By Omobayo Azeez

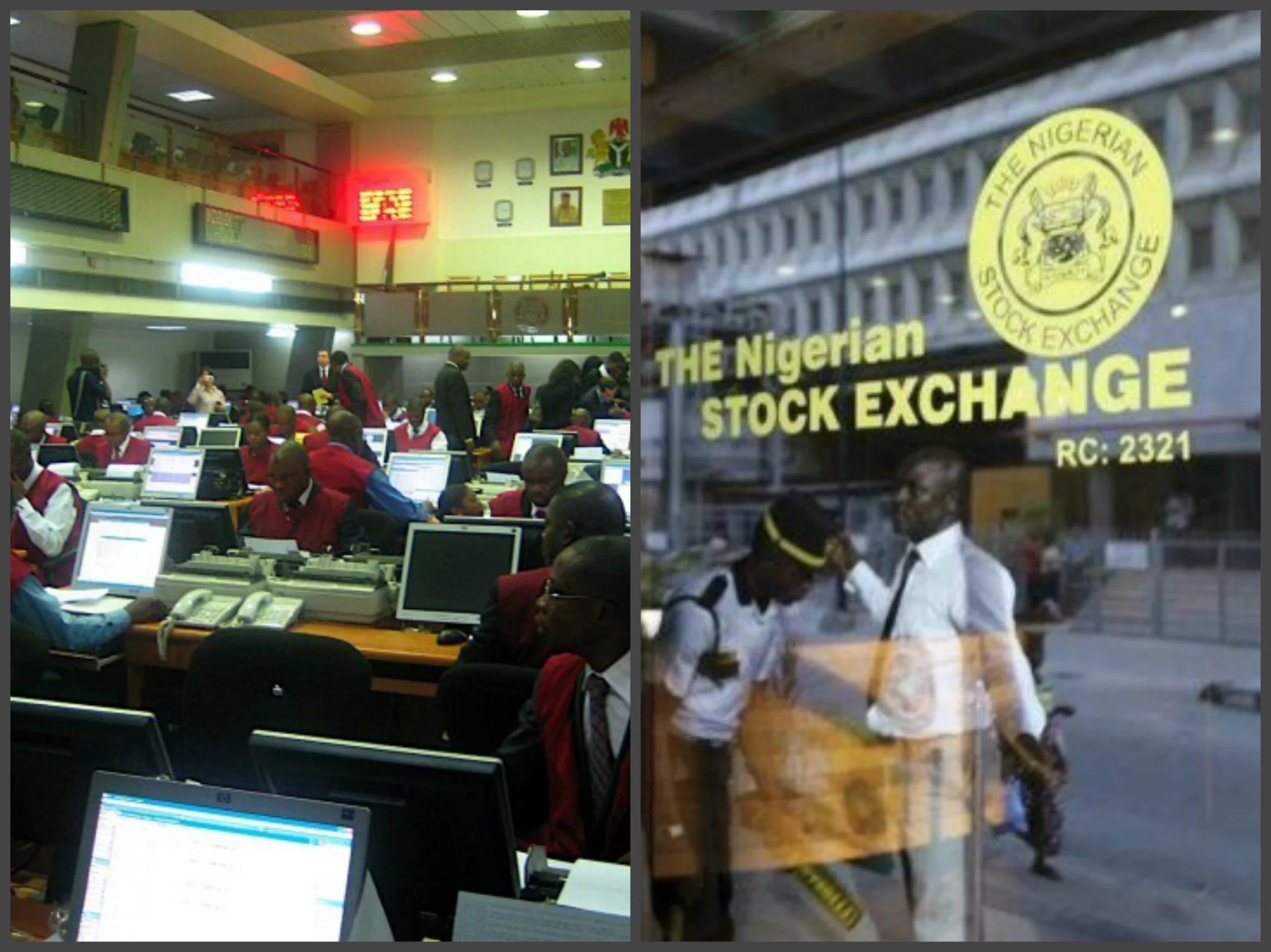

Shareholders have their hopes high as listed companies at the Nigerian Stock Exchange (NSE) began processes leading to the closing of accounts for 2019 financial year.

This symbolizes the beginning of the earnings season for the investors as some companies have begun giving notice of the final meeting by their boards of directors during which dividend for the shareholders will be fixed and the 2019 full year audited account be considered.

This, in compliance with Rule 17.2 of the amendment to the Listing Rules of the Nigerian Stock Exchange, demands that no director, employee, person discharging managerial responsibility and adviser of the company and their connected persons may directly or indirectly deal in the shares of the company in any manner during the closed period.

Checks by business a.m shows that the earning season was heralded by Access Bank Plc with its filing at the Exchange on December 30, 2019, notifying the public of the close of transactions on its securities starting from January 1, 2020.

This was followed by Zenith Bank Plc on Friday January 2, when it notified its shareholders through a filing at the Exchange of the closed period for trading in the bank’s shares from the same day in respect of the audited financial statements for the financial year ended December 31, 2019.

Guaranty Trust Bank Plc shared followed with similar notice on Monday January 6, as its declared trading on its shares closed on January 7, 2020 for its members to consider the audited financial statements for the year ended December 31, 2019.

While Access board will meet on Wednesday, January 29, Guaranty board members fixed January 22, and Zenith Bank plc would meet on January 28, to for the assessment of their 2019 financial reports.

Meanwhile, the institutions are required to forward the audited accounts to the Central Bank of Nigeria (CBN) for approval.

The notification of the scheduled board meetings quickened investors’ appetite for these of the Nigeria’s five largest banks.

GTBank, Nigeria’s largest financial services company, in terms of market capitalisation, rose by 90 kobo at the weekend to close at N30.10. Zenith Bank, the second largest bank, also rose by 55 kobo to close at N19.25 while Access Bank appreciated by 5.0 kobo to close at N10.15

Meanwhile, post listing rules at the NSE require quoted companies to submit their annual audited account to the Exchange not later than 90 calendar days after the relevant year end, and published same in at least two national daily newspapers not later than 21 calendar days before the date of the annual general meeting.

They are also required to post same on their websites with the web address disclosed in the newspaper publications. Also, an electronic copy of the publication shall be filed with the NSE on the same day as the publication.

Most quoted companies including all banks, major manufacturers, insurers, oil and gas companies, breweries and cement companies use the 12-month Gregorian calendar year as their business year.

The deadline for the submission of annual report for the year ended December 31, 2019 is thus Monday March 30, 2020.

Apart from the banks, Unilever was the fourth listed companies to close account for the year, giving the notice on Tuesday January 7 when it shares will remain inactive till Friday 24, 2020 or 24 hours after filing of the unaudited interim financial statements for quarter ended December 31, 2019.

While notice of close period continues to role in, the management of some other listed companies have notified the management of the bourse of late filing of their reports.

This for such companies is a wise move prevent being sanctioned by the Exchange for late filing of report is a violation of extant post-listing rules.

Recall that for the same offence, business a.m reported that 18 listed companies paid a collective sum of N135.5 billion in fines when the bourse wielded the big stick between January and November, 2019.