OPEC and its allies indicated that they’ll wait a bit longer to see if further action is required in their bid to clear a global oil glut, while the Nigerian Minister of State for Petroleum Emmanuel Ibe Kachikwu said that his country would accept an output cap once security in its oil-producing region has fully stabilised.

Ministers from nations that together pump more than half the world’s oil at times made conflicting statements but broadly signaled that their meeting on Friday wouldn’t take concrete steps to address concerns that their agreement may end too early. While their production cuts have shown signs of success in recent months, the market could return to surplus next year if the group allows the accord to expire at the end of March.

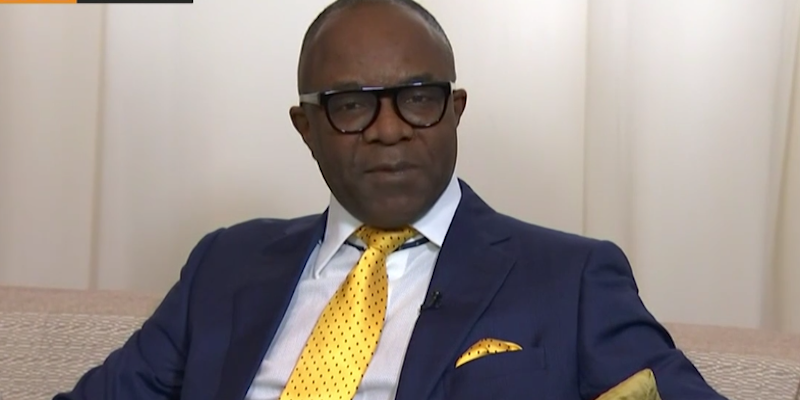

“OPEC members are trying to target a figure of close to $60 a barrel. We’re not too far away from that,” Nigerian Minister of State for Petroleum Emmanuel Ibe Kachikwu said in an interview on Friday with Bloomberg television in Vienna. “If we get to March and find that there’s a need to do more, I think we will.”

While Issam Almarzooq, Kuwait’s Oil Minister and his Russian counterpart Alexander Novak said it was too early to discuss extending the cuts, Algerian Energy Minister Mustapha Guitouni told his country’s state-run press service that they would talk about it. Novak also said there was no formal proposal for a further 1 percent cut, which Iraq’s Oil Minister Jabbar Al-Luaibi had suggested on Tuesday that some members were considering.

The Organization of Petroleum Exporting Countries and its allies have several reasons to hold a steady course. Brent crude, the international benchmark, closed at $56.43 a barrel on Thursday, the highest level since February and an increase of more than 25 percent since June. Nine months into their agreement, implementation of the pledged 1.8 million barrels a day of production cuts remains high and the world’s bloated fuel inventories are shrinking.

Still, as U.S. shale oil continues to thrive and seasonal demand wanes, the surplus that has weighed on markets for three years could soon return. If OPEC doesn’t extend the supply curbs beyond their current expiry at the end of March, the market will return to oversupply again, forecasts from the International Energy Agency indicate.

It’s in OPEC’s interest to wait before pledging to extend its cuts, Goldman Sachs Group Inc. said in a note dated Sept. 21. “The main focus of the meeting will be the monitoring of compliance to the cuts, which has reached new highs of 110 percent in August, as well as Libya and Nigeria’s production levels,” the bank said.

The two African nations are currently exempt from cutting output because of internal strife, and recent production gains from both countries have diluted the efforts of other members to boost prices.

Nigeria’s Kachikwu reiterated that his country would accept an output cap once security in its oil-producing region has fully stabilized.

“Militancy is down, there’s a bit calm in the Niger Delta areas — our production has gone from the all-time low of about 1.1 million barrels a day up to about 1.7 million to 1.75 million,” Kachikwu said. When the country achieves consistent production of 1.8 million barrels a day “we will basically place a cap on ourselves,” he said.

Caps for both Libya and Nigeria will be discussed at Friday’s meeting, Russia’s Novak told reporters in Vienna on Thursday.

The Joint Technical Committee, a group of OPEC and non-OPEC officials that met on Wednesday to assess compliance with pledged targets, recommended that ministers should consider informal monitoring of exports in addition to production, a move that Saudi Arabia has been pushing for in order to improve transparency.

OPEC’s rules mean these figures would only be discussed internally and the so-called secondary sources production estimates — compiled from third parties and published each month — would remain the only official way for measuring compliance, said two delegates, who asked not to be named because the talks were private.

“Whatever else we find — exports or other mechanisms — to ensure that the secondary sources are reliable, that’s fine,” said Kachikwu. However, nothing is going to replace the secondary sources, he said.