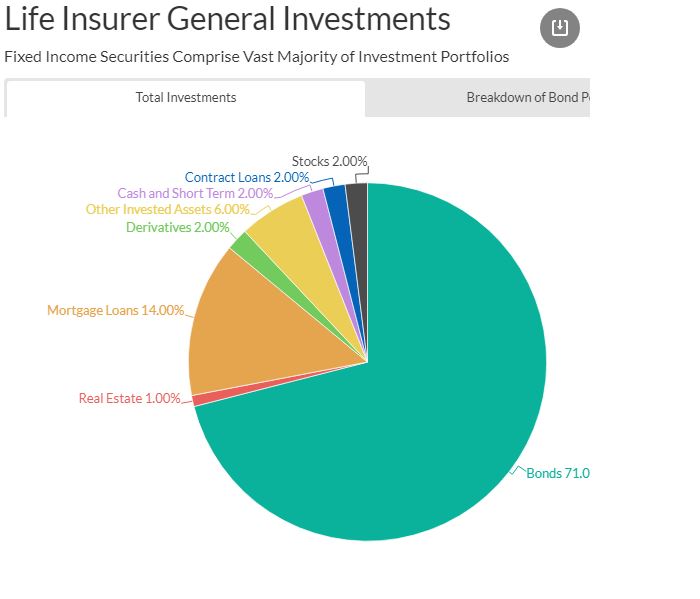

The report revealed that disabilities have ticked upward as the pandemic has caused boundless economic disturbance and disintegration across most asset classes, adding, in any case, its reviewed universes of life insurer investment portfolios maintain steady, top-notch investment allocations, with fixed-income securities containing the greater part of contributed resources.

Liquidity in the credit market at first declined for the beginning of the pandemic, while default expectations rose, creating additional widening in credit spreads and, thus, increments in opportunistic purchases, it noted. The report added that credit spreads have since been limited toward more recent averages due, to some extent, on U.S.

governments’ fiscal and monetary reactions.

The report also stated that given the Federal Reserve Bank’s (Fed’s) viewpoint for lower, longer rates through 2023 because of the pandemic, investment yields are relied upon to remain constrained. In 2019, so as to battle the extended low financing cost environment, insurers proceeded with trading liquidity for yield, unassumingly expanding their exposures to less liquid asset classes, such as private placements and commercial mortgage loans in lieu of public corporate bonds, it added.

The Fitch report further informed that at 14 per cent of contributed assets, commercial mortgage credit exposure is material, with the rating agency anticipating that losses should run around 50 per cent higher than during the money related emergency.

Be that as it may, losses have yet to emerge, it states, helped by impermanent regulatory alleviation identified with allowances for forbearance. The life security industry’s presentation to ABS, CMBS and non-agency RMBS added up to 13 per cent of contributed resources, the report stated, adding that inside this, the biggest allotment was to ABS, almost 45 per cent of which were

CLOs.

In any case, assets allocation has remained generally consistent, with fixed-income securities proceeding to include by far most of life insurers’ portfolios. Inside fixed income, the biggest designation is to corporate securities (63%), which are basically investment grade.

As of August this year, Fitch forecast a 5 per cent to 6 per cent corporate default rate for 2020 and a 2-year increasing base case default rate of about 15 per cent by year (estimated) 2021. Meanwhile, the outlook for high yield defaults has increased in the year 2020, with notably exposed sectors including consumer cyclical, energy and transportation. Life insurers’ largest portfolio allocations are to the utilities, financials and consumer noncyclical sectors.