Over the weekend, North Korea conducted its sixth and largest nuclear test to date. South Korea responded with live-fire exercises and, in the process, determined that the North is preparing more missile launches. Although US markets are closed today for the Labor Day holiday, there are plenty other signs that investors are nervous about where this will lead.

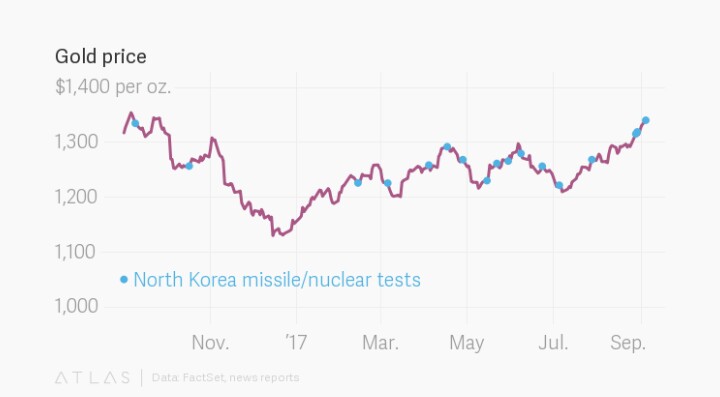

The price of gold climbed 1% on Monday morning, to its highest level since September 2016. This is the first nuclear test in North Korea in about a year, but Pyongyang has tested many ballistic missiles in this time, including one last week that flew over Japan.

The UN Security Council is holding an emergency meeting today after US president Donald Trump called North Korea a “rogue nation” and South Korean President Moon Jae-in pushed for even stronger international sanctions to “completely isolate” the country.

Traditionally, the Japanese yen, like gold, acts as a haven for investors during times of turmoil. But in this instance, with a threat so close to home, it’s hard to see how the yen could offer traders much protection. Still, it rose 0.7% against the dollar this morning. A month ago, when Trump threatened to unleash “fire and fury like the world has never seen” upon North Korea, traders scrambled to buy the Swiss franc, making it the biggest one-day rallyagainst the euro in more than a year. At the time of writing, the franc had gained just 0.4% against the euro.

This relatively muted reaction in the currency market suggests either traders don’t expect the provocations to escalate(pdf) into war or reflect the fact there is simply few meaningful ways to protect investments against nuclear war. Instead of expecting markets to panic now, a relief rally later might be more likely (provided the threat subsides). For example, in November 1962 the resolution of the Cuban Missile Crisis pushed the Dow up more than 10%, its best month since the end of World War II, according to the Wall Street Journal(paywall).

This is not to say that investors are sitting on their hands and hoping for the best. Escalating geopolitical tensions and the heightened risk of a “mistake” leading to armed conflict is hurting Asian stock markets. Japan’s Topix index fell 1% and South Korea’s KOSPI index was down 1.2% on the day.