Omobayo Azeez

On the back of its positive performance across major metrics in 2019, Conoil Plc has proposed the payment of N1.39 billion in dividends to its shareholders for the financial year.

The proposed payout amounts to paying the shareholders 200 kobo or N2 per share held in the company’s books, according to a statement made available to Business A..M.

Amidst tough challenges that marked the operating environment of the downstream oil sector, the total energy provider saw its turnover surge by 14.4 per cent to N139.8 billion in 2019.

The full year results also showed that the company maintained a competitive position in the industry, reaping bountifully from the huge investments in its business portfolios.

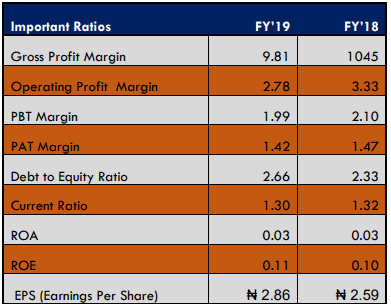

It recorded a 9.8 per cent growth in profit after tax (PAT), which rose to N1.97 billion in 2019 from N1.79 billion posted in 2018.

Operating profit on ordinary activities before taxation and exceptional items grew by 10.4 per cent from N2.56 billion to N2.83 billion while it also recorded an increase of 10.2 per cent in its net assets from N15.26 billion to N16.82 billion.

Explaining the company’s positive growths in turnover and profitability, the management in a statement said: “The impressive results are as a result of effective cost management strategy, aggressive marketing and improved sales. We repositioned our retail stations by embarking on a massive upgrade of the outlets thereby boosting sales.

“The modest dividend proposal is hinged on the need to consolidate our cash management effort vis-à-vis the liquidity squeeze in the economy. We look forward to opportunities in the coming years to continue to deliver solid financial results and increase competitive returns and shareholder value,” it added.

Conoil said that it would continue to leverage on its strong, leadership position in the industry to deliver value to investors through taking advantage of emerging opportunities in the industry.

It stated that it had launched far-reaching initiatives to strengthen its income base in core business segments of retail, lubricants, aviation, and specialized products.

At its last annual general meeting held in Uyo, Akwa Ibom State, Mike Adenuga, the chairman, Conoil Plc, had assured its shareholders that conscious efforts would be directed at achieving better execution of value-added products and services especially in the areas of marketing and customer management.

He had promised that the company would embark on strategic cost reduction while ensuring that the future growth potential of its business was not sacrificed.