Prime Minister Narendra Modi launched India’s biggest tax reform in its 70-year history, as businesses and citizens across the country steeled themselves for the economic turmoil that’s expected to follow, Bloomberg reports.

The new goods and services tax was formally ushered in at a late-night session of parliament, reminiscent of the midnight meeting presided over by India’s first prime minister, Jawaharlal Nehru, on the eve of the country’s independence in 1947.

“GST marks the economic integration of India,” Modi said in his speech to current and former lawmakers, business leaders and central bank officials in the parliament’s packed central hall. “There are 500 taxes and we are getting rid of it. From Ganganagar to Itanagar and Leh to Lakshadweep, it is one nation, one tax.”

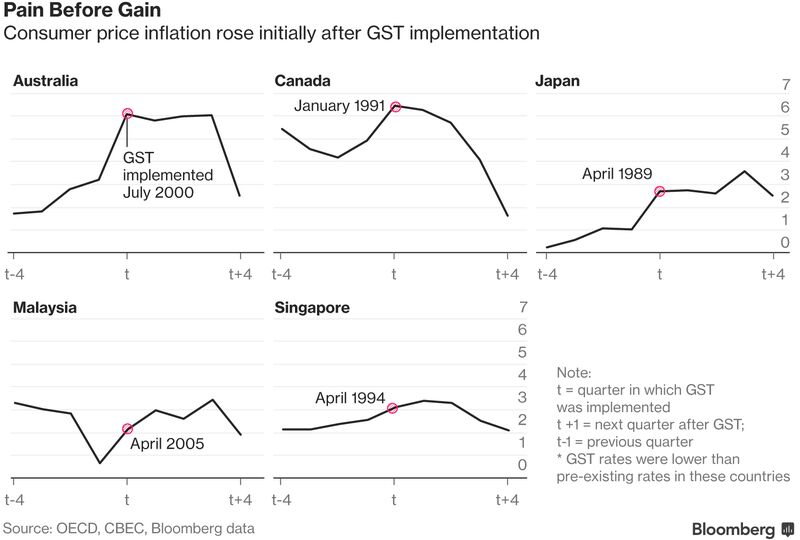

But amid the euphoria, President Pranab Mukherjeeh also offered some words of caution. “GST is a disruptive change, no doubt,” he told the gathering. “When a change of the magnitude is undertaken, however positive it may be, there are bound to be some teething troubles and difficulties in the initial stage.

First proposed in 2006, the GST subsumes more than a dozen state and central levies into one tax, unifying 29 states and 1.28 billion people into a single market for the first time.

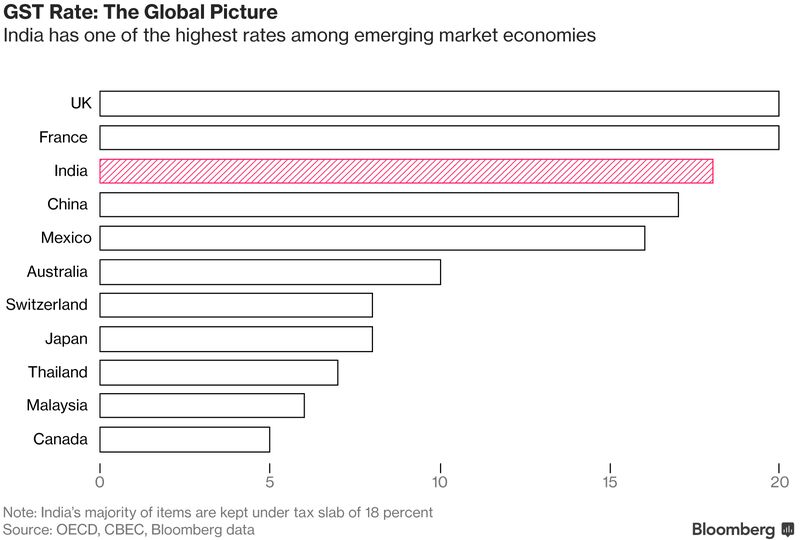

It’s expected to expand India’s narrow tax base and increase government revenues. It has been heralded by economists and will count as the most important economic reform of Modi’s three-year-old administration.

Evan as the tax was launched, shoppers were lining up to take advantage of potential offers. “I wanted to be one of the first buyers in the GST era — I was the first one to enter the store at 12 a.m.” said Dunsten Joe Miranda, 45, at a Big Bazaar store in Mumbai. “All I am bothered about with the GST is whether prices are coming down or not. I came here for some deals,” Miranda said.

Short-Term Chaos

Still, even supporters think it’s going to be chaotic in the short-term, despite a two-month relaxation in initial filing requirements.

“There will be disruption,” said Rajeev Chandrasekhar, an investor and upper house lawmaker who is part of Modi’s ruling coalition and sat on a parliamentary committee on GST. “There will be plenty of hiccups — part technology, part administration.”

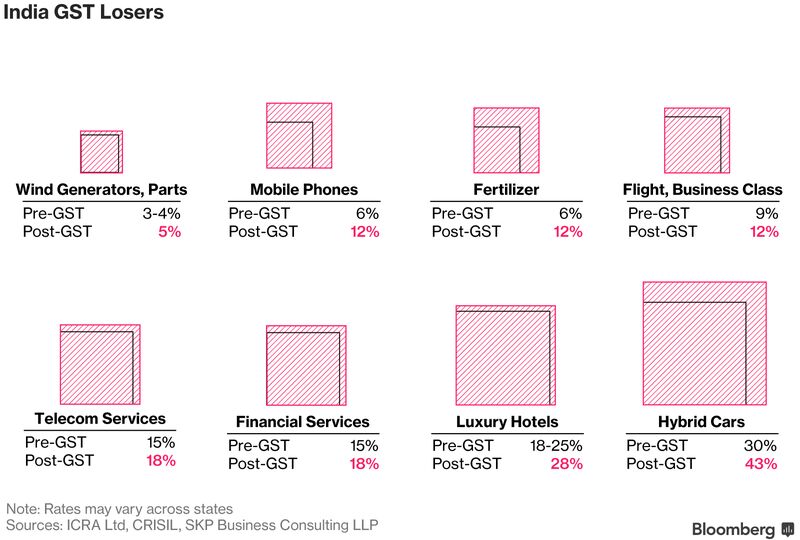

Businesses are confused by a complicated structure, which includes four tax slabs ranging from 5 percent to 28 percent and numerous exemptions. It’s also not clear what sort of damage the nationwide roll out will inflict on the country’s fast-growing, $2 trillion economy before the long-term benefits kick in.

“We are not ready,” said K.E. Raghunathan, a Chennai-based business owner and president of the All India Manufacturers Association. “We do expect tremendous chaos.”

Protests and industrial strikes broke out across the country as the deadline approached. In the states of Tamil Nadu, Gujarat and Rajasthan, tens of thousands of textile workers went on strike, while the association that represents sellers of seeds, pesticides and fertilizers protested in the agricultural state of Punjab.

Just hours before the launch, the tax rate on fertilizer was reduced to 5 percent from 12 percent and tractor components were cut to 18 percent from 28 percent, a government official told reporters in New Delhi, asking not to be identified citing rules.

Some large companies have assigned staff full-time to the transition, while others worry their thousands of small-time suppliers will find it difficult — if not impossible — to register online and comply with filing requirements. Everyone from businesses to the central bank are watching for the first signs of stress as the tax ripples through India’s largely informal economy.

Part of the problem is that India is a “non-tax compliant” society, as the country’s finance minister has said frequently. Across India, fewer than 1 percent of people pay income tax and nearly 90 percent of workers are employed in the mostly non-taxed informal economy. Many will be paying tax for the first time.

“Our chartered accountant says that we need to file three monthly sales reports for GST,” said Ashok Kumar Gupta, 37, who manages a small pharmacy in New Delhi. “Along with this, we will file monthly, quarterly and annual returns.”

The tax will boost the country’s fiscal health in the medium-to-long term, wrote Eurasia Group analysts Shailesh Kumar and Sasha Riser-Kositsky in a June 28 note.

“The GST is considered the most important milestone for the Modi government,” they said. “It signals to investors the government’s ability to deliver on its reform agenda. Once the GST is fully operational, it will be groundbreaking and significantly change India’s business environment.”

Still, short-term disruption are expected as supply chains grapple with the new requirements.

“Given that literacy and digital knowledge in India varies, proper compliance with the registration and filing process is challenging,” Kumar and Riser-Kositsky wrote. Businesses “may temporarily cease to do business with errant filers, disrupting supply chains and the availability of goods, and fueling near-term inflation.”

In the central Indian town of Bhopal, Amit Verma, a wholesale distributor of surgical disposables, said small businesses are in a state of “utter confusion” and that the intricacies of the tax are beyond many of them.

“We are not against the GST,” Verma said. “But the issue is it’s so complicated that a normal businessman is finding it very problematic.”

For larger companies, compliance has meant organizing training seminars for suppliers and vendors and assembling dedicated GST teams. Aditya Gupta, head of business development for logistics firm Drive India Enterprise Solutions Ltd., said the firm has assigned four executives to work full-time on the new tax — and that doesn’t even include international tax consultants.

“An entrepreneur, instead of running a business is now running after auditors,” said Raghunathan, president of the manufacturers association who lobbied to have the GST roll out delayed. He said chartered accountants across the country are charging as much as 15,000 rupees ($232) to help register small businesses with the GST’s free online portal.

Digital Revolution

The Reserve Bank of India has said the impact from GST is likely to be minimal.

India’s inflation has eased to a record low of 2.2 percent as the central bank’s battle against price pressures gains traction. It could ease further as businesses offer hefty discounts to consumers in “GST sales” before July 1.

Central bank Governor Urjit Patel said the new tax will lower overall tax rates in the long-term. “GST itself is part of the digitization revolution,” Patel told a June 22 event organized by industry lobby IMC Chamber of Commerce and Industry.

The opposition Congress party, which originally proposed the GST in 2006, boycotted the midnight ceremony. It said the ruling Bharatiya Janata Party was implementing the GST without proper planning. “How many Indians will suffer because of the haste of the BJP?” read a message on the party’s Twitter account on Friday.

Courtesy Bloomberg