By Lukman Otunuga, Senior Research Analyst at FXTM

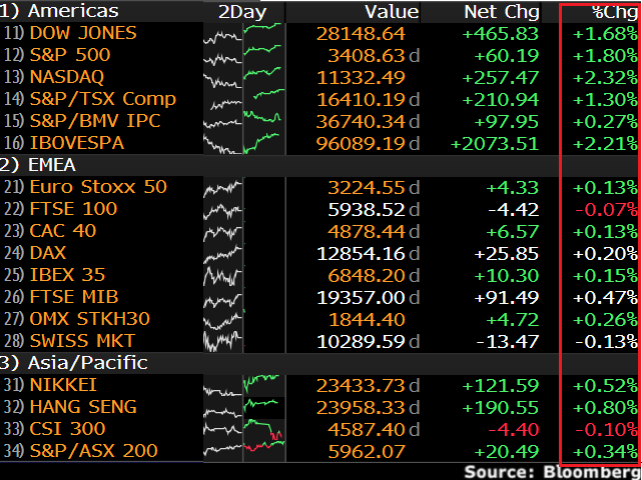

The sentiment pendulum swung deeper into “risk-on” territory on Tuesday morning after President Donald Trump’s departure from hospital soothed concerns about his health.

Equity bulls in Asia were instilled with a renewed sense of confidence on this news, elevating shares to levels not seen in more than two weeks. European stocks opened slightly higher with the positive mood potentially finding its way back into Wall Street this afternoon. In Nigeria, the All Share Index (ASI) gained 2.11% on Monday and was on its way to extend gains Tuesday at the time of writing amid the risk-on sentiment.

There seems to be a growing sense of optimism for more U.S fiscal stimulus after House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin spoke by phone for about an hour on Monday. Market sentiment could brighten if both sides reach a breakthrough on new government spending before the Presidential elections less than a month away. Such an outcome may inject equity bulls with enough inspiration to retest 2020 highs. However, the road north remains filled with many obstacles in the form of rising coronavirus cases in the United States and across the globe and lingering fears around economic growth.

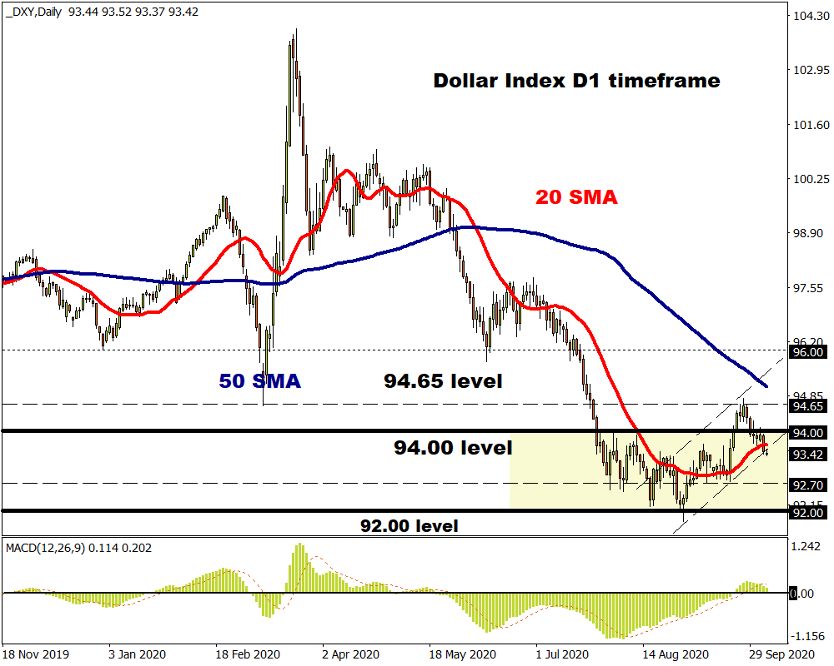

Dollar waits for Jerome Powell

After depreciating against most G10 currencies yesterday, the Dollar has entered Tuesday’s session struggling to shake away the Monday blues. In our technical outlook, we discussed the possibility of the Dollar Index trending lower if 94.00 proves to be reliable resistance. The Dollar Index is trading around 93.48 as of writing and could slip towards 92.70 if bears can conquer the 93.30 intraday support.

Fed Chair Jerome Powell will be under the spotlight today as he delivers a keynote speech at the National Association of Business Economics (NABE) conference. Any fresh clues on monetary policy could influence where the Dollar Index (DXY) performance this week.

Currency spotlight – Naira

The Nigerian Naira recovered from a low of 385.50 per USD on the official market seen last Friday after the Central Bank of Nigeria offloaded Dollars to stabilize the local currency.

On the black-market exchange, the Naira has slightly recovered trading around 458 per USD today. The positive sentiment and recent jump in Oil prices could support the Naira in the near term. However, the recent decline in foreign exchange reserves and rising inflationary pressures amid the coronavirus crisis may limit the Naira’s upside gains.

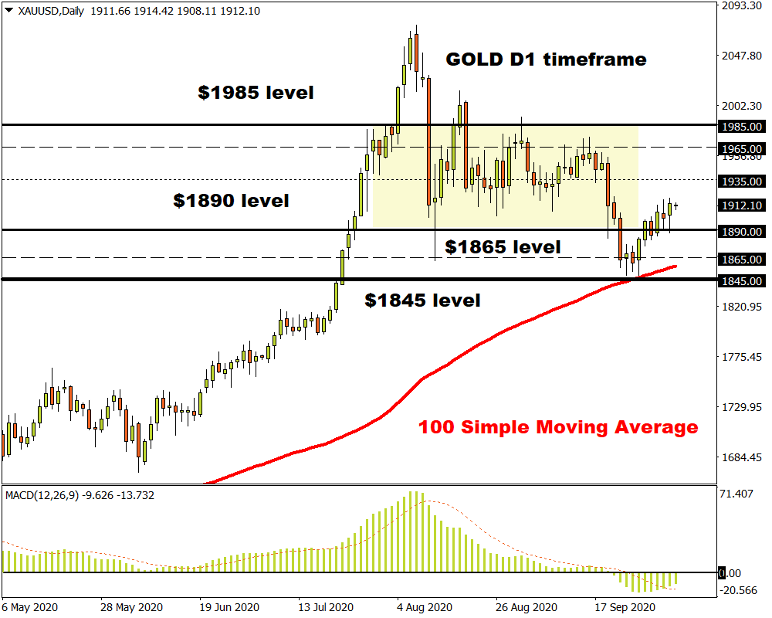

Commodity spotlight – Gold

Gold prices slightly dipped on Tuesday morning as equities roared to life following Trump’s discharge from hospital, though a softer Dollar limited the precious metal’s downside losses.

Overall, the outlook for Gold remains bright despite the risk-on mood sweeping across financial markets. Rising coronavirus cases across the world, political risk ahead of November’s US election, Brexit related uncertainty and low-to-negative US government bond yields are likely to stimulate appetite for the Gold in Q4. If the Dollar ends up weakening on rising inflationary pressure in the United States, this could prove a tailwind for Gold which is also considered an inflationary hedge.

Looking at the technical picture, the daily close above $1900 could open a path towards $1935. Should prices break back below $1900, Gold may sink towards $1865.