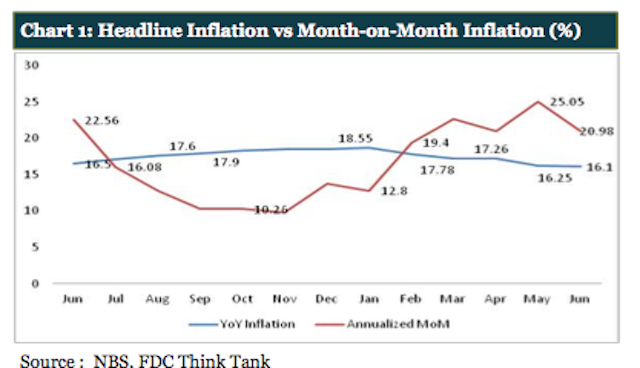

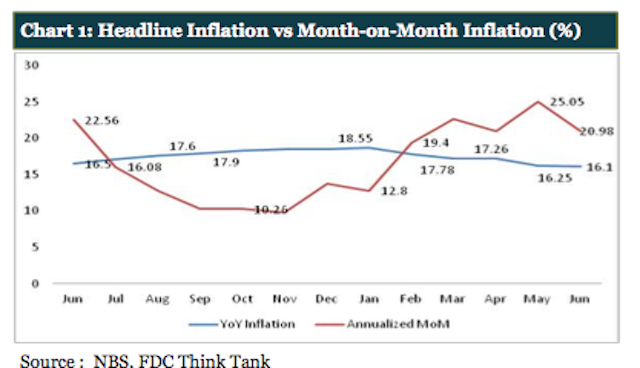

Ahead of the release of inflation data for the month of June by Nigeria’s statistical agency, the Nigeria Bureau of Statistics (NBS), analysts at Financial Derivative Company (FDC) have projected year-on-year headline inflation declining marginally to 16.1% from 16.25% in May.

“In general, we see a tapering in the price level due to a combination of factors, notably a stable naira, declining price of diesel, harvest season and switching consumer preferences, the FDC analysts noted.

“We believe that we may be entering into a period of lower consumer prices, as competitive pressures amongst manufacturers and retailers intensify. This trend is reinforced by huge carrying costs due to a high interest rate environment.”

The assumptions for their projections are based on recent exchange rate gains and waning base year effects, saying that by this time in 2016, most of the aberrational events had settled, thus making the base year impact minimal, projecting annualized month-on-month inflation dipped sharply to 20.98% from 25.05% in May.

“The monthly decline was actually 0.28% to 1.6% in June as against a surge to 1.88% recorded in May,” they pointed out, adding that conventional logic suggests that price inflation in Nigeria has been a function of exchange rate volatility.

They stated that in the past few months, the naira has appreciated by 42.08 percent in the parallel market but manufacturers have failed to pass through the benefits to consumers in the form of lower prices.

“Therefore we notice a slowdown in price change but no significant decline in the general price level. The food basket, which is both exchange rate sensitive and seasonal, has remained relatively flat,” the said, noting that it is primarily as a result of the planting season, shortages, limited purchasing power and consumer illiquidity.

See also:

Nigerian equities sustain bullish sentiments as market index up 0.6%

Nigeria cannot afford to “borrow anymore,” finance minister says

The food basket, according to them is also responsive to the price of diesel, a major factor in distribution and logistics costs.

The price of diesel dropped sharply in June to an average of N160/ltr. Also, storage of perishables is better when temperatures are low, which increases the shelf life of products. The average temperature in Nigeria in June has been 79° Fahrenheit.

They however see inflation risk lingering in the likely difficulty the CBN may face in supporting interventions in the foreign exchange market. This is in addition to unpredictability of oil prices, which could mean bad news for Nigeria’s forex receipts.

“In addition, talks about an imposition of a cap on Nigeria’s oil production have surfaced. In the event that this manifests, FX receipts and fiscal revenues will decline and will in turn affect the level of FX interventions and budgetary spending,” they noted.