For now, this is as close as it gets to a devaluation in Nigeria.

Monetary policy officials unified some of their multiple exchange rates when they let currency dealers quote naira levels used in actual trades this month. They did it to entice back bond investors who fled in 2014 and 2015 as oil prices collapsed and the central bank tightened capital controls.

But not everyone is clear on the changes in the currency market of Africa’s biggest economy, or why they matter.

So, what happened?

Banks had been using a currency window for investors known as Nafex since April, but weren’t allowed to publish their trades. This month, the FMDQ OTC Securities Exchange, a Lagos-based platform that oversees naira transactions, asked banks to start quoting Nafex rates, effectively merging that market with the main interbank one.

The move immediately weakened the naira’s interbank rate 14 percent to about 365 per dollar, knocking $6.5 billion off the value of the stock market.

David Cowan, an Africa economist at New York-based Citigroup Inc., the world’s biggest foreign-exchange trader, called it a “devaluation by stealth.”

What’s the impact?

For foreign investors not already using Nafex, it made naira assets a lot cheaper. And even for those that were, it boosted transparency and allowed them to see live quotes on their screens for the first time.

“It has clearly put investors more at ease,” said Joe Delvaux, a money manager at Duet Asset Management in London, which oversees about $500 million of African bonds and stocks and started buying naira debt again this month. “Foreign currency trading volumes have already picked up and analysts are more and more inclined to recommend local-currency debt.”

Nigeria’s local-currency bonds could do with the attention. They’re currently the worst performers this year among 31 major emerging markets tracked by Bloomberg, losing about 6 percent in dollar terms.

What more do investors want?

They’ve long called for Nigeria to use a single exchange rate predominantly driven by market forces. For now, the country is keeping several exchange rates in place, but the spread between the black-market and interbank rate is negligible.

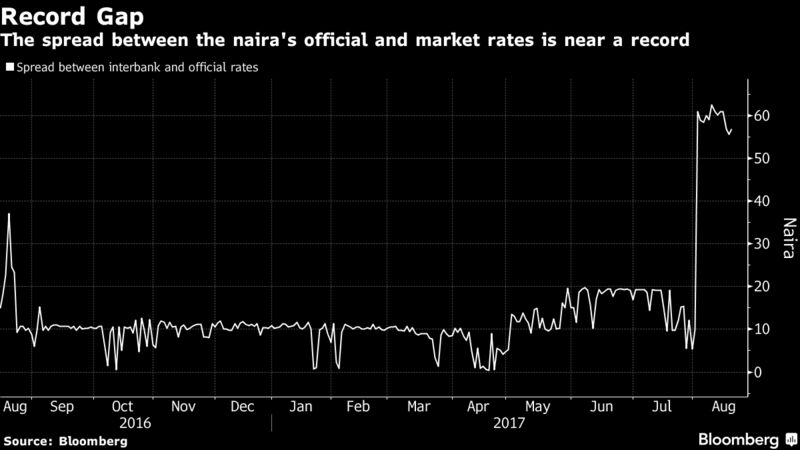

Still, the central bank hasn’t abandoned the official rate of 305 per dollar, which it uses to provide cheap dollars for some government transactions as well as fuel importers. After the changes, the gap between this rate and the interbank market has never been wider.

Nigeria’s foreign-exchange market remains more opaque than those in other African countries such as South Africa, Ghana, Kenya, and Uganda, according to Duet’s Delvaux. A web of other rates continues to warp the market, keeping the naira artificially strong for pilgrims seeking dollars to travel to Mecca, small and medium businesses, or Nigerians who need to pay overseas school fees, to name a few.

Nigeria “is less compelling as a frontier market,” said Diana Amoa, a co-manager of JPMorgan Asset Management’s $2.8 billion emerging-markets local-currency debt fund in London. “Ideally, the central bank needs to move to a unified exchange system and let the currency levels settle at the point where there is a clearing up of the foreign currency backlog.”

Can’t Nigeria have one exchange rate?

That would entail an official devaluation, which President Muhammadu Buhari and central bank Governor Godwin Emefiele have long stood firm against, saying it would only boost an inflation rate at 16 percent. Early indications are that the government will keep the naira’s official value unchanged for now, with the 2018 budget to be based on an exchange rate of 305 per dollar, the Lagos-based Vanguard newspaper reported Aug. 10.

“Investors would love it if Nigeria moved to a single rate,” said Rick Harrell, an analyst in Boston at Loomis Sayles & Co., which manages $258 billion of assets and recently started investing in naira bonds again. “But the central bank is constrained because of the need to supply cheaper dollars to fuel importers.”

“It’s such a sensitive matter, especially with the economy still weak,” he said. “It’s still not ideal. But by Nigeria’s standards, this is good enough.”

Now what?

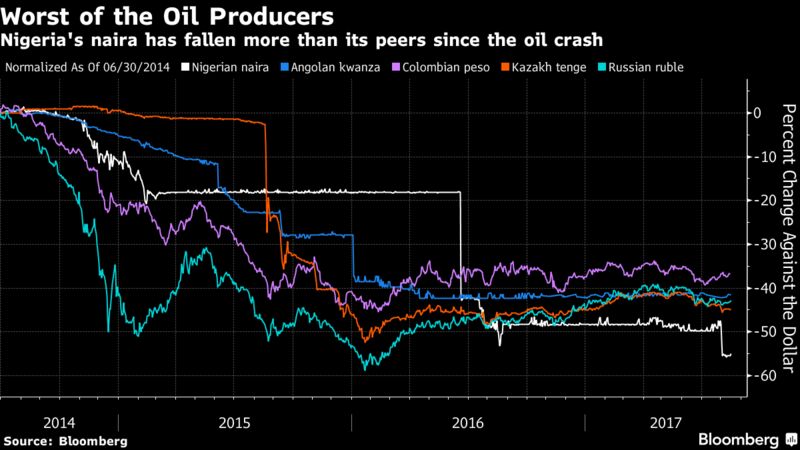

With the interbank rate at 361.95 per dollar as of Monday, its 55 percent slump since 2014 is the most among oil currencies. But even that might not be enough. Citigroup says a drop to 400 could be what it takes to attract enough inflows to end the country’s dollar shortages and boost an economy that’s contracted for the last five quarters.

“Despite the greater availability of foreign exchange, there are still major constraints,” said Citigroup’s Cowan. “There may have to be further naira weakness to fully kick-start the foreign-exchange market and the economy.”

Courtesy Bloomberg