For decades, Singapore and Hong Kong have reigned supreme: as key transit points connecting travelers in Asia to and from the rest of the world. But now, a $1 trillion global airport spree is threatening the status quo.

About half that money is due to be spent on upgrading or building new airports in Asia, the Sydney-based CAPA Centre for Aviation estimates. In Beijing, a new $12.9 billion airport due to open in 2019 will turn China’s capital into one of the world’s biggest aviation hubs. Bangkok’s Suvarnabhumi Airport is set for 117 billion baht ($3.5 billion) of upgrades through 2021 including a third runway. South Korea’s Incheon International Airport is spending 5 trillion won ($4.5 billion) on a second terminal as it aims to become “the world’s leading mega-hub airport.”

As part of efforts to keep up, Singapore’s Changi Airport this month unveiled a S$1.3 billion ($950 million) fourth terminal. Hong Kong, meanwhile, plans to fill in part of the South China Sea to make room for a third runway — at a cost of HK$141.5 billion ($18 billion).

“It’s a race between global hubs,” said Torbjorn Karlsson, a partner in the civil aviation practice at Korn Ferry International in Singapore. “The question is who are going to be the big winners.”

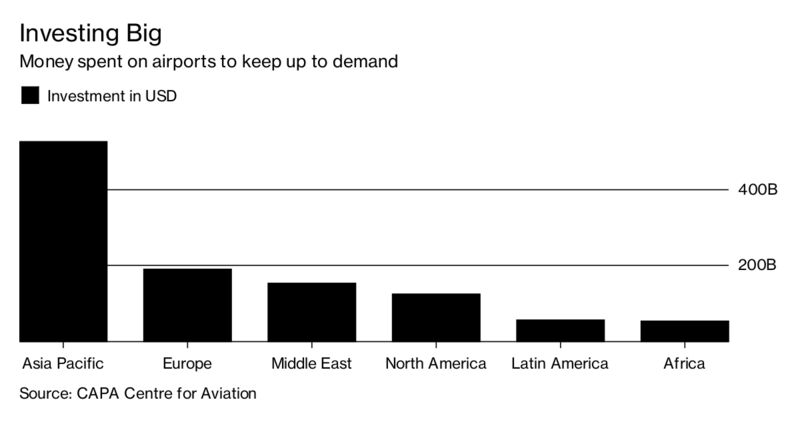

According to CAPA research published July 20, about $255 billion is currently earmarked to build new airports worldwide, with another $845 billion to be spent on upgrades such as extra runways and terminals. All told, the construction work stretches out to 2069, CAPA said.

New airports in Asia will soak up more than $125 billion, compared with just $3.6 billion on brand new sites in the U.S. and Canada, CAPA said.

The new developments are an identity crisis in-waiting for Hong Kong and Singapore. Cathay Pacific Airways Ltd. and Singapore Airlines Ltd. have made their names in the jet era ferrying visitors in and out of the cities and onward.

“Twenty years ago, airports were just sitting there waiting for airlines to come and fly there,” said Joanna Lu, who specializes in airports and route networks as the Hong Kong-based head of Asian advisory at Flight Ascend Consultancy. “Things change very quickly. It’s hard to say the transfer market is going to be always yours.”

In China, mainland carriers such as China Southern Airlines Co. are carrying so many first-time flyers each year that aviation authorities plan to create a mega-airport cluster almost within sight of Hong Kong. China Southern, Hainan Airlines Holding Co. and Chengdu Airlines Co. have opened new routes from second- and third-tier Chinese cities that go straight to the U.S. and Europe, bypassing Hong Kong.

“They have the potential to redraw the travel flows,” Korn Ferry’s Karlsson said.

China Southern, one of the nation’s three largest state-run carriers, wants to turn its home base at Guangzhou Baiyun International Airport — less than 150 kilometers (94 miles) from Hong Kong — into China’s primary transfer hub to Australia and Southeast Asia, it said in May.

Even closer to Hong Kong, the Civil Aviation Administration of China aims to build a cluster of airports around Shenzhen, the Chinese city on Hong Kong’s northern fringes, and do the same around Beijing and Shanghai.

By 2036, China’s domestic air-travel traffic will quadruple to 1.6 billion passengers, or 1.3 flights for each person per year, according to Airbus SE.

Hong Kong’s answer? Fill with cement a stretch of coastal water larger than New York’s Central Park. Next, lay down a 3.8-kilometer runway and build a passenger building bigger than the White House compound. Then roll out a 2.6-kilometer transport link to connect an estimated 30 million new travelers with the existing terminals.

Hong Kong International Airport last year almost maxed out as it handled 71 million passengers. Its development project is so vast that authorities are demanding between HK$70 and HK$180 from each passenger flying out of Hong Kong to help fund the construction. That’s on top of increasing parking and landing fees for airlines by as much as 27 percent.

Infrastructure and capacity on their own don’t guarantee success. Already, not all airlines want to use Hong Kong’s customized check-in kiosks, self-service immigration gates don’t work if there aren’t enough staff to monitor them, and security queues are long because the system can’t process bags fast enough, said Will Horton, a Hong Kong-based analyst at CAPA.

“Not all infrastructure is created equally,” said Horton. “Airports need to think big but also significantly consider the unglamorous task of making better use of floor space and checkpoints.”

The Hong Kong Airport Authority didn’t respond to requests for comment.

At Changi Airport, the new fourth terminal is due to open by the end of this year. It will feature dozens of automated check-in kiosks and bag-drop counters, according to a media briefing on Tuesday. Changi will be the first airport in the world to use tomography scanners, which means passengers don’t need to take laptops out of their bags for screening.

The new terminal will increase total capacity from 66 million to 82 million. Last year it handled a record 58.7 million passengers. Singapore is already working on a third runway and a fifth terminal due to be completed in the late 2020s.

A spokesman for Changi said advance planning will help the airport, with passenger traffic forecast to rise to 60 million this year, meet its needs.

To be sure, airport hubs can thrive even if their marquee airlines are partially displaced by regional rivals. Singapore is still a launch pad for Southeast Asian destinations such as Penang in Malaysia and Thailand’s Phuket, islands that might be commercially unviable as stand-alone routes. Some 30 percent of all passengers at Changi Airport are in transit.

And fuel-efficient, long-range airliners such as Boeing Co.’s 787 Dreamliner aren’t about to destroy hubs, even as Qantas Airways Ltd. plans to fly the jet non-stop from Australia to the U.K. for the first time next year.

“Ultra-long haul flights are not necessarily cheaper to operate,” said Mathieu De Marchi, a Bangkok-based aviation consultant at Landrum & Brown Inc. “Hub bypass only works if there is significant demand for that point-to-point route.”

On the website for Hong Kong’s proposed third runway, the project is described as “urgent” in order to preserve the airport’s hub status. It points to growing competition from Singapore, Seoul, and Shenzhen, as well as Guangzhou and Shanghai, which both plan to operate five runways.

When it comes to adding capacity and adding destinations, timing is everything.

“The challenge is building them early enough not to constrain growth but not so early that the growth can’t pay for the cost of running them,” said Korn Ferry’s Karlsson.

Courtesy Bloomberg