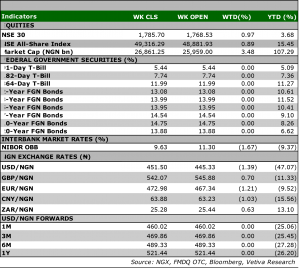

Currency: The Naira depreciated ₦1.46 w/w at the I&E FX Window to ₦451.50.

| What will shape markets in the coming week?

Equity market: It was another good week for the banking sector, in terms of both performance and activity. While, we expect some profit taking next week, we anticipate another positive week on week close on the back of positive activity in some of the heavy weights.

Fixed Income: Given the aggressive buy-side activity witnessed this week, we cannot rule out the possibility of profit-taking action from investors to start next week. Meanwhile, we expect liquidity levels to dictate activity in the NTB space.

November 2022 Inflation – Year-long fuel scarcity intensifies inflation in November Consumer prices punched higher in November to 21.47% y/y (Oct’22: 21.09% y/y). On a month-on-month basis, headline inflation rose to 1.39% m/m, 15bps higher than the previous month amid prolonged fuel scarcity and demand frontload ahead of the festive season.

Demand frontload keeps food inflation elevated Despite being at the crux of harvest, food prices rose at a faster pace of 1.40% m/m (Oct’22: 1.23% m/m). When annualised, food inflation rose to 24.13% y/y (Oct’22: 23.72% y/y). This uptick was driven by processed foods (+66bps to 1.63% m/m) and non-alcoholic beverages (+17bps to 1.39% m/m), which implies demand pressures ahead of the festive season. Surprisingly, the prices of farm products witnessed a 0.13% m/m deflation, as supply glut from year-end harvest moderated farmgate prices, showing that the impact of floods on farmgate prices was muted. Bread and cereals remained the food items with the highest price changes. This was due to a substantial reduction in wheat import from Russia amid the enforcement of sanctions against the Eurasian country.

Fuel scarcity stokes core inflation Elsewhere, core inflation, which excludes volatile agricultural produce, increased to 18.24% y/y (Oct’22: 17.76%), due to higher energy prices and exchange rate pressures. On a month-on-month basis, the core index accelerated to a 6-month high of 1.67% m/m (Oct’22: 0.93% m/m), driven by prolonged fuel scarcity in the month of November.

Consumer prices could be ready for an inflex |

While fuel scarcity has lingered in December, we have observed reduced month-on-month upticks since August, partly supported by the harvest season. Thus, we expect headline inflation to slow to 20.99% y/y in December. We attribute this decline to high base effects from the prior year and robust year-end harvest, despite factoring elevated year-end demand and fuel scarcity aftereffects. We expect reduced exchange rate volatility to keep core inflation in check despite higher outturns. Tying this together, we now expect headline inflation to average 18.73% y/y in 2022 (2021: 16.98% y/y).

The art of doing nothing: Nigeria & The World