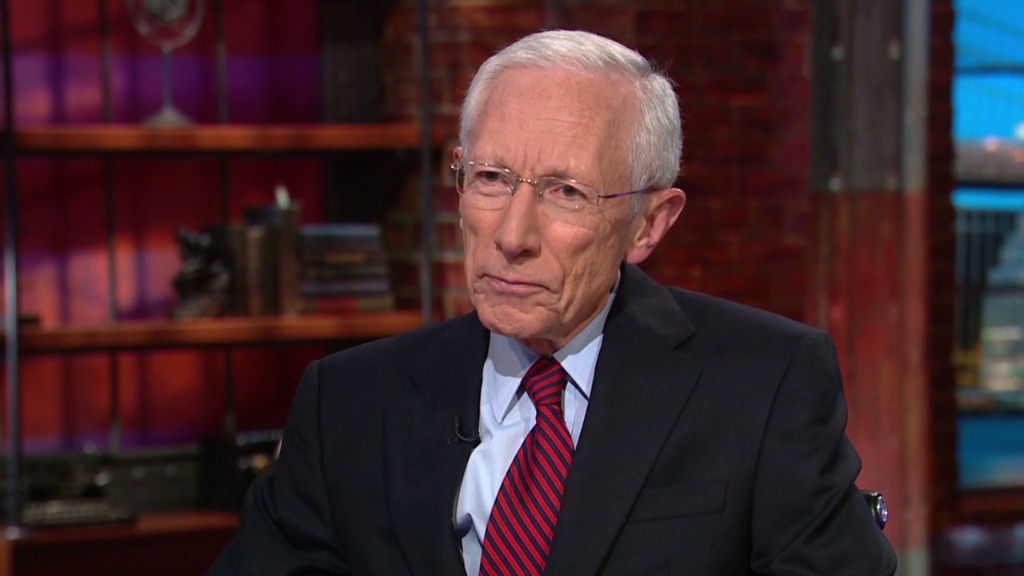

Stanley Fischer is stepping down as vice chairman of the Federal Reserve, creating another opening at the central bank for President Donald Trump to fill.

In a letter to Trump on Wednesday, Fischer cited “personal reasons” and said the resignation will take effect Oct. 13, two days before his 74th birthday.

“It has been a great privilege to serve on the Federal Reserve Board and, most especially, to work alongside Chair [Janet] Yellen as well as many other dedicated and talented men and women throughout the Federal Reserve system,” Fischer wrote.

The resignation of Fischer, whose term was set to expire on June 12, 2018, creates yet another opening at a critical time for the Fed. The central bank is set to begin unwinding the $4.5 trillion balance sheet of bonds it built up during its economic stimulus efforts and is trying to normalize interest rates after keeping its benchmark rate near zero for seven years.

Trump already has nominated Randal Quarles to one vacancy and now will have at least two more. In addition, Yellen’s term ends in February.

Though Fischer did not elaborate on his reasons for leaving, he did talk up the Fed’s accomplishments during his tenure.

“During my time on the Board, the economy has continued to strengthen, providing millions of additional jobs for working Americans,” he wrote. “Informed by the lessons of the recent financial crisis, we have built upon earlier steps to make the financial system stronger and more resilient and better able to provide the credit so vital to the prosperity of our country’s households and businesses.”

The Fed used a two-prong approach of low rates and the “money-printing” program of quantitative easing to help boost the economy out of the financial crisis and the accompanying Great Recession.

While asset values zoomed, particularly the stock market, the Fed has been vexed by its inability to meet its 2 percent inflation mandate.

At the same time, the Fed has overseen a tough new regulatory regime that sought to prevent the too-big-to-fail crisis scenario that precipitated trillions in government bailout efforts. Banks are better capitalized now though Trump has complained that the added regulations have held back business lending.

In an April interview with CNBC, Fischer cautioned against weakening the new regulatory framework.

“We seem to have forgotten that we had a financial crisis which was caused by behavior in the banking and other parts of the financial system and it did enormous damage to this economy,” Fischer said then. “Millions of people lost their jobs, millions of people lost their houses.”

“The strength of the financial system is absolutely essential to the ability of the economy to continue to grow at a reasonable rate, and taking actions which remove the changes that were made to strengthen the structure of the financial system is very dangerous,” he added.

Born in Rhodesia, Fischer was governor of the Bank of Israel from 2005 to 2013 and holds dual citizenship in Israel and the United States. He was nominated to the Fed by President Barack Obama in January 2014.

Report courtesy CNBC