Global equities showed signs of stabilizing at the end of a turbulent week in which investors confronted political crises in Washington and Brazil. Oil headed for a second weekly gain as OPEC members supported Saudi Arabian and Russian pledges to extend supply cuts.

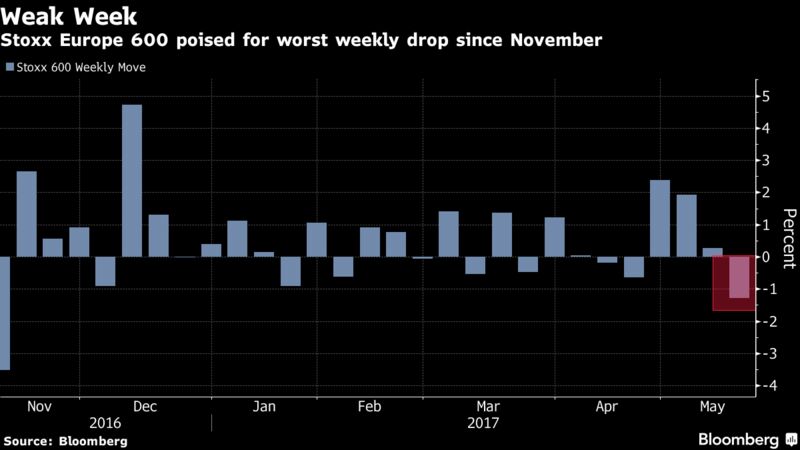

Stocks in Europe gained, paring their worst week since November. Gold resumed gains after briefly halting a five-day rally, while the dollar fell as emerging-market currencies rebounded from a selloff sparked by calls for Brazil’s leader to resign over an alleged cover-up.

Market volatility eased after U.S. President Donald Trump’s administration sought to move past controversies surrounding Russia that have threatened to ensnare its plans for tax cuts and infrastructure spending. Risk sentiment was also helped by better-than-expected U.S. jobless claims and regional manufacturing data Thursday.

“Following the initial excitement about the chaotic situation in the White House market participants seem to have calmed down again,” analysts at Commerzbank AG including Thu Lan Nguyen said in a note to clients.

The crisis in Brazil added another layer of worries for investors. President Michel Temer has defied calls for him to step down, saying a Supreme Court probe will debunk allegations he participated in a cover-up. Meanwhile, geopolitics remained in the spotlight, amid reports that the U.S. Navy is moving a second aircraft carrier to the Korean peninsula and that Chinese jets intercepted a U.S. Air Force plane.

Read our Markets Live blog here.

What investors will be watching:

- Federal Reserve Bank of St. Louis President James Bullard speaks to the Association for Corporate Growth at Washington University’s Knight Center in St. Louis.

- Trump’s first foreign trip as president will be to Riyadh on Saturday, at the invitation of Saudi King Salman bin Abdulaziz. After Saudi Arabia, Trump visits Tel Aviv and Rome before heading to a NATO summit in Brussels and the G-7 meeting in Sicily.

Here are the major moves in the markets:

Stocks

- The Stoxx Europe 600 Index rose 0.4 percent as of 9:23 a.m. in London, paring its weekly loss to 1.4 percent.

- S&P 500 futures were up less than 0.1 percent. The benchmark index rose 0.4 percent on Thursday after plunging 1.8 percent in the previous session, its worst day since Sept. 9.

- Brazil’s Ibovespa Index tumbled 8.8 percent on Thursday, the most since October 2008, as political crisis returned to the country after last year’s impeachment process.

- A Japan-traded ETF tracking Brazil’s Ibovespa Index dropped 6.5 percent after an even larger decline on Thursday, closing at the lowest level of the year.

Currencies

- The Bloomberg Dollar Spot Index fell 0.2 percent after increasing 0.3 percent Thursday. The gauge is 1.2 percent lower for the week.

- The yen was little changed at 111.55 per dollar after falling 0.6 percent on Thursday. The currency is up 1.8 percent for the week, its strongest performance in a month.

- The euro strengthened 0.3 percent to $1.1136, bringing its gain this week to 1.9 percent. The British pound stood 0.4 percent higher at $1.2986.

- Emerging-market currencies rebounded. The South African rand climbed 0.8 percent after tumbling 2.6 percent over the previous two sessions. The Turkish lira gained 0.7 percent after a 1.6 percent drop on Thursday.

Bonds

- The yield on 10-year Treasuries was little changed at 2.24 percent. It is down nine basis points this week.

- Benchmark yields in Germany and the U.K. rose one basis point.

Commodities

- West Texas crude rose 0.7 percent to $49.68, poised for a weekly increase of 4 percent, on optimism OPEC will reaffirm efforts to drain a global glut at their meeting in Vienna on May 25.

- Gold was set for the biggest weekly gain in more than a month as investors weigh political risks in U.S. Bullion for immediate delivery climbed 0.3 percent to $1,250.74 an ounce, on track for a 1.8 percent advance this week.

- Copper rose 0.8 percent to $5,622.50 a ton, leading most industrial metals higher as sentiment steadied after strong U.S. jobs data.

- Soybeans were stable after the biggest one-day drop since August as farmers in Brazil rushed to sell at a “once in a decade” pace as a deepening political crisis sent the nation’s currency tumbling. The commodity was 0.5 percent higher at $9.495 a bushel.

Asia

- The MSCI Asia Pacific Index rose less than 0.1 percent, with more stocks advancing than declining.

- Japan’s Topix index climbed 0.3 percent, after sliding 1.3 percent on Thursday. The gauge lost 1.3 percent for the week. The Hang Seng Index rose 0.2 percent and the Shanghai Composite was little changed.

- Jakarta stocks soared as much as 3 percent to a record after S&P upgraded Indonesia to investment grade.

Courtesy Bloomberg

Problem with Nigeria Revision of first-hand account of the AGSMEIS programme (2)