Oil prices are recovering. U.S. storm damage and strengthening economies may have finally dislodged sentiment away from resignation to a future of low oil prices.

That’s the story, but it isn’t the whole picture. And while OPEC and other countries that have cut production will undoubtedly take comfort from Brent near $60 a barrel, they should be wary of taking too much of the credit and certainly can’t relax their output restraint. They are not yet out of the woods.

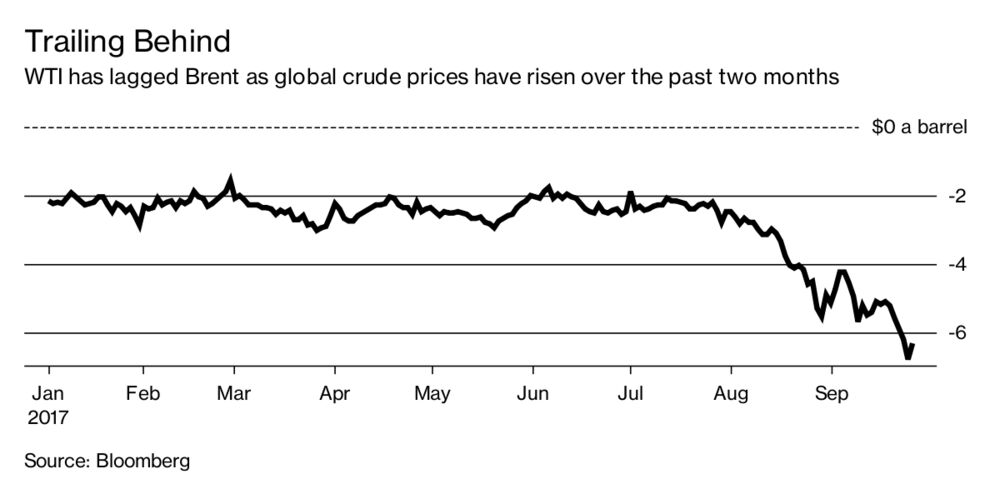

On Monday, Brent crude came within a dollar of the $60-mark that seems to be OPEC’s unofficial target (at least for now), although U.S. benchmark WTI is lagging ever further behind.

Nine months of output cuts by the group and its friends have certainly contributed to the higher prices. But to pin the 16 percent rally in Brent crude since August 30 on these actions alone would be a mistake, and raise the risk that ministers make the wrong decisions in the months ahead.

Oil traders and executives meeting in Singapore this week are more focused on the state of the global economy and the resulting strength of oil demand than they are on output cuts.

One thing that sets this year’s strong economic performance apart is that it is touching economies everywhere. Yes, the economic boom may be particularly strong in emerging Asian economies, but it extends further, including to the developed economies of the U.S. and Europe. And that boom is being felt particularly in demand for so-called middle distillates — diesel, heating oil and jet fuel — and for petrochemical products.

Weekly data from the U.S. Energy Information Administration bear this out, with distillate demand up 9 percent so far this year compared with the same period in 2016, and inventories dipping below their 5-year average in last week’s preliminary data. U.S. jet fuel inventories fell below their five-year average in July and gasoline is headed in the same direction.

Add to this the suggestion that, as I wrote on Sunday, U.S. oil production growth has been over-estimated, and it is easy to see why sentiment is shifting away from “lower for longer” towards rebalancing.

But we need to be careful, because there are short-term factors whose influence we neglect at our peril.

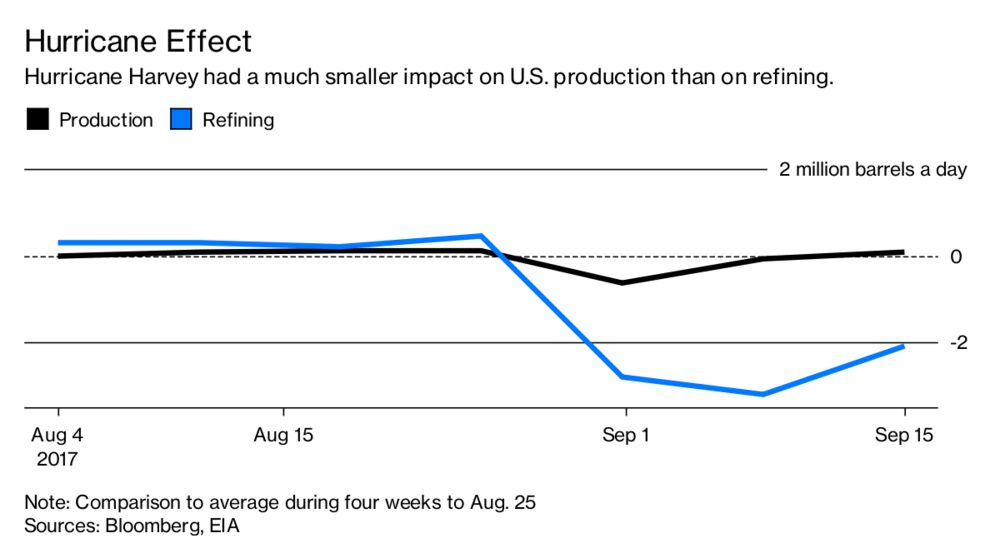

Disruptions to U.S. refineries caused by Hurricane Harvey have been a big factor in driving the correction in the country’s product inventories. Crude oil input to refineries fell around 3 million barrels a day, or 17 percent, below normal in the three weeks to Sept. 15, curtailing production of distillates and gasoline. But the storm had a much smaller and shorter impact on crude oil production, which fell by 750,000 barrels a day the week the storm made landfall but recovered most of that over the two following weeks.

For an overall rebalancing of the market, it is the volume of crude coming out of the ground, rather than products coming out of refineries, that is most important. And the U.S. refinery hiccup should prove temporary.

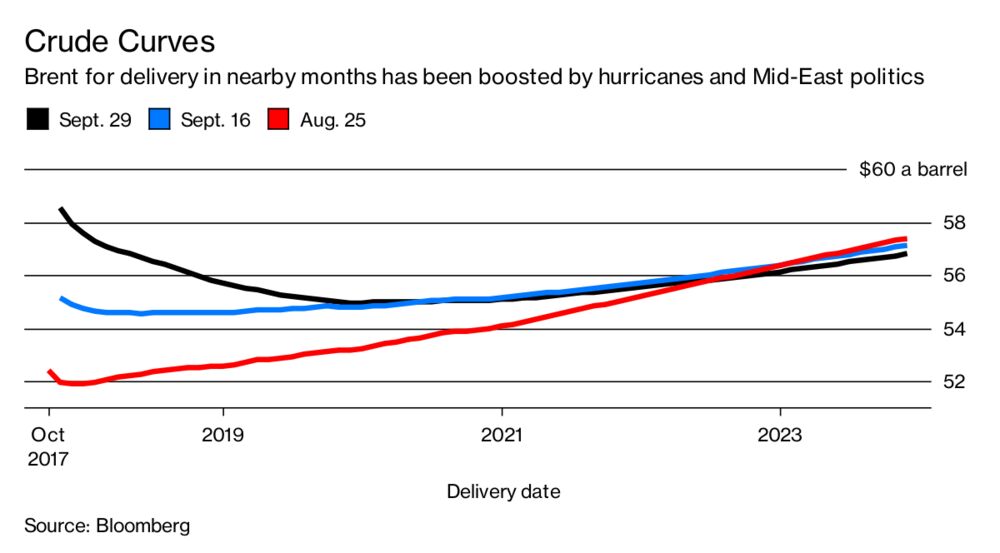

The Kurdish referendum on independence from Iraq may have no immediate impact on oil supply, but it is a timely reminder that potentially disruptive political events in the Middle East can never be ignored. Threats to political stability in the region can quickly boost oil prices, as they did Monday, while the easing of those threats can just as quickly unwind the rally.

The vote will almost certainly deliver a mandate for independence, but the impact on oil supply will depend on the reactions of the region’s neighbors. Turkey has already threatened to shut the taps on the only route to market for nearly 600,000 barrels a day of crude exported through the Kurdistan region of Iraq. Were it to follow through on this threat, it would be equivalent to boosting OPEC’s output cut by half and would certainly hasten market rebalancing.

Can the crude rally last?

If economic growth remains strong then oil demand may continue to outstrip supply, slowly eating into the surplus inventory. The focus on over-supply will switch to worries about impending shortage. Indeed, Citigroup Inc. and Trafigura Group are already there. And the global demand picture looks promising: the International Energy Agency sees it growing by 1.6 million barrels a day in 2017, up from a June forecast for growth of less than 1.3 million barrels a day.

But, as I wrote here, that boost to demand growth comes entirely from a downward revision to last year’s oil use, not an increase in how much the IEA thinks the world will consume this year. With no corresponding downward revision to last year’s oil supply, that can only mean that there is even more excess inventory than previously thought.

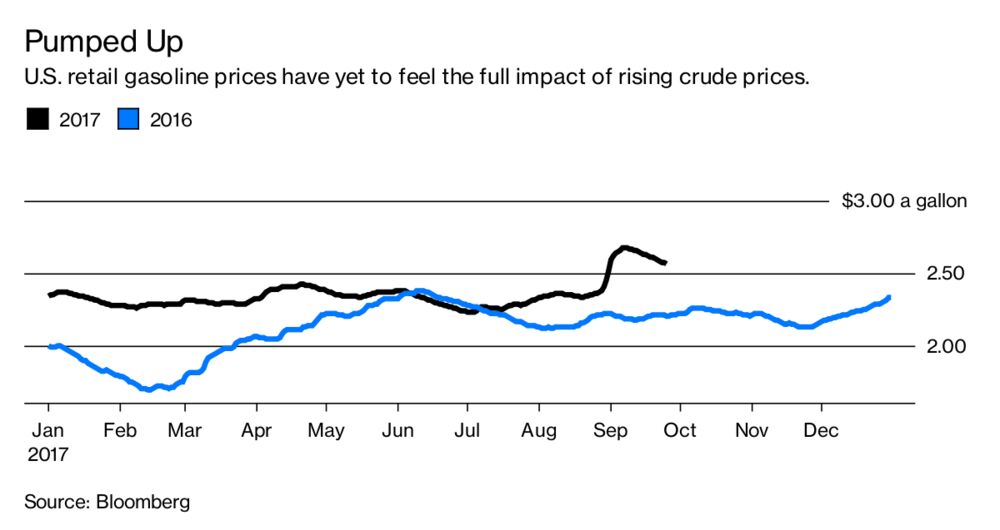

And, higher crude prices have yet to feed through fully to gas station forecourts — but they will, raising the cost of driving, which is already above last year’s level. That alone will cut into demand growth, never mind the drag that rising oil prices, and their inflationary impact, may have on economic prospects.

Then there is shale. U.S. oil prices are still well short of $60 a barrel, but they are already high enough to start encouraging some producers to begin locking in prices for next year and boosting investment.

When OPEC and their friends meet at the end of November, their decision on the future of their output agreement may be no easier to make. At that time, the deal will still have four months to run, so don’t be surprised if they simply decide to kick the can down the road and leave a formal decision on where to go next for another meeting early in 2018. If the recent past has shown us anything, it is that the market outlook can change dramatically in four months.

Article courtesy Bloomberg