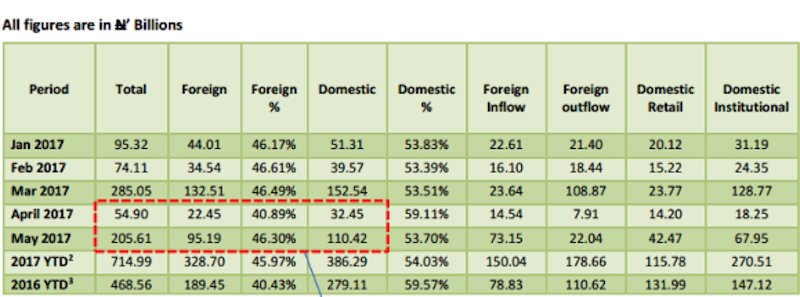

Activities at the Nigeria’s equities market rebounded in the month of May as total transaction at the market rise 274.51 percent to close N205.61 billion from N54.90 billion recorded in April, according to the Nigerian Stock Exchange (NSE) polled trading figures.

The NSE figures also indicate that domestic investors outperform foreign portfolio participation in Nigeria’s equities by 7.40 percent, accounting for transactions worth N110.42 billion or 53.70 percent of total transactions. On the other hand, foreign portfolio investors accounted for N95.19 billion or 46.30 percent of total transaction.

Domestic transactions in the equities market specifically increased 240.2 percent to N110.42 billion in the month of May from N32.45 billion recorded in April.

Foreign transactions also increased by 324.01% from N22.45 billion to N95.19 billion within the same period.

Meanwhile, monthly foreign inflows outpaced outflows as foreign inflows increased by 403.09% from N14.54 billion in April to N73.15 billion in May 2017. Foreign outflows also increased by 178.63% from N7.91 billion in April to N22.04 billion in May 2017.

In comparison to the same period in 2016, total FPI transactions from January to May 2017 increased by 74.03% from N189.45 billion to N328.70, whilst the total domestic transactions increased by 38.40% from N279.11 billion to N386.29 billion.

The rise in transaction was as a result of positive sentiments in the market and the perceived undervaluation of most of the stocks, especially banking stocks.

The banking stock lifted the bourse all-share index in the period under review and contributed to the bourses year-to-date gain, which is now at about 19.53 percent at close of trading June 28, 2017.