Goldman Sachs Group Inc. analysts might not be the only ones to have incorrectly called commodity prices this year, but they are at least trying to figure out how they misjudged the market.

Commodities have tumbled 9 percent since their 2017 peak in mid-February, and Goldman acknowledges that some factors weren’t predictable, including rising oil supplies in Libya and Nigeria and the impact of weather on crops.

“But this still leaves the question of how did we (and the market) get it so wrong?” analysts from the bank said in a research note Thursday.

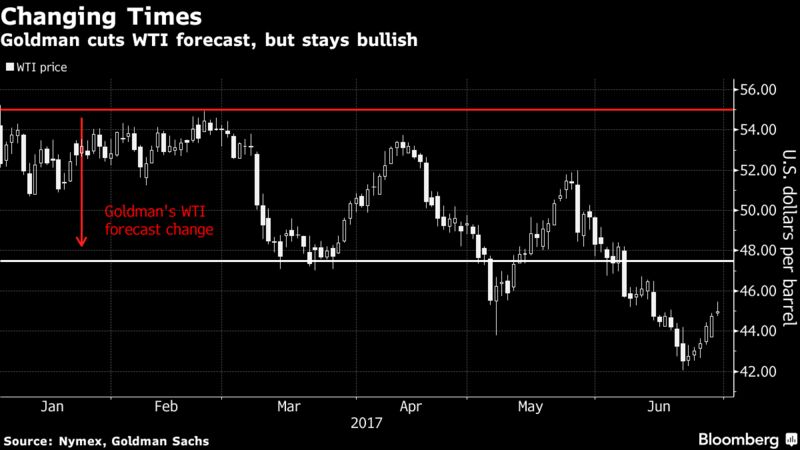

The report came less than 24 hours after Goldman joined other major banks including JPMorgan Chase & Co. and Morgan Stanley in cutting its forecast for West Texas Intermediate crude. Societe Generale SA has also slashed its crude forecasts.

Across the globe, traders have been wrong-footed by the commodities rout this year. They’ve watched as oil prices have slipped despite production cuts by the Organization of Petroleum Exporting Countries. They’ve seen copper prices drop as scrap dealers de-stocked heavily to take advantage of higher prices. They’ve witnessed policy changes in the Philippines that caused a sell-off in nickel.

Goldman says an under-appreciation of some rules of commodity investing contributed to its misjudging of the market. They include an analysis of the price differences in some contacts, which is key to understanding whether the market is oversupplied or under-supplied, analysts including Jeff Currie wrote.

Crude Oil

In a separate note on Wednesday, Goldman cut its WTI forecast for the next three months by $7.50 a barrel to $47.50. A plunge in oil prices sent WTI and Brent, the global benchmark, into bear markets last week. The contract for August delivery traded at $45.19 on Friday in New York.

Still, Goldman remains optimistic on oil.

“While the trading range is probably lower than we initially thought, we are likely at the bottom end of that range now and at current price levels the asset class looks attractive,” the bank’s analysts said in their note Thursday.

Also see: NNPC signs $700 million joint venture to develop oil fields in country’s energy hub

In the last few days, the market has grown more bullish after U.S. data on Wednesday showed oil-product inventories declined. WTI was headed for its sixth straight gain Thursday, the longest such run since early April.

Copper Market

Goldman says it also misread supply dynamics in the copper market.

A rally started to unravel in recent months as scrap dealers de-stocked heavily to take advantage of higher prices. Copper bottomed out at a low of $5,462.50 a ton on May 8, below Goldman’s three-month target of $6,200. The price was at $5,942 on Friday.

The scrap surge in the copper market had the same depressing effect as North American shale had in the energy market, Goldman said.

The copper market has recently been kinder to Goldman’s view. Prices rallied back toward $6,000 this week, and the bank is maintaining its bullish view.

Courtesy Bloomberg

Oil windfall expectations from the Middle East crisis