Oil skeptics are letting a little sunshine in.

After the worst June for oil in six years, hedge-fund bets on declining West Texas Intermediate retreated. That made room for futures to rebound more than 5 percent last week on optimism that the summer will finally boost demand for crude and gasoline.

“The market is starting to recognize that demand is a little better than what has been the consensus view so far this year,” Matt Sallee, who helps manage $16 billion in oil-related assets at Tortoise Capital Advisors in Leawood, Kansas, said by telephone.

While doubts persist that the Organization of Petroleum Exporting Countries and its allies will manage to bring the oil market back to balance anytime soon, the mood improved as the International Energy Agency said world demand is climbing faster than initially estimated. Meanwhile, Libya and Nigeria may be asked to join the other members of OPEC in capping output, according to Kuwait’s oil minister.

In the U.S., data from the Energy Information Administration showed crude and gasoline stockpiles shrinking.

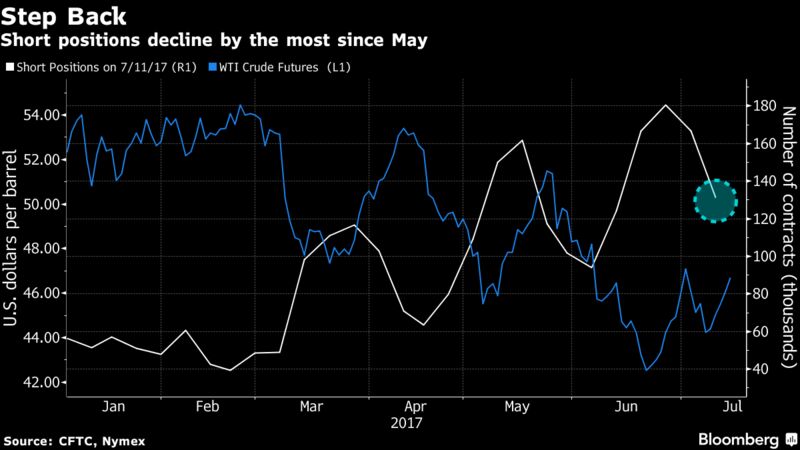

Hedge funds increased their WTI net-long position, or the difference between bets on a price increase and wagers on a drop, by 19 percent to 178,654 futures and options over the week ended July 11, the sharpest increase in seven weeks, according to data from the U.S. Commodity Futures Trading Commission. The improvement was entirely due to a 21 percent retreat in shorts, more than offsetting a 2.1 percent decline in longs.

The mood has been largely set by big swings in bearish wagers over the past months, with bullish bets not increasing more than 5 percent in any week since January.

Read also: Oil prices edge up on strong China demand, signs of U.S. output slowdown

Bets on the benchmark U.S. gasoline contract flipped to a net-bullish position for the first time since early June. The net-position on diesel was the least bearish in five weeks.

Investors are “starting to see, not necessarily full conviction, but a little bit more optimism about some of the developments in the market, even though the overall tone is clearly still bearish — it’s kind of going from bad to a little less bad,” Tamar Essner, an energy analyst at Nasdaq Inc. in New York, said by telephone. “The shorts were at very high levels. We knew that that wasn’t going to be sustainable.”

WTI climbed 0.3 percent to $46.68 a barrel at 9:19 a.m. London time on Monday, after rising 5.2 percent last week. Stuck below $50 since May, the U.S. crude benchmark is still down 13 percent for the year and worth less than half its price three years ago.

“For the near-term, oil is in a $40 to $50-a-barrel range. As you get toward the low end of that range, you see shorts close out,” Tortoise Capital’s Sallee said. “Your risk-return is kind of skewed against you if you are on the short side and on the lower end of that range.”

Last week, EIA data showed U.S. crude stockpiles slid by 7.56 million barrels, the biggest decline since September, in the week ended July 7. Gasoline supplies fell for a fourth straight week, tumbling to the lowest level since December, and demand increased by 81,000 barrels a day.

“Perhaps, the worst is behind us,” Stewart Glickman, an energy equity analyst at CFRA Research in New York, said by telephone. “It doesn’t mean necessarily that we are on the verge of a V-shaped recovery. You can bounce along the bottom for quite a while.”

Courtesy Bloomberg