Investors in the nation’s stock market lost N533bn in the last seven trading sessions as bearish sentiment persisted in the market.

The market capitalisation of equities listed on the Nigerian Stock Exchange fell from N13.789tn on May 28 to N13.256tn on Tuesday.

The NSE All Share Index declined to 30,099.83 basis points on Tuesday from 31,307bps.

The ASI and market capitalisation depreciated by 2.05 per cent and 2.06 per cent last week to close at 30,432.13 bps and N13.402tn respectively.

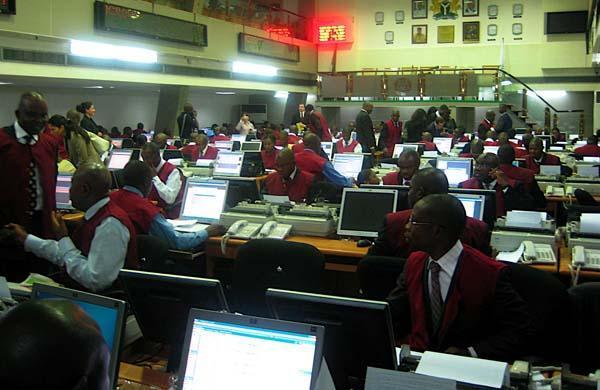

A total turnover of 768.983 million shares worth N12.546bn in 11,291 deals were traded last week by investors on the floor of the Exchange in contrast to a total of 1.082 billion shares valued at N18.111bn that exchanged hands in 16,400 deals the previous week.

The financial services industry (measured by volume) led the activity chart with 578.032million shares valued at N7.384bn traded in 5,934deals, thus contributing 75.17 per cent and 58.85 per cent to the total equity turnover volume and value respectively.

The oil and gas industry followed with 55.229 million shares worth N1.486bn in1,111 deals while the third place was occupied by the conglomerates industry with a turnover of 48.332 million shares worth N227.418m in 470 deals.

Commenting on Tuesday’s market performance, analysts at Afrinvest “Investor sentiment as measured by market breadth (advance/decline ratio) weakened to 0.6x from 0.8x recorded the previous day. We expect the bearish sentiment in the market to persist in the near term,” the analysts said.

“In the absence of a positive catalyst, we guide investors to trade cautiously in the short term. However, stable macroeconomic fundamentals and compelling valuation remain supportive of recovery in the mid-to-long term,” analysts at Cordros Capital Limited said.