By Omobayo Azeez

The Nigerian Stock Exchange (NSE) and the Luxembourg Stock Exchange (LuxSE) have signed a Memorandum of Understanding (MoU) to cooperate in promoting cross listing and trading of green bonds in Nigeria and Luxembourg.

___________________________________________________________________

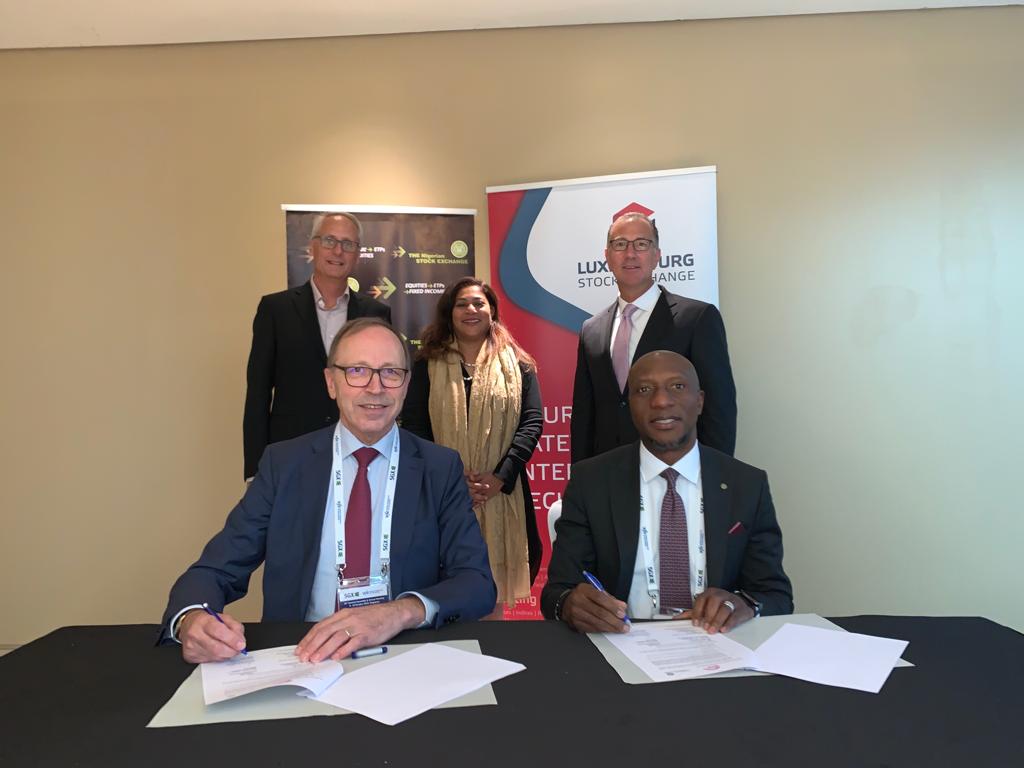

The announcement was made at the signing ceremony led by Oscar Onyema, NSE chief executive officer, and Robert Scharfe, the CEO of LuxSE, which took place during the annual meeting of the World Federation of Exchanges in Singapore on Wednesday.

The MoU further establishes an agreement for the two exchanges to collaborate with a view to sharing best practices and organising joint initiatives in their respective markets.

According to Onyema, “This collaboration reinforces NSE’s drive to foster the growth of sustainable finance in Nigeria, a journey that commenced with the launch of the first Sovereign Green Bond by NSE, in partnership with the Federal Ministry of Environment, Federal Ministry of Finance and the Debt Management Office.

“With the MoU, issuers will enjoy the benefit of increased visibility through the cross listing of their securities in Nigeria and Luxembourg. The partnership will further facilitate the growth of the green finance industry in Nigeria and ultimately deepen the Nigerian capital market through the mobilisation of the foreign green capital needed to fund sustainable projects in the country.”

Robert Scharfe, stated that sustainable finance is becoming a truly global movement.

He said, “By joining forces with other exchanges to promote and facilitate green finance, we strive to accelerate the sustainable finance agenda and increase awareness of and interest in investment projects that support the sustainable development that our world needs. We are pleased to cooperate with the Nigerian Stock Exchange to further strengthen sustainable finance in and between our markets.”

The Nigerian Green bond market received international recognition following the issuance and listing on the NSE of the ₦10.69 billion Federal Government sovereign green bond in December 2017.

This issuance sparked significant interest from the international and local capital market communities as it opened new investment opportunities, especially for domestic investors, to increase their exposure to financial instruments that generate social and environmental

impact.

The Luxembourg Stock Exchange operates the Luxembourg Green Exchange (LGX), a platform exclusively dedicated to sustainable finance instruments.

LGX now holds a 50 per cent global market share of listed green, social and sustainability bonds. LuxSE works closely with selected stock exchanges around the world to support the growth of sustainable finance.