By Moses Obajemu

The CBN’s foreign reserves sustained its descent as forex outflows continue to outpace inflows, thus dipping by USD86.69 million week on week to USD36.00 billion.

As a result, the naira weakened against the US dollar by 0.3% week on week to NGN389.50/USD at the I&E window, and by 0.4% to NGN472.00/USD at the parallel market. In the forwards market, the naira weakened against the US dollar across the 1-month (-0.3% to NGN391.38/USD), 3-month (-0.4% to NGN395.16/USD), 6-month (-0.6% to NGN400.14/USD) and 1-year (-1.1% to NGN418.10/USD) contracts.

Despite the CBN’s stronger commitment towards exchange rate unification, analysts still see some legroom for the currency to depreciate further, at least towards its REER derived fair value. The analysts’ position is hinged on (1) the widening current account (CA) position, (2) currency mispricing, which could induce speculative attacks on the naira, and (3) the resumption of FX sales to the BDC segment of the market which should place an additional layer of pressure on the reserves as the CBN funds the backlog of unmet FX demand.

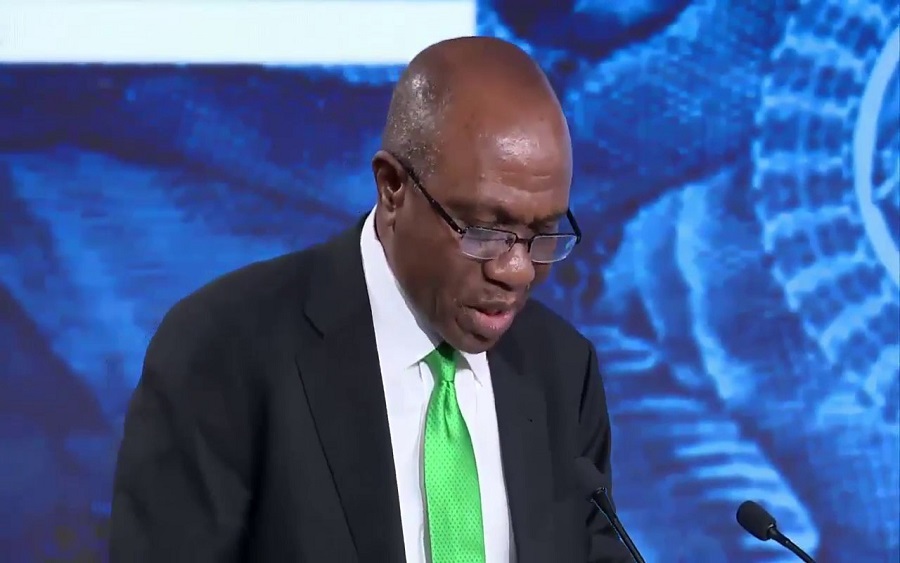

However, governor Godwin Emefiele allayed customers’ fear during the last MPC meeting in Abuja that they would get their forex needs. According to him, the $3.4 billion loan from the IMF is still intact, saying the apex bank has the muscle to provide the forex needs of the people.