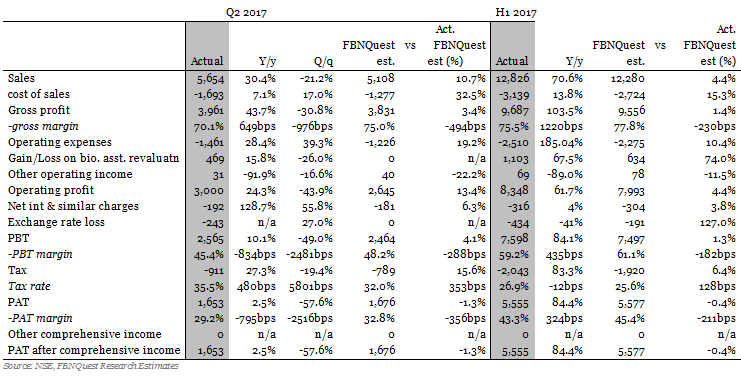

Presco reported its Q2 2017 results this afternoon showing sales growth of 30.4% y/y to N5.7bn. Similarly, PBT and PAT increased by 10.1% y/y and 2.5% y/y respectively. The topline growth surprised slightly.

The company continued to benefit from increased demand following encouraging government policy on crude palm oil imports. This has also given it increased pricing power. The bottom line growth was significantly influenced by a gross margin expansion of 649bps y/y to 70.1%.

Added to it was a 15.8% y/y rise in biological asset revaluation gain to N469m. Both factors were large enough to offset the impact of a 28.4% y/y rise in opex, a -91.9% y/y reduction in other operating income, a 128.7% rise in net finance charges as well as a -N243m exchange rate loss. Tax expense was 27.3% higher y/y, resulting in the modest PAT growth.

When compared the company’s stellar Q1 2017 results, the quarterly trends showed declines. Sales fell by -21.2% q/q, while PBT and PAT were down by -49.0% q/q and -57.6% q/q respectively.

With respect to the H1 figures, sales increased by 70.6% y/y to N12.8bn, PBT advanced by 84.1% y/y to N7.6bn while PAT increased by 84.4% y/y to N5.6bn.

Responsible for the PBT growth were a 1,220bp y/y expansion in gross margin to 75.5% and a 67.5% y/y rise in biological assets revaluation gain to N1.1bn, despite a huge 185.0% y/y jump in opex to N2.5bn and a -N434m exchange rate loss. Income tax expense was 83.3% higher y/y.

If we strip out the gains on biological asset revaluation and the fx loss, the underlying results reveal that Q2 PBT was flattish y/y while PAT was down -11.5% y/y.

The H1 results were still up, although by a lower magnitude: PBT and PAT grew by 78.6% y/y and 76.9% y/y respectively. Comparing underlying results with our estimates, sales were 10.7% ahead while PBT and PAT missed by -5.1% and -14.8% respectively.

On an annualised basis, H1 sales are in line with consensus’ FY sales estimate of N25.7bn. PBT and PAT are tracking ahead of consensus’ N12bn and N9bn estimates.

Year-to-date, Presco shares have gained 85.8%, outperforming the NSEASI by 48.5%. We expect the market to react positively to these results initially but not aggressively given where the stock is currently trading at. We rate the stock Outperform.

Our estimates are under review.

Presco Q2 2017 results: actual vs. FBNQuest Research estimates (N millions)

FBNQuest Research