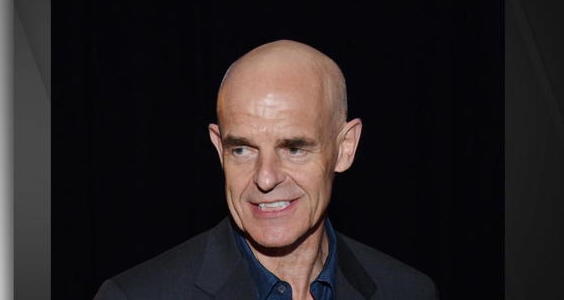

Andy Hall, the oil trader sometimes known in markets as “God,” is closing down his main hedge fund after big losses in the first half of the year, according to people with knowledge of the matter.

The global crude market has “materially worsened” and prices may be stuck around $50 a barrel or below, Hall told investors in his Astenbeck Capital Management LLC firm in a letter last month. The flagship Astenbeck Master Commodities Fund II lost almost 30 percent through June, a separate person with knowledge of the matter said. The people asked not to be identified because the details are private.

A representative of the firm declined to comment.

Hall shot to fame during the global financial crisis after Citigroup Inc. revealed that, in one year, he pocketed $100 million trading oil for the U.S. bank. His career stretches back to the 1970s and includes stints at BP Plc and legendary trading house Phibro Energy Inc., where he was chief executive officer.

“I’m shocked,” said Danilo Onorino, a portfolio manager at Dogma Capital SA in Lugano, Switzerland. “This is the end of an era. He’s one of the top oil traders ever.”

Hall is a prodigious collector of art who, with his wife and their foundation, owns more than 5,000 pieces by several hundred artists including Andy Warhol and Joseph Beuys. They exhibit some of it at Schloss Derneburg, a 1,000-year-old castle in Germany they bought in 2006.

This year, Hall has consistently pushed against the bearish tide on oil, arguing in investor letters that data showing rising crude supplies were incomplete and that a sustained rally was on its way.

Oil hedge funds such as Astenbeck wagered earlier this year that OPEC production cuts would send prices climbing. Yet, their bets backfired as U.S. shale producers boosted output and Libya and Nigeria recovered from outages caused by domestic disturbances and civil war. Hall wasn’t alone in losing money, with Pierre Andurand, the founder of the eponymous hedge fund, and Cumulus Fund, which speculates on weather patterns, also down.

The Southport, Connecticut-based Astenbeck managed $1.4 billion at the end of last year, according to a filing with the Securities and Exchange Commission.

From Bloomberg news service