Crude prices started the week in an upbeat mood on Monday, reaching their strongest level in almost four years as traders increased bets the U.S. would pull out the Iran nuclear deal, raising the potential for tighter global oil stockpiles.

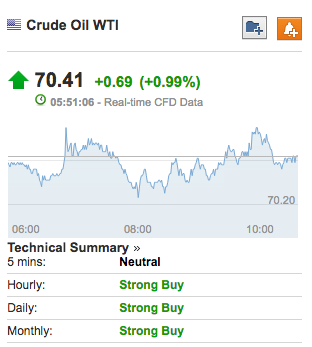

New York-traded WTI crude futures rose to an intraday peak of $70.69 a barrel, breaching the $70-mark for the first time since November 2014.

It was last at $70.30 by 07;05 GMT, up 58 cents, or around 0.9 percent.

Oil prices have been climbing, according to CNN report, partly because of expectations that President Donald Trump will abandon the 2015 Iran nuclear deal, which allowed Iran to export more crude.

Meanwhile, Brent crude futures, the benchmark for oil prices outside the U.S., tacked on 56 cents, or 0.8%, to $75.42 a barrel, after climbing to $75.89 earlier in the session, its highest since November 2014.

The showdown between President Donald Trump and Iran will likely continue to be the main driver of sentiment in the oil market this week.

President Trump has until May 12 to decide whether to pull the United States out of a 2015 international accord to curb Iran’s nuclear program and restore sanctions on one of the world’s biggest oil producers.

Trump has repeatedly threatened to abandon the deal, reiterating last week that unless European allies rectify the “terrible flaws” in the agreement, he will refuse to extend U.S. sanctions relief for the oil-producing country.

If sanctions are reinstated, that could contribute to tighter global oil inventories, as it would likely result in a reduction of Tehran’s oil exports.

Iran, which is a major Middle East oil producer and member of the Organization of the Petroleum Exporting Countries (OPEC), resumed its role as a major oil exporter in January 2016 when international sanctions against Tehran were lifted in return for curbs on Iran’s nuclear program.

President Hassan Rouhani said on Sunday Iran had plans to respond to any move by Trump and the U.S. would regret a decision to exit the accord.

Concerns over a deepening economic crisis in Venezuela, which has threatened the country’s already tumbling oil supplies was another factor supporting prices.

However, a steady increase in U.S. drilling for new production marked one of the few factors tamping back crude in an otherwise bullish environment.

U.S. drillers added nine oil rigs in the week to May 4, bringing the total count to 834, the highest number since March 2015, General Electric’s Baker Hughes energy services firm said in its closely followed report on Friday.

That was the fifth consecutive weekly increase in the rig count, underscoring worries about rising U.S. output.

Indeed, domestic oil production – driven by shale extraction – rose to an all-time high of 10.62 million barrels per day (bpd) last week, the Energy Information Administration (EIA) said.

Only Russia currently produces more, at around 11 million bpd.

Fresh weekly data on U.S. commercial crude inventories on Tuesday and Wednesday to gauge the strength of demand in the world’s largest oil consumer and how fast output levels will continue to rise will capture the market’s attention.

In other energy trading, gasoline futures added 0.6% to $2.127 a gallon, while heating oil tacked on 0.6% to $2.166 a gallon.

Natural gas futures were a shade higher at $2.724 per million British thermal units.