Onome Amuge

FirstBank of Nigeria has unveiled a new digital payments platform designed to strengthen financial inclusion and improve transaction efficiency for businesses in Africa’s largest economy, as lenders compete to capture growth in the fast-expanding fintech sector.

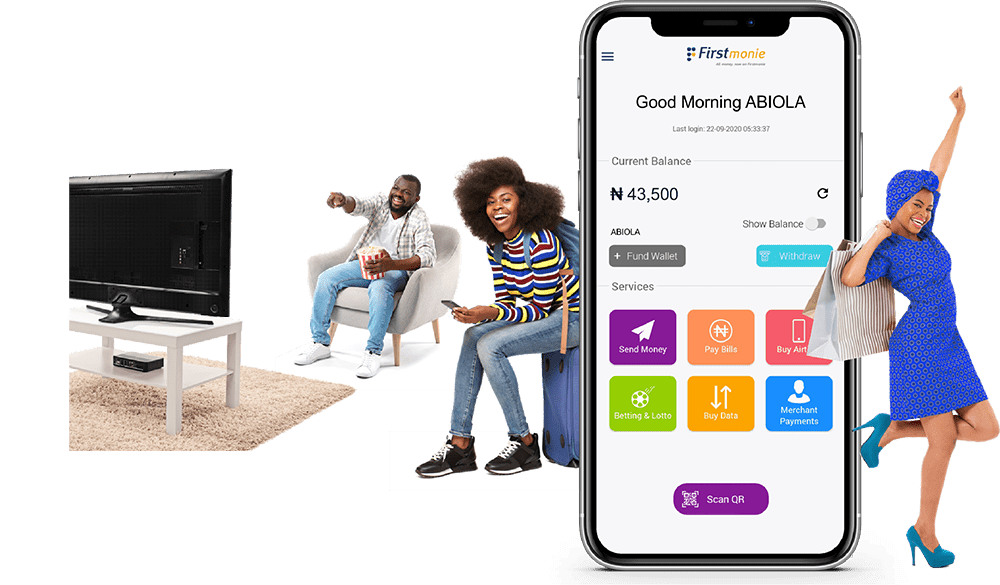

The FirstMonie Merchant Wallet, launched this week, gives enterprises of all sizes a centralised tool to accept and manage digital payments. Equipped with pre-configured point-of-sale terminals and an integrated dashboard, the platform offers real-time monitoring, instant settlement, and dispute resolution,features the bank says will ease one of the most persistent pain points for Nigerian merchants.

Chuma Ezirim, group executive for e-business and retail products at FirstBank, said the initiative underscored the lender’s longstanding role in shaping the country’s financial services industry. “FirstMonie Merchant Solution is set to transform digital payments in Nigeria. With its advanced features and seamless onboarding, we are empowering businesses of all sizes and locations to thrive in the digital economy,” he said.

The product, which supports payment methods such as Pay with Transfer and Pay with Purchase, also incorporates automated onboarding and flexible pricing to attract a wide spectrum of enterprises, from small corner shops to larger corporates. The bank said it had prioritised transaction security and chargeback reduction in the design, in an effort to build trust in a market where failed transactions and fraud remain a concern.

Nigeria has emerged as one of Africa’s most vibrant hubs for digital payments. The Central Bank of Nigeria has pursued an ambitious financial inclusion strategy, with a goal of bringing 95 per cent of adults into the formal financial system by 2024, up from around 64 per cent in 2020, according to official data. The push has fuelled rapid adoption of mobile money, instant transfers and agent banking networks, but small merchants have often struggled with fragmented infrastructure and high transaction costs.

FirstBank, which has operated in Nigeria for more than 131 years, sees the Merchant Wallet as a way to address those gaps while reinforcing its presence in a competitive market. Its FirstMonie network already includes over 300,000 agents across the country, giving the bank a distribution advantage as it integrates new services.

The move comes as traditional lenders jostle with fintech upstarts for market share in digital payments. Start-ups such as Flutterwave, Paystack and Moniepoint have captured international attention and significant venture capital by offering fast, reliable payments infrastructure. Incumbent banks are responding by modernising their offerings and embedding technology more deeply into their services.

Analysts say the timing of FirstBank’s product launch is significant. Nigeria’s payments sector has grown in double digits in recent years, even as the wider economy struggles with inflation, currency depreciation and sluggish growth. Transaction volumes on the Nigeria Inter-Bank Settlement System rose to more than N600tn in 2023, according to official figures, reflecting consumers’ growing preference for electronic payments.

By offering merchants instant settlement and digital control over concessions, FirstBank is betting it can reduce friction in day-to-day business operations. For small traders, who often rely on cash for liquidity, faster settlement could be particularly attractive, while larger corporates may find value in the platform’s ability to centralise oversight across multiple outlets.

“The wallet provides improved speed, transparency and control, aligning with FirstBank’s goal of building financial ecosystems that deliver value and trust,” Ezirim said. He described the initiative not merely as a product launch, but as part of a broader strategy to embed digital processes in the fabric of commerce.

Registration for the Merchant Wallet is open to both existing and new account holders through the bank’s website, with the bank promising a simplified onboarding experience. The wider agent network is expected to support roll-out and adoption.