Joy Agwunobi

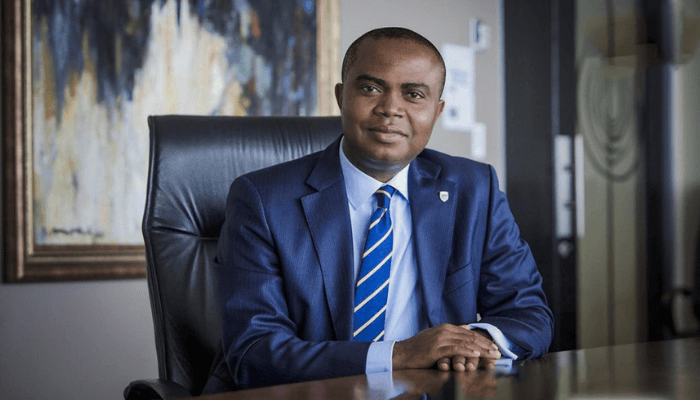

Stanbic IBTC Holdings Plc has appointed Chukwuma (Chuma) Nwokocha as substantive group chief executive officer, effective October 2, 2025, in a move analysts say positions the financial services group to consolidate gains from its recent recapitalisation and drive future expansion.

Nwokocha, a seasoned banker with more than 30 years of experience across African markets, takes over from Adekunle Adedeji, who has served as acting CEO since the beginning of the year. Adedeji will return to his substantive role as executive director and chief finance and Value management officer, after leading the group through a transition period marked by record earnings and a successful N500 billion rights issue programme.

That capital raise, completed ahead of the Central Bank of Nigeria’s (CBN) March 2026 recapitalisation deadline, has placed Stanbic IBTC in a stronger capital position than many of its peers, an advantage that Nwokocha will now be expected to leverage.

“The board is delighted with Chuma’s appointment. We believe his leadership will further strengthen the group’s position in Nigeria’s financial services industry,”said chairperson Sola David-Borha.

Nwokocha, a chartered accountant by training, previously led Standard Bank’s operations in Mozambique, where he delivered growth through corporate and retail banking expansion. His background in governance, regulatory engagement, and mergers and acquisitions will be key as Stanbic IBTC sets to scale rising competition from fintechs, tightening monetary conditions, and the new capital adequacy thresholds.

For stakeholders, his appointment signals continuity but also strategic renewal. While Adedeji’s tenure secured the group’s balance sheet, Nwokocha’s task is expected to translate that stability into growth, especially in areas such as digital banking, wealth management, and regional expansion.

Industry watchers say the move underscores Stanbic IBTC’s ambition to remain one of Nigeria’s top-tier financial institutions in the post-recapitalisation era.

The board praised Adedeji for exemplary leadership, noting that under his watch the group delivered its best financial performance since inception. With the leadership baton now passed, attention will turn to how Nwokocha balances consolidation with innovation, a dual mandate set to define Stanbic IBTC’s trajectory in the coming decade.