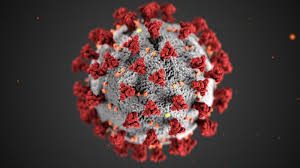

With the commodity market feeling the brunt of the COVID-19 pandemic which has led to closures of businesses as well as jewellery stores globally, Zimbabwe’s second-largest diamond miner, RioZim Limited, says it expects a bounce-back in demand after the coronavirus pandemic forced the miner to halt sales in March in the midst of falling gem prices.

The diamond market grounded to a halt over the previous six months, resulting from the closure of jewellery stores, cutters and polishers being stuck at home and standstill in global travel. While De Beers, the top diamond producer, decided to slash the price of its diamonds in a bid to spark sales this week, consumer demand for polished stones is already recuperating, RioZim Limited revealed.

Wilson Gwatiringa, a spokesman for RioZim, revealed that, “It has in fact picked up with a vengeance in some parts of the world. As a result, we expect an imminent bounce back in the demand for rough diamonds.”

Meanwhile, the company’s spokesman related that with the precious stone market in crisis, RioZim shareholders have kept the company going through bridge financing and production from its Murowa Diamonds unit has been accumulated. Though, RioZim is now carefully considering two-phase expansion that will more than double diamond output, Gwatiringa said that growth projects have also been put on hold.

On the two-phase expansion, the first phase which costs $52 million would enlarge the life of the 348 kilometres (217 miles) Murowa mine by four years from the current 14 months, while the second, a $400 million phase, and currently being planned, would see the construction of Zimbabwe’s largest underground diamond mine, he said, as the project would increase production to 2.5 million carats, and making it 10 times the amount produced when the mine was owned by Rio Tinto Group. Though, the life of the process would also be extended by another 10 years.

Meanwhile, RioZim halted production at its mines in June this year, saying it can no longer meet costs as a result of the foreign-exchange policy by the government.

Mining is the key foreign exchange earner for Zimbabwe, a country currently struggling with soaring inflation, food and fuel shortages, as well as a falling currency.