BY VETIVA CAPITAL

What shaped the past week?

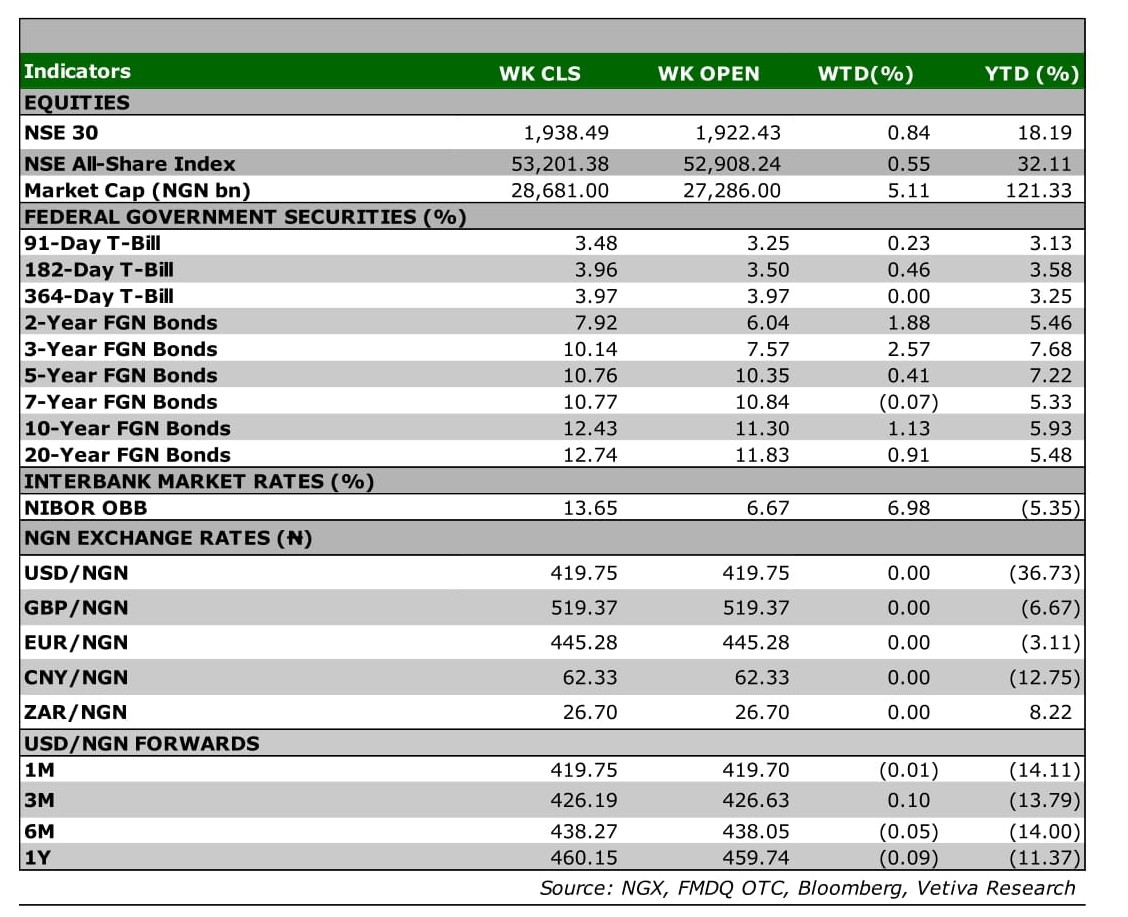

Global: Global investors continue to favor stocks in the Asian-pacific region, as a weaker Yen and easing of restrictions in parts China drives buy-side action in the region. The Hang Seng, Nikkei-225 and Shanghai Composite all closed in the green w/w, rising 3.43%, 2.80% and 0.23% respectively. Investors also reacted favorably to the latest economic data out of the region; in Japan, gross domestic product contracted 0.5% y/y in Q1’22 compared to a contraction of 2.2% in Q1’21. Meanwhile, in China May inflation printed at 2.1% y/y according to data from the National Bureau of Statistics. Moving to Europe, investors remain bearish due to the impact of runaway inflation and higher energy prices on company earnings in the region. The German DAX, French CAC, and London FTSE-100 all fell sharply w/w, losing 3.70%, 4.01% and 3.14% respectively. On the data front, the Eurozone reported a 5.4% y/y expansion for GDP, while GDP for the European Union expanded by 5.6% y/y. Additonally, European Central Bank (ECB) announced its decision to “leave the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility unchanged. The bank stated that it is planning to hike its key interest rates by 25 bps at the July meeting. Furthermore, the bank revealed that the Asset Purchase Programme (APP) will end on July 1 Finally, in North America sentiment remains bearish as well, as the latest inflation numbers from the U.S. dampen investor sentiment. US inflation surged to a 40-year high of 8.6% in May after moderating to 8.1% in April. At time of publishing the S&P 500, Nasdaq and Dow Jones were down 3.84%, 2.22% and 3.34% respectively.

Domestic Economy: According to Debt Management Office, Nigeria’s debt stock increased by 5.1% q/q to ₦41.6 trillion in Q1’22. The slight uptick was driven majorly by a net-accumulation of ₦1.3 trillion from domestic sources and the $1.25 billion Eurobond issuance in the month of March. As a result of the uptick, Nigeria’s Debt-to-GDP ratio has increased to 24%, below the 40% medium-term threshold of the DMO. Although the debt-to-GDP ratio is quite modest, external debt stock continues to rise amid falling crude receipts and a weaker Naira. Despite increased external borrowings in recent times, the debt-mix showed that Nigeria has more outstanding domestic debt (60% of debt stock) than external (40% of debt stock). The pace of external borrowings could ease as tighter financing conditions prevents Nigeria from raising $990 million in the international debt market. Thus, we expect more domestic borrowings in the near term, as the Government moves to fund its amended budget.

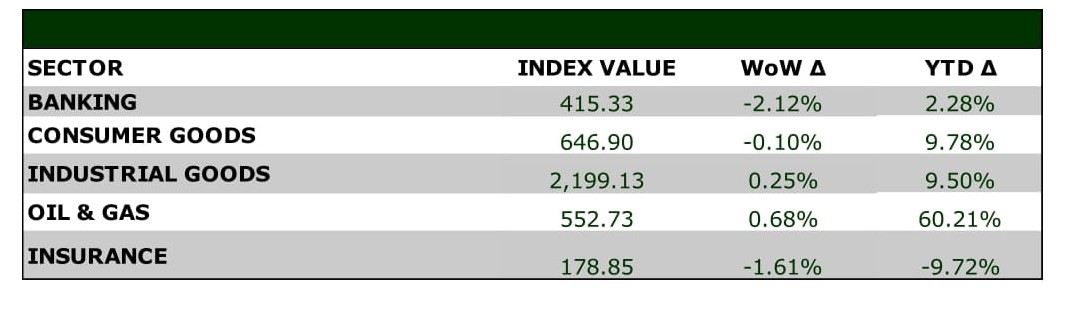

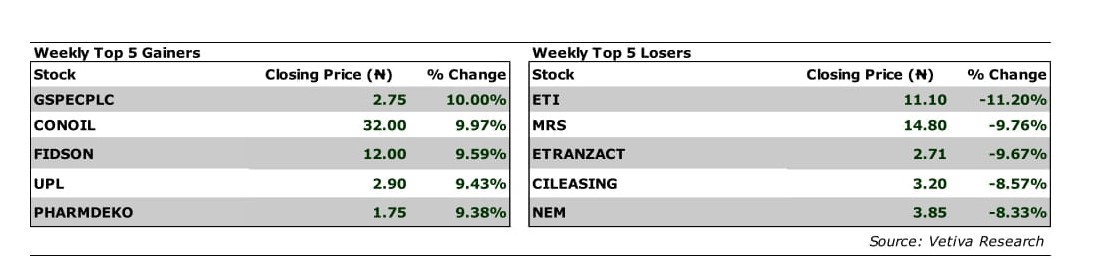

Equities: It was a mixed week of trading across the NGX; however, the bulls came out on top as they drove activity at the latter stages of the week, propping up the market. The local market rose 0.50% w/w, as interest in the telecommunications space, helped push the market higher. MTNN rose 4.35% w/w, to settle at ₦240.00; the stock remains the second most capitalized stock on the NGX after rival AIRTELAFRICA. As earlier mentioned, sentiment across the market was mixed with the Banking and Consumer Goods sectors trading lower w/w, while the Industrial Goods and Oil and Gas sectors closed higher w/w. In the Banking sector, losses in ETI, FCMB, ZENITHBANK and FBNH saw the sector plunge 2.18%, while in the Consumer Goods space, sell-side action in brewer NB and other mid-small cap players in the space saw the sector sink 0.12% w/w. on the other hand, WAPCO saw renewed interest following last week’s sell-side action in the counter; the cement maker saw its stock rise 3.70% w/w to settle at ₦28.00. Finally, in the Oil and Gas space, interest in oil marketers was the primary driver of its performance as the sector rose 1.14% w/w.

Fixed Income: In the fixed income market, trading activity was mixed this week, with yields trending upwards in the NTB and OMO spaces, while the bonds segment was majorly buy-side driven. In the bonds space, investor activity was largely mixed with a bullish skew, as we observed aggressive buy-side action at the short-mid end of the market, while select counters at the long-end saw some pockets of demand as well. Yields on benchmark bonds eased 3bps w/w as a result. Moving to the T-bills segment; action in the market was largely bearish this week, with investors selling off tenors at the short end consequently, yields rose 19bps on average. Finally, the OMO space also witnessed selloffs at the short end of the curve as result, average yields rose 15bps w/w.

Currency: The Naira depreciated by ₦1.50 w/w at the I&E FX Window to close at ₦421.25.

What will shape markets in the coming week?

Equity market: Despite today’s positive close, market sentiment remained slightly bearish as the session ended with more losers than gainers (18 to 14). Although we anticipate further recoveries in some of the stocks with beaten down prices, however we do not rule out sell-offs in specific counters next week.

Fixed Income: In the absence of significant market catalysts, we anticipate further bearish trading in the bonds market next week. Meanwhile, the NTB and OMO spaces are expected to trade quietly, as attention shifts to next week’s T-Bills PMA.

Currency: We expect the naira to remain largely stable across the various windows of the currency space as the CBN maintains interventions in the FX market.

NIGERIA MPC – At last, the hawks carry the day

At its third meeting of the year, the Monetary Policy Committee (MPC) raised the Monetary Policy Rate (MPR) by 150bps to 13.0%. While six members voted to raise interest rates by 150bps, four members preferred a 100bps hike, while one opted for a 50bps hike.

Nigeria joins other African economies like Egypt (+200bps YTD) and Ghana (+450bps YTD) in raising interest rates to curb inflation. On a comparative basis, however, Nigeria’s negative real rate of return is still above Egypt and South Africa’s levels. If there were no capital controls, the MPR needs to rise to 15.0% – 15.5% to match the current real rate of return in Egypt and South Africa, respectively.

The backdrop remains the same

The background underpinning this decision is similar with the last meeting – the ongoing war in Ukraine, backlash from sanctions on Russia, lockdowns in China, swift change in monetary policy stance, and risk aversion in the global financial markets.

The Ukraine-Russian war aggravated supply chain disruptions as major trade routes were closed amid sanctions on Russia. Should the war escalate, this could worsen already high food inflation, as food prices rise to levels not seen in 40 years. In our view, the resurgence of the pandemic in China could spill over to resource-dependent emerging economies in form of lower external demand and lean current account balances, while reducing demand for oil. The decline in Chinese demand is however inadequate to stop the oil bull, as oil prices sit comfortably at $114/barrel. China could decide to buy Russian crude at discounts, risking international sanctions, that could boomerang on emerging markets in form of higher imported inflation.

The surge in inflation has led many central banks to raise interest rates and curb external pressures on their economies. Notwithstanding, there have been net portfolio outflows from emerging markets since the US Fed began raising its policy rate in March this year. The strengthening of the dollar to multi-year highs has attracted portfolio interests and led to reduced demand for safe-haven assets such as gold, a trend that has occurred in previous hiking cycles. Thus, the stock markets’ rout is far from over. Nigeria appears to be exempted with a positive year-to-date return of 21.6% in naira terms. However, this is due to the existence of capital controls and FX backlogs, which have dented foreign appetite for Naira assets.