Nigerian equities Tuesday shed N57 billion in market capitalization as the bears continued their stranglehold on the market for the fifth consecutive trading session.

This is despite impressive earnings reports for full year 2017 by blue chips and large caps on the Nigerian Stock Exchange (NSE). On the day, Dangote Cement (DANGCEM( released an impressive FY:2017 result, posting a 31.0 percent increase in gross revenue to N805.6bn while PBT and PAT inched 60.1 percent and 43.0 percent higher to N289.6 billion and N204.2 billion respectively. The company declared a dividend of N10.50 for the period.

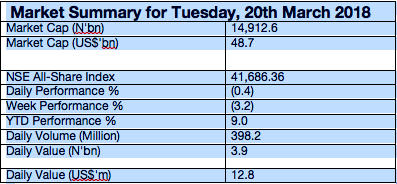

The market on the day was dominated by sell-offs in GUARANTY (-1.8%), SEPLAT (-5.0%) and WAPCO (-5.0%). As a result, the benchmark index, the NSEASI declined by 38bps to 41,686.36 points while YTD return contracted to 9.0 percent. Accordingly, market capitalization decreased by N57.1bn to N14.9 trillion.

Activity level was however mixed as volume traded advanced 21.8 percent to 398.2 million units while value traded fell 25.7 percent to N3.9 billion.

FIDSON (85.1m), AFRINSURE (40.1m) and FBNH (34.9m) were the top traded stocks by volume while GUARANTY (N826.7m), ZENITH (N682.3m) and FIDSON (N424.8m) led by value.

The oil and gas index led the day’s bearish performance, posting a 2.7 percent decline on account of price depreciation in SEPLAT (-5.0%). The industrial goods index trailed, shedding 2.0 percent as WAPCO (-5.0%) recorded losses.

Similarly, sell pressures in NEM (-3.9%), AFRINSURE (-3.6%), GUARANTY (-1.8%) and UBA (-1.3%) drove the negative performance of the Insurance (-1.1%) and Banking (-0.7%) indices.

On the flip side, the consumer goods index was the only gainer, up 0.1% buoyed by gains in UNILEVER (+5.0%) and NASCON (+3.4%).

Investor sentiment measured by market breadth (advance/decline ratio) improved marginally to 0.5x from 0.4x recorded yesterday consequent on 19 stocks advancing relative to 31 that declined. The best performing stocks were UNITY (+6.5%), UNILEVER (+5.0%) and TOTAL (+5.0%) while CABDURY (-9.4%), JAPAUL OIL (-9.4%), and MULTITREX (-9.1%) led the laggards.

Despite the apparent non-response by investors to the impressive earnings results by corporates, analysts are still confident that the market would rebound in the near term as they believe investors would begin to seek for bargain opportunities in trading sessions ahead.