Crude oil prices regained some ground on Friday, as news of a U.S.-North Korea lifted market sentiment, although concerns over U.S. oil inventories and production levels continued to weigh.

The U.S. West Texas Intermediate crude April contract was up 18 cents or about 0.30% at $60.30 a barrel by 07:40 GMT, just off the previous session’s three-and-a-half month low of $59.97.

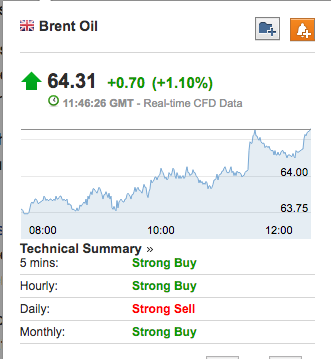

Elsewhere, Brent oil for May delivery on the ICE Futures Exchange in London gained 28 cents or about 0.44% to $63.89 a barrel.

Market sentiment improved after U.S. President Donald Trump on Thursday announced his willingness to accept an invitation to meet North Korean leader Kim Jong Un before May, with hopes of achieving “permanent denuclearization”.

Meanwhile, concerns over a potential global trade war due to U.S. tariffs on steel and aluminum imports eased after President Trump signed a more tempered version of the plan on Thursday.

Trump signed the imposition of 25% tariffs on steel imports and 10% for aluminium but announced exemptions for Canada and Mexico and left the door open for exceptions for other countries.

But oil prices were still expected to be pressured lower, after the U.S. Energy Information Administration reported on Wednesday that crude oil inventories rose by 2.408 million barrels for the week ended March 2.

While that was below expectations for a rise of 2.723 million barrels, it was the second-straight weekly build in crude stockpiles, adding to concerns that rising U.S. output could dampen global efforts to rid the market of excess supplies.

The Organization of the Petroleum Exporting Countries (OPEC), along with some non-OPEC members led by Russia, agreed in December to extend oil output cuts until the end of 2018.

Elsewhere, gasoline futures were little changed at $1.876 a gallon, while natural gas futures declined 0.91% to $2.729 per million British thermal units.