By Lukman Otunuga, FXTM senior analyst

2019 was packed with uncertainty thanks to persistent trade drama, global growth fears and volatile oil prices.

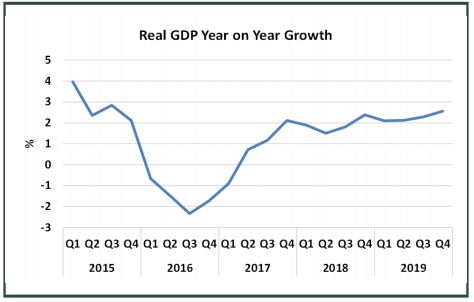

Unfavourable global economic conditions left no prisoners with both developed countries and emerging markets feeling the heat. Although the market mood slightly improved during the final months of 2019 amid trade optimism, caution remained a dominant market theme. Nevertheless, Nigeria was able to capitalise on the semblance of market stability and this was reflected in the Gross Domestic Product (GDP) which expanded 2.55% during the final quarter of 2019.

The combination of increased oil output, rising commodity prices and steps by the Central Bank of Nigeria (CBN) to boost credit growth stimulated the economy with full-year GDP expanding 2.27%. This figure was not only above the International Monetary Fund (IMF) forecast of 2.1% but the highest growth seen since 2015. While the GDP figure is certainly encouraging and continues to illustrate Nigeria’s resilience to external and domestic threats, the risks to the economy are mounting.

Severely depressed Oil prices could hit economic growth during the first quarter of 2020. Oil has depreciated over 15% since the start of the year amid the coronavirus outbreak. Crude accounts for less than 10% of GDP but it remains the biggest source of foreign revenue for the nation. China is one of Nigeria’s biggest trading partners with total trade flows during the third quarter of 2019 surpassing $3.2billion. The combination of weak oil prices and slowing growth from China could negatively impact Nigeria’s growth potential in 2020.

There will be a strong focus on economic data ahead of the next CBN policy meeting in March. Investors will direct their attention towards the latest manufacturing PMI figures scheduled for release on Thursday, February 27. A figure that meets or exceeds the PMI market forecast of 58.4 may signal a recovery in the manufacturing sector – something that is supportive of growth potential.

Outside of Nigeria, the main theme influencing market sentiment will revolve around the coronavirus outbreak and impacts it will have on the global economy. If risk aversion remains a dominant market theme and demand-side fears hit Oil prices, the Nigerian Naira and All Share Index (ASI) could slip this week.