Oil climbed, paring losses earlier this week, as Saudi Arabia moved to dispel doubts over Russia’s readiness to extend output curbs.

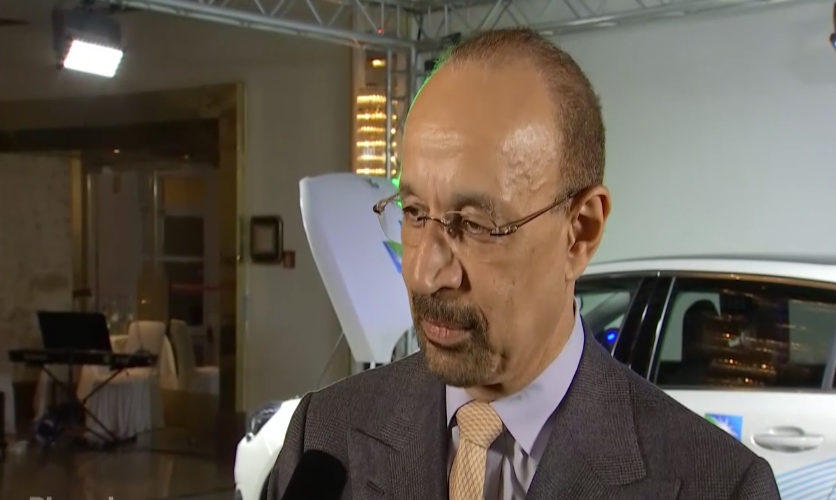

Futures rose 1.5 percent in New York, trimming the weekly decline to 1.4 percent, after Khalid Al-Falih, Saudi Arabia’s Energy Minister said OPEC should announce an extension of output curbs when it meets on Nov. 30., according to Bloomberg.

Russia is said to be hesitant to commit to a decision so soon, suggesting the group waits until closer to the deal’s end-March expiry. U.S. crude output gained this week to the highest in more than three decades, according to government data.

Oil rose to the highest in more than two years last week amid near certainty that the Organization of Petroleum Exporting Countries and its allies would prolong the output deal and heightened geopolitical tension in the Middle East. The recovery has abated in the last few days after the International Energy Agency said milder-than-normal winter weather is putting a brake on demand growth. While Russia’s reluctance is causing concern, Saudi Arabia’s Al-Falih is trying to reassure the market the deal will be extended.

Nigeria’s aviation industry picking up on recent exit from recession, grows 0.1% year-on-year

“He was quite clear: he is working to get a deal at the end of November,” said Giovanni Staunovo, an analyst at UBS Group AG in Zurich. “The U.S. data and uncertainty over Russia have been the main drivers of the oil market this week. A lot of positive news has also already been priced in, which makes it more difficult to see prices inching further up.”

West Texas Intermediate for December delivery was at $55.95 a barrel on the New York Mercantile Exchange, up 79 cents, at 11:31 a.m. in London. Total volume traded was about 72 percent above 100-day average. Prices lost 19 cents to $55.14 on Thursday.

Brent for January settlement was 65 cents higher at $62.01 a barrel on the London-based ICE Futures Europe exchange. Prices are down 2.4 percent this week and headed for the first weekly drop since the start of October. The global benchmark was at a premium of $5.85 to January WTI.

OPEC is unlikely to reduce excess oil inventories to average levels by the time the current supply deal expires, Al-Falih said Thursday. The kingdom has had extensive consultations with Russia and the minister said he feels “fully convinced” the country will be “fully on board” when a resolution is made.