European stocks rose and U.S. equity futures and the dollar both steadied as investors awaited fresh insights into the path for borrowing costs from the Federal Reserve. A credit-rating downgrade in China sank industrial metals and oil’s winning streak continued.

Moody’s action on China briefly rattled Asian markets, but against a backdrop of strengthening global growth and the impending release of minutes from the Federal Reserve’s latest meeting, investors appeared to quickly move on. Fed Bank of Philadelphia President Patrick Harker said June “is a distinct possibility” for the U.S. central bank’s second interest-rate increase of 2017.

Here are some key upcoming events:

- On the data front on Wednesday, notable indicators include U.S. wholesale inventories and existing home sales numbers.

- Canada releases a monetary policy decision the same day, followed by South Korea on Thursday.

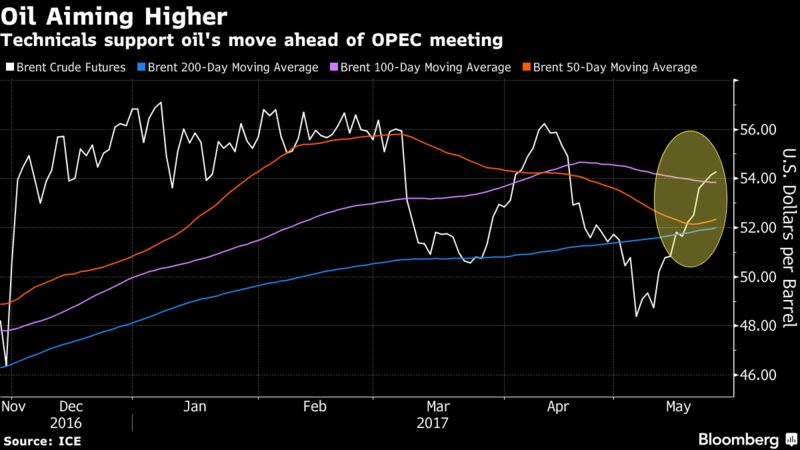

- OPEC will meet in Vienna on Thursday, with major oil producers edging closer to extending an agreement to curb output.

Here are the main moves in markets:

Currencies

- The pound rose 0.1 percent to $1.2971 as of 11:09 a.m. in London, following a two-day loss. The euro fell by less than 0.1 percent to $1.1178.

- The Bloomberg Dollar Spot Index was flat after climbing 0.3 percent Tuesday.

Commodities

- Nickel slumped 1.9 percent and copper fell 0.6 percent. Iron ore futures dropped 4.7 percent. China is the top user of materials.

- West Texas oil rose 0.2 percent to $51.56 a barrel, adding to a five-day advance.

- Gold added 0.1 percent to $1,252.30 an ounce, after dropping 0.8 percent on Tuesday.

Stocks

- The Stoxx Europe 600 Index added 0.2 percent.

- Futures on the S&P 500 were little changed. The underlying gauge rose 0.2 percent Tuesday, reaching as high as 2,400.85, two points from a closing record.

Bonds

- The yield on 10-year Treasury notes fell less than one basis point to 2.27 percent. Bonds fell during the previous four days.

- Yields on benchmark French, German and British bonds all dropped two basis points.

Asia

- The Shanghai Composite rose 0.1 percent, reversing a drop of 1.3 percent. The Hang Seng also ended higher after an earlier decline of 0.4 percent.

- Japan’s Topix index climbed 0.6 percent, while Indonesia’s benchmark index slumped 0.7 percent.

- The Australian dollar slipped 0.1 percent, paring a steeper drop of as much as 0.5 percent.

Courtesy Bloomberg