Goldman Sachs Group Inc., the dominant commodities trader on Wall Street, is reviewing the direction of the business after a slump in the first half of the year, according to people with knowledge of the matter.

By reconsidering the bank’s long-held view that the downturn in profitability is cyclical and will eventually reverse, Chief Executive Officer Lloyd Blankfein, who started his career in the commodities business, is drawing closer to the industry’s prevailing wisdom. Morgan Stanley, JPMorgan Chase & Co., Barclays Plc and Deutsche Bank AG have cut back or exited commodities trading in recent years amid falling revenue and tougher regulation.

While the bank flagged the poor results for the first quarter — without giving specific numbers — the weakness has continued and the unit’s start to the year has been the worst in more than a decade, said one of the people, who asked for anonymity to discuss internal deliberations. The commodities division was one of the topics of discussion at a board meeting held in London late last month, the people said.

No decision has been reached and the bank may not pursue large-scale changes, according to the people. It’s common for the bank to review struggling business units to see what can be improved, one of the people said.

“Commodities has been and still is an important business for our clients and we will continue to invest in it to ensure we are best meeting their needs,” Michael DuVally, a bank spokesman, said in an emailed statement.

The informal review is being led by Isabelle Ealet, one of three global co-heads of the securities division who ran the commodities unit for five years until 2012 — a golden age for the division when revenue regularly topped $3 billion per year.

Ealet, who joined Goldman in 1991 as an oil products trader, is known in the industry for her relentless focus on controlling costs. In a rare interview a few years ago with the French magazine L’Expansion, she said: “What I appreciate most is the culture of results. At Goldman Sachs, you are judged on your performance.”

Peak Revenue

Goldman has for decades boasted the leading commodity franchise among Wall Street banks. Its revenue from commodities rose from less than $500 million a year between 1981 and 2000 to a peak of $3.4 billion in 2009, according to a Senate report on U.S. banks’ involvement in the commodity markets.

Last year, the bank made less than $1.1 billion in revenue from commodities, according to one of the people. The business still ranked No. 1 among global investment banks, according to Coalition Development Ltd., a London-based analytics company.

But this year, Goldman said that “significantly lower” net revenue from commodities was partly to blame for weak first-quarter trading results. Client volumes suffered, with crude oil volatility averaging the lowest level in more than two years, Chief Financial Officer Marty Chavez said in April.

Major Banks

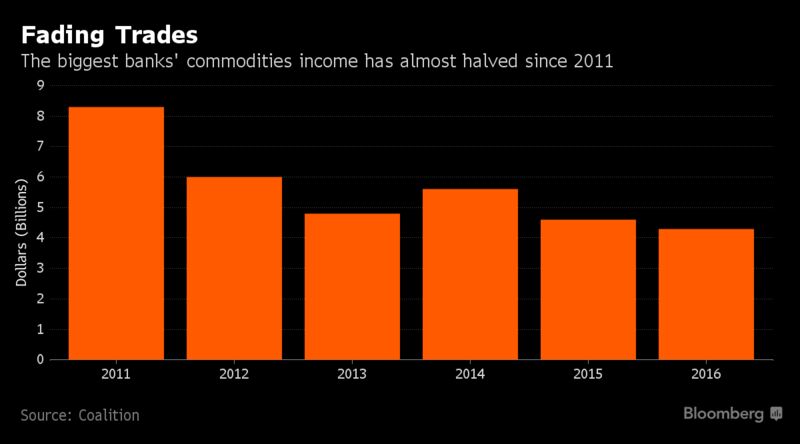

Major banks’ commodities revenue sank to an 11-year low in 2016, according to Coalition. In the first quarter of this year, commodities trading revenue across the industry dropped to $800 million, Coalition estimated — down 29 percent from 2016 and less than a third of the level of 2012.

Separately, the bank has reshuffled senior commodities executives in recent weeks, with Don Casturo, previously head of trading in Europe, moving back to the U.S. to serve as the unit’s chief operating officer, and Jeremy Taylor, who joined the bank last year from Mercuria Energy Group, moving to London to take on Casturo’s role.

Owen West, Goldman Sachs’s global head of natural gas trading and co-head of global power trading, last month accepted a role in Donald Trump’s administration as assistant secretary of defense, special operations and low-intensity conflict.

Courtesy Bloomberg

Problem with Nigeria Revision of first-hand account of the AGSMEIS programme (2)