Oil traded near a three-week high as key refineries and pipelines restarted from shutdowns forced by Hurricane Harvey, reviving crude demand in the heart of the U.S. energy sector, according to Bloomberg.

Futures were little changed in New York after closing 2.9 percent higher Tuesday. While U.S. Gulf Coast refiners are working to restore operations to normal, traders are also watching the approach of another Atlantic hurricane, Irma. Motiva Enterprises LLC said its Port Arthur Refinery in Texas, the largest in the U.S., will return to 40 percent production by the end of the weekend.

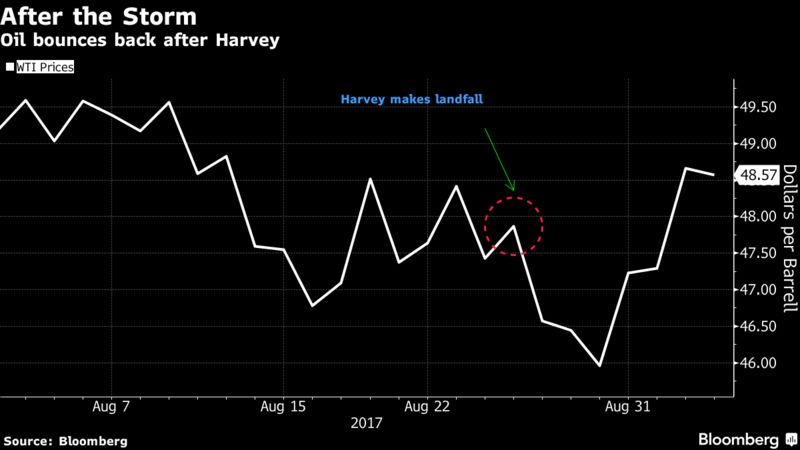

Harvey forced refineries, pipelines, ports and offshore platforms to shut as the storm intensified before making landfall on Aug. 25. Many of those facilities are back in service, though others have yet to resume operations. Goldman Sachs Group Inc. forecast half of the refining capacity lost to the storm will be back online by Thursday and may prove positive for the oil market in a few months.

“The post-Harvey clean-up is in full swing and the U.S. energy business is returning to normality,” said Norbert Ruecker, head of commodity research at Bank Julius Baer & Co Ltd. “Refineries are resuming operations and ports are re-initiating trade.”

West Texas Intermediate crude for October delivery was at $48.87 a barrel on the New York Mercantile Exchange, up 21 cents, as of 10:59 a.m. in London. The contract on Tuesday added $1.37 to settle at $48.66 a barrel, the highest since Aug. 11.

Brent for November settlement added 48 cents, or 0.9 percent, to $53.86 a barrel on the London-based ICE Futures Europe exchange. Prices advanced $1.04, or 2 percent, to close at $53.38 a barrel Tuesday. The global benchmark traded at a premium of $4.51 to the November WTI contract.

U.S. crude stockpiles likely rose by 2.5 million barrels last week, while gasoline inventories dropped by 5 million barrels, which would be the biggest loss by volume since March, according to a Bloomberg survey before government data to be released Thursday.

October gasoline futures in New York dropped as much as 1.5 percent to $1.6740 a gallon, falling for a third session. The decline comes after prices surged in August by the most in more than a year.

Hurricane Irma, the most powerful storm ever to form in the open Atlantic Ocean, was moving toward Puerto Rico late Tuesday. Although the latest models show it veering away from gas and oil platforms off the coast of Texas and Louisiana, sparing Houston from more devastation, it’s still threatening to wreak havoc upon the Caribbean islands and Florida.

“The upgrade of Hurricane Irma may have spurred some precautionary buying of crude oil,” said Jens Naervig Pedersen, senior analyst at Danske Bank A/S in Copenhagen. “The impact of Harvey and likely impact of Irma will distort upcoming U.S. inventory data and thus limit visibility in the oil market with regards to the ongoing rebalancing process.”