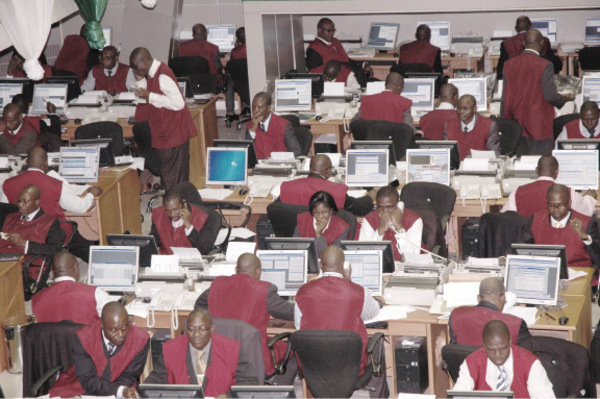

The Nigerian equities market maintained its upward trend as the Nigerian Stock Exchange (NSE) All-Share Index (ASI) and market capitalization appreciated by 1.60 per cent to close the week at 33,810.56 and ₦11.692 trillion respectively.

The ASI closed at 33,810.56 Friday against Thursday’s figure of 33,276.68 while Market Capitalization closed Friday ₦11.692 trillion against previous day’s ₦11.687 trillion.

Businessamlive.com notes that this is against +0.59% appreciation recorded previously. Its Year-to-Date (YTD) returns currently stands at +25.81%.

Renaissance Capital, in an investor note, acknowledged that the new Investor and Export window has made financial assets in Nigeria cheaper and more attractive while recommending that investors should start buying Nigeria’s financial assets including equities and bonds.

Investors have taken the advice to heart piling into both the stock and bond markets. Banking stocks, especially tier 1 banks have seen a significant inflow of cash.

The banking index is already up 31 percent half year, outperforming the ASI which is up about 9.1 percent within the same period after reversing the negative return it recorded in the first quarter of the year.

Meanwhile, the Financial Services sector led the activity chart at the close of trading Friday with 403.479 million shares exchanged for ₦4.236 billion.

Conglomerates came next with 60.768 million shares traded for ₦0.124 billion, Consumer Goods, Industrial Goods, Agriculture sectors followed respectively on the activity chart.

Lasaco, Zenithbank, Access, Transcorp and Guaranty Bank were the most active stocks by volume. ETI, CCNN, Maybaker, Skyebank and AIICO emerged the highest price gainers on the chart, while Intbrew, Betaglas, Continsure, Unitybnk and Honyflour topped the losers’ chart.