- Energy demand and oil prices slumped on the back of Covid-19

- OPEC+ countries agreed on sharp production cuts to stabilise prices

- While coal, oil and gas investment fell, investment in renewables increased

- Rise in sustainable finance looks set to bolster the renewable transition

This has been a dramatic year for the global energy sector, with the coronavirus pandemic slashing demand and upending market norms.

Further to this, with investment in oil and gas taking a hit and renewable energy remaining resilient, some industry stakeholders are suggesting that 2020 could result in a permanent realignment of the global energy market.

Slump in demand and prices

Perhaps more than most industries, the energy sector was dramatically affected by the outbreak of the pandemic.

Travel restrictions and government-imposed lockdowns – designed to halt the spread of the virus – had a considerable impact on energy demand. With industrial capacity significantly reduced due to social distancing requirements and disrupted shipments, the need for oil and other forms of energy was significantly lower.

The fall in demand, in combination with a price war between Saudi Arabia and Russia, led to a sharp fall in the price of oil. After opening the year at $66 per barrel, prices slumped to a two-decade low of $19.33 on April 21 as the virus spread around the world.

To help stabilise prices, in April members of the Organisation of Petroleum Exporting Countries (OPEC), along with other oil-producing nations including Russia, Azerbaijan, Malaysia and Mexico, agreed to cut total global output by 9.7m barrels per day (bpd) – equivalent to around 10% of global production.

The 23-nation group, known as OPEC+, decided to scale back the cuts to 7.7m bpd in August, before announcing in early December that they would reduce production by a further 500,000 bpd as of January 2021.

While these efforts have helped oil prices recover to around $49 per barrel as of December 8, they have had a significant impact on oil companies and major oil-producing nations.

In Saudi Arabia, for example, where oil accounts for around 45% of GDP, the government implemented a series of measures to bolster finances, including the tripling of the value-added tax rate from 5% to 15%, the suspension of certain allowances for public sector workers, and spending reductions in some elements of its Vision 2030 diversification strategy.

Elsewhere, in Nigeria – which sources 10% of GDP, 57% of government revenue and 80% of its exports from oil – the government approved $5.5bn in additional loans to help fund a new budget. In Algeria, where oil makes up 90% of export revenue and funds 60% of the budget, the government announced in May that it would slash 2020 spending plans by 50%.

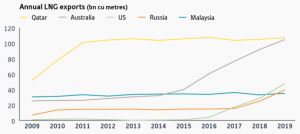

While the gas industry has not been as dramatically affected as the oil sector, the overall reduction in energy demand has nevertheless had an impact on major gas countries too.

Changing of the guard?

Perhaps unsurprisingly, the collapse in energy demand has also coincided with a dramatic fall in investment in the sector.

The “World Energy Outlook 2020” report, released by the Paris-based International Energy Agency (IEA) in October, predicted that global energy investment would fall by 18.3% this year, with total energy demand declining by 5.3% and emissions dropping by 6.6%.

The report forecasts that investment in oil, coal and gas will fall by 8.5%, 6.7% and 3.3%, respectively, while investment in renewable projects is projected to increase by 0.9%.

Given the report’s findings, which include a projection model stating that renewables could meet 80% of all energy demand growth over the next decade, some have suggested that the pandemic could precipitate a dramatic shift in the global energy mix.

“I see solar becoming the new king of the world’s electricity markets. Based on today’s policy settings, it is on track to set new records for deployment every year after 2022,” said Fatih Birol, executive director of the IEA.

Rise in green bonds

Renewable energy investments are supported by the rise in sustainability-focused financial instruments issued throughout the course of 2020.

Despite the fall in overall energy investment, figures compiled by Moody’s showed that global sustainable bond issuance – consisting of green, social and sustainability bonds – totalled $288.2bn over the first nine months of the year, 24% higher than the corresponding period in 2019.

The ratings agency predicts that sustainable bond issuance could reach $450bn by the end of the year, with green bonds on track to total $250bn.

While much of this growth has come from developed markets such as Germany – which launched its first two sovereign green bonds this year, worth around €10bn – emerging markets have also contributed to the trend.

In June the Indonesian government issued a $2.5bn green sukuk (Islamic bond), its third venture into the sustainable debt market, while in September Egypt launched its inaugural green bond, worth $750m – the first in the MENA region.

In terms of private sector activity, in September Saudi Electricity Company, which is 80% owned by the government and has a monopoly on electricity transmission in the country, raised $1.3bn with a green sukuk, the first of its kind in the Kingdom. In the same month Qatar National Bank became the first company to issue a green bond in the country, raising $600m.

Meanwhile, building on its government’s use of sovereign green bonds, in October Indonesian power company Star Energy Geothermal sold the country’s first green corporate bond with an investment-grade rating, raising $1.1bn.

Questions over the pace of transition

While trends suggest the energy industry is moving away from traditional fossil fuel sources towards renewables, there are still some questions over the scale and timeline of such a transition.

“It has been a tumultuous year for the global energy system. The Covid-19 crisis has caused more disruption than any other event in recent history, leaving scars that will last for years to come,” the IEA’s World Energy Report 2020 stated. “But whether this upheaval ultimately helps or hinders efforts to accelerate clean energy transitions and reach international energy and climate goals will depend on how governments respond to today’s challenges.”

Indeed, despite the dramatic fall in fossil fuel investment, there was still some significant activity in this segment throughout the year.

In late June Abu Dhabi National Oil Company announced a $20.7bn energy infrastructure deal with a global consortium that would lease the rights to 38 gas pipelines, while in mid-May the Bahrain Petroleum Company (Bapco) pushed ahead with its $6bn Bapco Modernisation Programme, which is slated for completion by the third quarter of 2022.

Meanwhile, despite national efforts to diversify away from hydrocarbons, Saudi Arabia’s Public Investment Fund invested around $2bn in the oil industry over the course of the year. The fund acquired stakes in oil giants BP, Shell and Total, which were seen as attractive investments given the fall in share prices.

Questions have also been raised about whether emerging markets can afford a green recovery, with some analysts anticipating that countries will prioritise economic growth over environmental goals as they emerge from the lockdown.

In South-east Asia, for example, countries such as Indonesia and Vietnam still have significant deposits of coal, which is viewed in some quarters as a cost-effective option for boosting power generation.

Furthermore, cheaper oil could incentivise the use of fossil fuels for energy during the initial part of the recovery phase.

“As South-east Asia rapidly becomes more developed, the need for energy service provision will continue to grow,” Roberto Lorato, the CEO of Indonesian energy company MedcoEnergi, told OBG in June. “There is still great potential for exploration activity in this region and, given that it is growing as a key economic bloc, it is imperative that established energy players are able to serve this dynamic market well.”

Nevertheless, the transition towards renewables is likely to continue.

“It is only a matter of time before green energy will control the market; it has been increasing its supply at a much higher pace than the fossil fuel industry,” Hatem Al Mosa, CEO of the Sharjah National Oil Corporation, told OBG in June. “Green energy will capture most of the market within the next two decades.”